If you’re like many homeowners who have considered reverse mortgage solutions but wonder if this type of loan could pass a financial burden onto your heirs, it’s important to know that a reverse mortgage will not leave a debt to your estate.

Today’s post discusses the basics of estate planning, including what it is, what the process entails, and the best strategies to plan for the future. We’ll also discuss how reverse mortgages may affect your estate planning so that you can feel confident about securing financial comfort for you and your family in the years to come.

What is estate planning?

Your personal estate is comprised of everything you own: your car, home, furniture, personal possessions, additional real estate properties, investments, checking and savings accounts, life insurance, and so on. Planning your estate involves deciding in advance how these assets are distributed, when, and to whom.

The Elements of Estate Planning

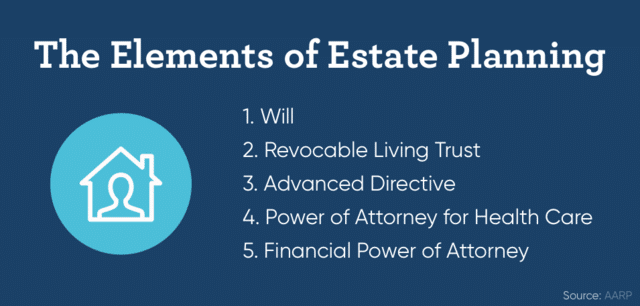

According to AARP, there are five elements that define estate planning:

- Will — Your will is the keystone of your estate plan; it spells out exactly how your assets will be distributed and how your dependents will be cared for after you die. Use your will to…

- Identify who will inherit your probate estate, including who gets what.

Note: Probate is the court-supervised process of authenticating a last will and testament (if the deceased made one). It includes locating and determining the value of the decedent’s assets, paying his or her final bills and taxes, and distributing the remainder of the estate to the appropriate beneficiaries. - Name guardians for your minor children.

- Choose an executor who will manage and settle your probate estate.

- Identify who will inherit your probate estate, including who gets what.

- Revocable Living Trust — This document allows you to keep control of your finances for as long as you like but prepares for the possibility that you may become unable to manage your finances and permits someone you’ve appointed to take control of the trust.

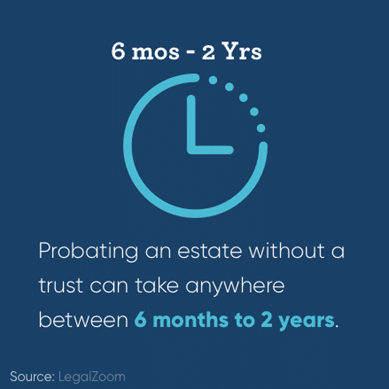

A trust will also make it easier for family members to pass assets to beneficiaries accordingly, as the probate process for estates can be expensive and time-consuming.

Probating can take quite a while since most states have established minimum periods of time that creditors are allowed to respond, during which time the probate estate cannot be distributed. - Advance Directive — This offers your loved ones and medical professionals a road map to your desired healthcare, including an explanation for the treatment you would elect to have in the event that you cannot speak for yourself. Some directives might include a DNR (do not resuscitate), instructions for when to stop administering pain medicine, and so on.

- Power of Attorney for Healthcare — This document is usually included within the advance directive. It appoints a person (plus an additional backup) to make the desired medical choices on your behalf when you are no longer able to communicate them on your own.

- Financial Power of Attorney — If you become incapacitated, the only way a person (acting on your behalf) can access a financial account, such as an IRA or pension, is through a durable financial power of attorney. For example, your spouse would be unable to talk to a credit card company about your account without a power of attorney, unless your names are co-listed as account holders.

What is the purpose of estate planning?

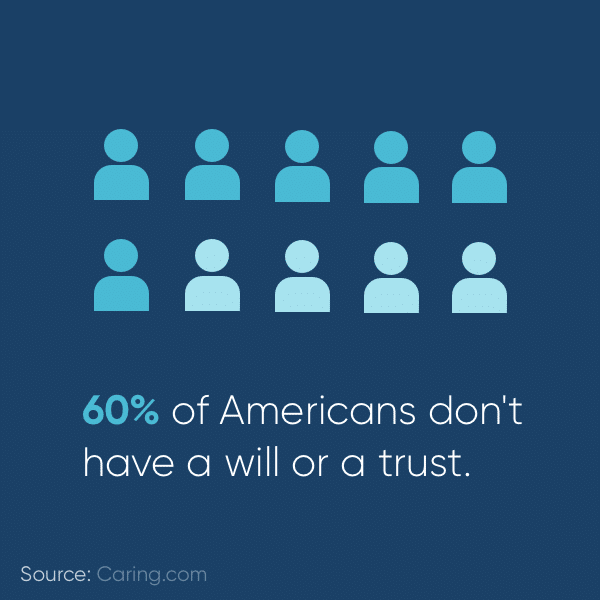

Many individuals—over half of American adults—undervalue the need for estate planning, often because they believe that they do not own enough to distribute, are not old enough to start planning, are too busy now, or have plenty of time later to write a will and a living trust. Then, if life throws an unfortunate, unexpected curveball, family members must settle the estate without instruction.

