As seniors progress through life, medical conditions may have them wondering how to pay for assisted living or alternative senior care. There’s no problem with seeking medical assistance, and seniors should be confident in their search for the best care for their particular needs.

Finding the right senior care facility is important for two reasons: one, it means that your needs are professionally tended-to, and two, it means that you and your family can focus on spending time together and enjoying all that retirement life has to offer.

However, paying for senior care can present a serious financial burden to many retirees – especially those living on a fixed income, who need their valuable funds to keep enjoying the retirement they deserve.

According to LongTermCare.gov, the average cost of living in an assisted living or nursing facility can range from $3,600 to $6,800 per month. Rates are similar, though sometimes lower, for in-home care depending on the type of care you need.

In this article, we’ll cover five ways that seniors can go about paying for elder care responsibly and efficiently The price tag may seem daunting, but with the right financial tools and clever planning, affording professional nursing or custodial care is possible. Read on to dive into our list of suggested strategies, or select one of the links below to jump straight to a strategy that catches your eye.

Coverage through Medicare and Medicaid

Depending on the long-term care insurance you’re enrolled in, your provider may cover part of the cost of senior care. The amount of coverage may also depend on the type of senior care you’re seeking. The most common type of senior health insurance is Medicare. Medicare has a few different parts that each cover different care services. Original Medicare Part A includes provisions for different kinds of inpatient care.

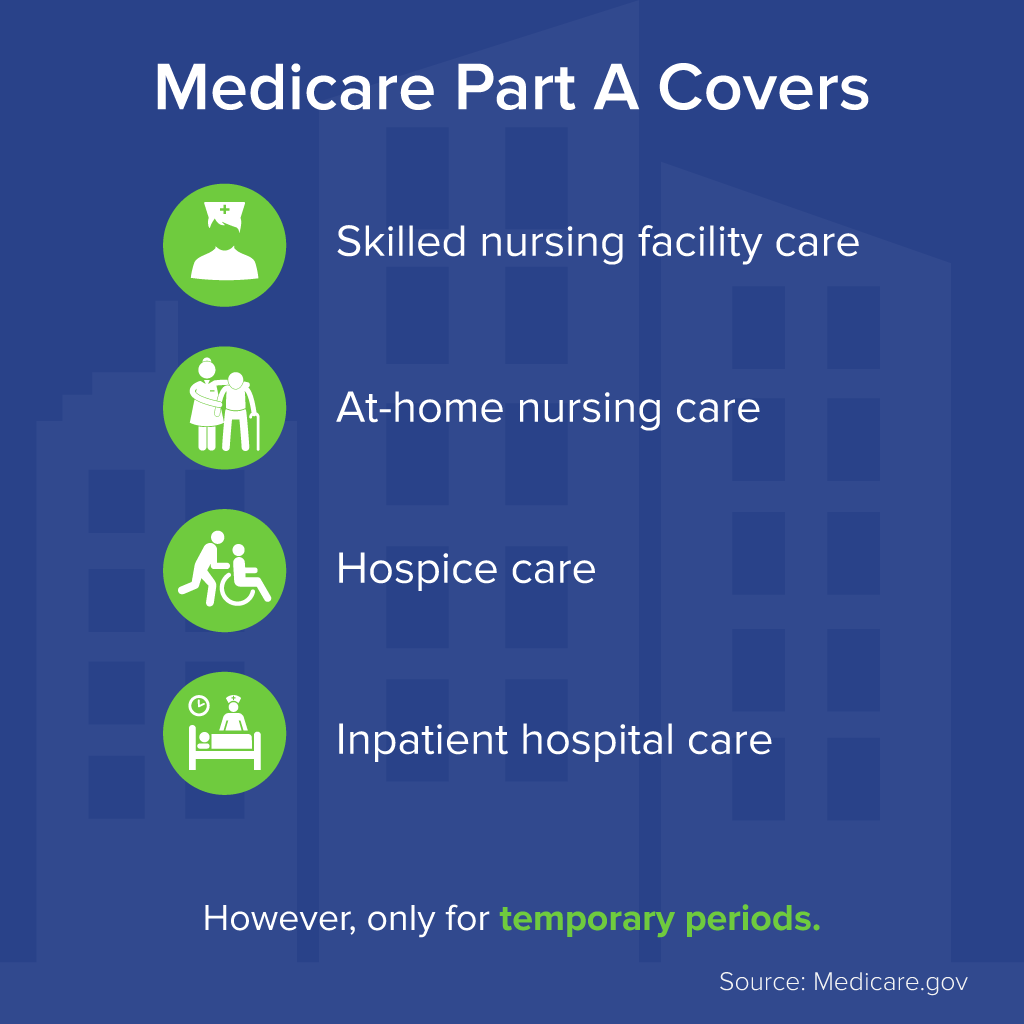

Inpatient care can mean a few different things. Under Medicare Part A, you are covered for a few different types of care. That includes:

- Skilled nursing facility care: As you recover from a procedure or recuperate from an illness for which you may have been hospitalized, you may spend time in a skilled nursing facility. There, nurses will ensure that your medicines are administered and you receive the necessary physical therapy to recover, along with meals and any necessary medical equipment.

- At-home nursing care: This covers a similar set of needs as skilled nursing facility care, but it is provided in your own home. Generally, this is for less severe cases.

- Hospice care: For those with a terminal illness, hospice care is almost fully provided-for by Medicare Part A.

- Inpatient hospital care: While you recover in the hospital after a procedure, nursing and other care are provided. However, only for temporary periods.

It’s important to note that Medicare part A does not cover long-term custodial care in a nursing home. What’s the difference between a skilled nursing facility and a custodial care facility? The former is for specific medical ailments that need attention from medical professionals as you rest and recover. The latter is what you might commonly think of as a senior living facility that doesn’t necessarily have a medical focus. If a senior living facility is better suited to your particular needs, you may need to consider alternate sources of funding, as Medicare.gov recommends.

Medicaid, the public insurance option for low-income earners, also covers nursing care. If you are in a position to take advantage of this government program, it’s generally wise to do so. The types of care provided by Medicaid are similar in nature to those provided by Medicare.

Private Insurance Coverage

In addition to government-sponsored insurance programs, private insurance can sometimes assist in paying for senior care. Remember, insurance isn’t just important for assisted living. Everything from primary care to specialists and senior dental coverage are necessary to keep in mind when seeking insurance. While Original Medicare doesn’t cover some of these things, supplemental Medicare and private insurance options can.

As seniors age, the likelihood of certain age-related illnesses increases. This means that a comprehensive health care plan should be a priority. While few will completely cover the cost of an assisted living facility, long-term care insurance can be a helpful option for some seniors.

Long-term insurance can help you with paying for senior care at an assisted living facility, a nursing home, or even at-home care with a custodial assistant. Depending on the type of plan you invest in, your coverage may change, so be sure to review the policy in detail before enrolling.

Investment and Retirement Savings

One source of income many retirees expect to rely on once their career ends is their retirement savings. Throughout your career, ideally, you set aside money each month into a 401k or IRA that you can tap into once you retire. The benefit of these accounts over ordinary savings is that they are investment accounts – they should grow in tandem with the economy, and often consist of a diversified portfolio of stocks and bonds.

An ideal retirement account can actually bring in cash flow without significantly depleting the amount you’ve invested. The money in the account is constantly accruing interest, so that you can live off the interest accrued by the account rather than making withdrawals from the principle.

In order to do this, Investopedia suggests you roll your 401k over into a Roth IRA once you retire. A Roth IRA allows you to keep making contributions after you retire, so you can be sure to replenish your account and continue bringing in revenue through interest.

For most people, the amount earned from interest on a retirement account will not be enough to pay for senior living alone, but it can certainly help a long way.

Family & Personal Contributions

Seniors fortunate enough to have family who are financially secure can often turn to them for help in paying for senior care or assisted living. It may feel uncomfortable to ask family members for financial support, but if your relatives have the resources to help, they’re more than likely willing to support your best quality of life.

Finding a way to split the cost can be a helpful strategy to fund your retirement home stay without imposing significant financial stress on your relatives. The important thing is to keep options open. Around 1.3 million seniors lived in nursing homes according to the CDC’s latest assessment, and the number is likely to keep growing. As it does, more diverse lines of payment for some seniors may become necessary.

Another way to help pay for senior care is to consider employment opportunities in retirement. If you’re fortunate enough to have your health, and you feel that you could add purpose to your life by taking up an encore career, you might be able to supplement the funds needed to pay for senior care down the road.

The more sources of funding, the better – so starting up an online shop selling hand-crafted jewelry or woodwork, or offering part-time consulting to younger professionals in the field you retired from can be great ways to add an extra revenue stream. It’s important to remember that you have options.

Reverse Mortgage Benefits

For those who would prefer to stay in their homes while receiving senior care, one helpful solution might be a Home Equity Conversion (HECM) loan, often referred to as a reverse mortgage. These loans help convert the equity in your home into liquid cash that you can use to pay for the various retirement expenses that you may encounter.

Essentially, instead of having to sell your home to access its equity, you can continue living there and receive a portion of the equity in the form of loan proceeds. Depending on the value of your home, this can go a long way toward paying for in-home senior care.

Bear in mind, however, that one of the reverse mortgage eligibility conditions is that your home remains your primary residence, so you must continue to live there and receive at-home care rather than moving into a full-time assisted living facility. Other conditions for eligibility include:

- You must be at least 62 years old to qualify.

- You must have significant equity in your home, generally around 50% or more.

- You must receive counseling on taking out a HECM loan with an agency that’s approved by the U.S. Department of Housing and Urban Development so that you fully understand the rules before committing to the loan.

- Your home must qualify – most single-family or even multiple family homes will qualify, as well as Federal Housing Administration-approved condominiums.

- You must pass a financial evaluation, including a credit report and ability to pay for basic property expenses like property tax and insurance.

If you’re curious about reverse mortgages and how they work, GoodLife provides a wealth of information on the topic. Our reverse mortgage application is clear and straightforward, and we’re happy to answer any questions you have during the process.

Takeaways

Paying for senior care can be daunting. It’s important to remember that you have options. In most cases, a mix of the strategies discussed today will be the most effective way of financing senior care.

Those worried about how to pay for assisted living are encouraged to explore reverse mortgage benefits that can help you maintain your lifestyle. As you consider paying for senior care, GoodLife may be able to assist.

1-866-840-0279

1-866-840-0279