If you pass away before creating an intentional estate plan (a condition called “intestate”), your assets will be distributed according to the probate laws in your state. Instead of leaving your personal property in the hands of state officials, consider these many benefits of estate planning, including the ability to control when and how your assets are divided.

The Benefits of Estate Planning

- Provides instructions for the passing of valuables and values (religion, education, etc.)

- Expedites probating an estate

- Names a guardian and inheritance manager for dependent children

- Instructs preferred medical care in the event of disability

- Includes life insurance (if applicable) for your family after death

- Creates a business succession plan at the time of your retirement, disability, or death

- Minimizes estate taxes, court costs, and legal fees

What does estate planning include?

ConsumerReports.org describes the process and its essential steps, which can be used as an estate planning checklist:

- Get assistance to plan your estate and minimize your federal estate tax

- Create a will and consider a revocable living trust

- Review your beneficiaries (and make amendments as necessary)

- Assign a reliable power of attorney

- Prepare an advanced directive

- Choose a healthcare proxy

- Organize your essential information

The final step in this checklist provides instructions for the executor or trustee. It should include express, final wishes, instructions on where to find the original copy of the will, trust, and any other documents that may be necessary to access after passing.

According to advice from Nolo, additional forms and documents to gather during estate planning include:

- Real estate deeds and mortgage information

- Insurance policies, including homeowner’s insurance, car insurance, and life insurance

- Certificates for stocks, bonds, annuities, and titles to other assets

- An updated list of bank accounts, mutual funds, and safety deposit boxes

- Information of retirement plans, 401(k) accounts, or IRAs

- Record of debts (mortgages and loans, credit cards, medical bills, unpaid taxes, etc.)

- Funeral payment plans and any other final arrangements

How do reverse mortgages affect estate planning?

As you prepare for retirement, consider options for long-term healthcare, budget future finances, and learn how to plan your estate, it’s possible that you may have considered a reverse mortgage loan to improve your circumstances. A reverse mortgage calculator can show you the estimated amount of equity eligible homeowners may be able to convert into useable cash—but how does a reverse mortgage affect estate planning?

Planning an Estate with a Reverse Mortgage

In our post about heirs’ responsibility for reverse mortgage debt, we explain that the estate will never be forced to take on the remainder of the loan balance and are not held responsible for paying back the loan. Instead, heirs have the choice to:

- Retain the home by repaying the reverse mortgage loan

- Sell the home and inherit the remaining proceeds after the reverse mortgage is paid

- Pay off the reverse mortgage for 95% of the appraised value, if the balance is greater than the appraisal

- Allow foreclosure and walk away from the property with no further financial obligation

- Provide the lender with a Deed-in-Lieu of foreclosure

It’s important for families to have conversations about the future and to create a plan for settling their estate’s primary residence. For more information about reverse mortgage estate planning, read our article on dealing with a reverse mortgage after the owner dies.

Who handles my estate planning?

As with most legal matters, it’s advised to hire a professional attorney who can draw up the paperwork and draft the will. You might also choose to hire an accountant or CPA who can help strategize the arrangement of an estate in order to minimize the gift, estate, generation-skipping transfer, and income tax that the heirs might be required to pay.

The person you decide to choose as your power of attorney and/or executor is up to you: most individuals elect a reliable family member to fulfill their wishes as expressed in their will and trust, although some may opt to hire an unbiased third party.

Estate Planning Costs

The aforementioned Consumer Reports publication notes that Do-it-Yourself estate planning software, like those offered by LegalZoom and Rocket, cost much less (perhaps $80 to a few hundred dollars) compared to the $800 – $1,200 fee charged by an attorney to draw up an estate plan.

Depending on the complexity of your financial and family circumstances, planning an estate can cost up to $2,000 – $3,500 or more. If you do decide to hire an attorney, make sure their fees cover all the basics: a will, a living trust, a durable power of attorney, and a healthcare proxy.

Conclusion

There’s no better time to plan for the future than right now. If you’re interested in learning about reverse mortgage eligibility and how this type of financing may be able to help you secure the retirement of your dreams, please contact a GoodLife® Reverse Mortgage Specialist who can answer any questions you may have.

1-866-840-0279

1-866-840-0279