Understanding Retirement Income and Taxes

Retirement is a time for relaxation, reflection, and enjoyment of the simple things in life. Having healthy retirement savings and reliable sources of retirement funding makes that much easier. While there are a number of ways that you can prioritize your own retirement finances, one thing that many retirees consider is moving to a state in the US that has a lower tax burden.

In many cases, retirement “income” is counted as taxable. For instance, if you have a traditional IRA (as opposed to a Roth IRA), your withdrawals may qualify as taxable income. That makes moving to a tax-friendly state desirable for many retirees who wish to avoid losing retirement funding to taxes. In fact, as many as 60% of Americans report they want to retire somewhere else.

Key Takeaways

- Tax friendly states charge fewer taxes that might apply to retirees, like income tax, capital gains tax, property tax, and sales tax.

- Low property tax is especially important for many retirees who may live in larger homes but have limited income streams.

- States like Alaska, Floriga, Georgia, and Nevada are some of the tax-friendliest for retirees. California, Connecticut, and Minnesota are some of the worst.

- Tax friendliness isn’t everything, though; keep in mind other factors like cost of living and proximity to family as you begin your search.

If you’re considering moving to a tax-friendly state for your retirement, it’s a good idea to read through this guide. We’ll explain what makes a state tax-friendly, which states are the most tax-friendly for retirees, and touch on the importance of property tax relief.

What makes a state tax-friendly?

You might hear people call a state tax-friendly if it doesn’t impose many taxes — or doesn’t impose high tax rates — on the people who live there. States can be tax-friendly to individuals by imposing few taxes that apply to average citizens, and they can be tax-friendly to businesses by having low corporate, payroll, or other taxes. Having low taxes can be a great way to prioritize saving money in retirement.

- Note: Tax-friendliness comes with certain tradeoffs. States with lower taxes may have fewer funds to pay for essential services like schools, roads, nutrition assistance, healthcare, transit, public housing, and other public goods. If you find that you frequently need services such as these, tax-friendly states might not be ideal.

There are a few different kinds of tax friendly states for retirees. The best way to understand this is by looking at the different taxes that states impose.

Types of taxes

As you are probably aware, there are a number of different taxes that the federal government and state governments impose. Here are a few important taxes to be aware of when looking for the right state to retire in.

- Income tax: Income taxes are an amount that you pay the government based on your income. Most states have a progressive income tax system, meaning that the more you earn, the larger portion of your income goes toward taxes.

- Capital gains tax: Capital gains are amounts of money you earned from investments, like selling stocks on the stock market, or earning dividends. Capital gains are taxed as income in many states, but some states have a separate capital gains tax

- Property tax: Property taxes are an amount that you pay your local government based on the value of your home. The more valuable your home, the more money you are likely to owe in property taxes.

- Inheritance tax: In some states, you may be required to pay a portion of inheritance in taxes. Generally, this applies to larger inheritances.

- Sales and use tax: Sales and use taxes are familiar to most people — it’s the extra amount you pay at the register, added to the sticker price. Some states also charge a use tax, requiring you to pay taxes for things that you purchased out of state too.

- Excise tax: Excise taxes are imposed on certain goods like alcohol and tobacco. Different states tax items like this differently, so if using goods like these is an important part of your lifestyle, it may be worth looking into ahead of time.

Keeping the various ways that states tax their residents in mind — and remembering to prioritize those that are most relevant to your own personal financial situation — let’s take a look at the states that are tax friendly for retirees.

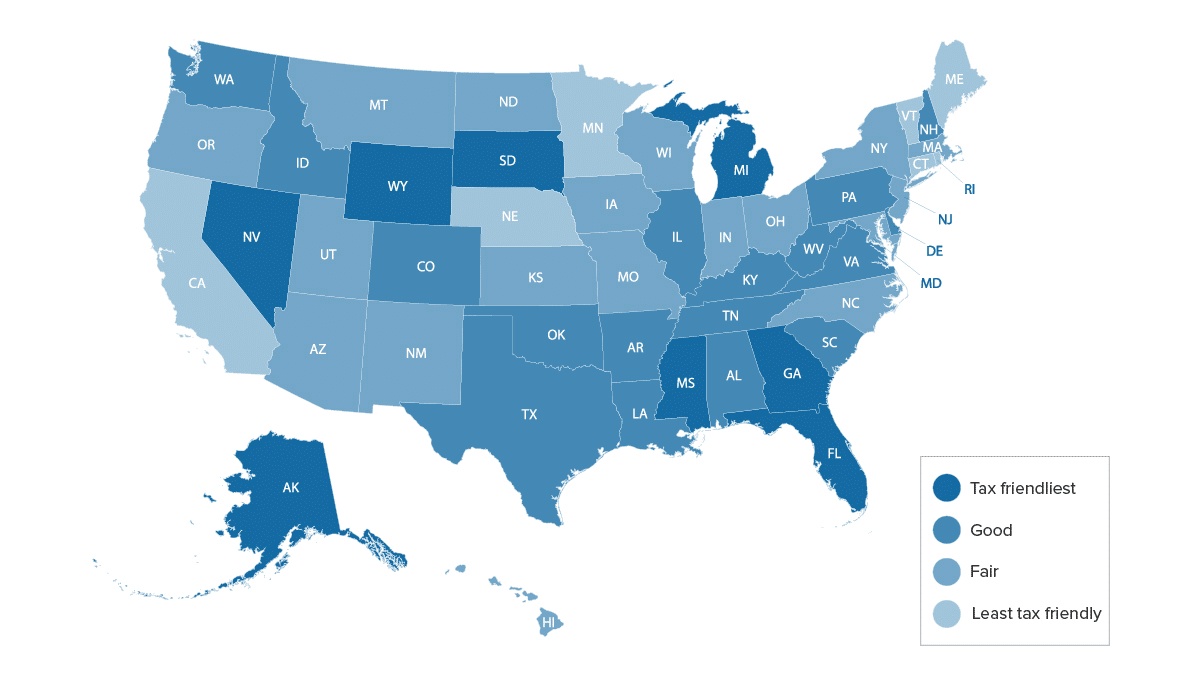

Which states are most tax-friendly for retirees?

The most tax friendly states for retirees may depend on factors like your sources of income, spending habits, and amount of property you own. However, in general, these states are the most tax-friendly states for retirees.

Best: States with the low to no taxes on retirement income, plus low property & sales taxes

- Alaska

- Florida

- Georgia

- Mississippi

- Nevada

- South Dakota

- Wyoming

Good: States with deductions for retirement income, plus low property & sales taxes

- Alabama

- Arkansas

- Colorado

- Delaware

- Idaho

- Illinois

- Kentucky

- Louisiana

- Michigan

- New Hampshire

- Oklahoma

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Virginia

- Washington

- West Virginia

Fair: States with smaller retirement income deductions, plus moderate sales & property taxes

- Arizona

- District of Columbia

- Hawaii

- Indiana

- Iowa

- Kansas

- Maryland

- Massachusetts

- Missouri

- Montana

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oregon

- Utah

- Wisconsin

Poor: States with higher taxes on retirement income, plus higher sales & property tax

- California

- Connecticut

- Maine

- Minnesota

- Nebraska

- Rhode Island

- Vermont

Knowing which state is right

Deciding which tax friendly state for retirees is right for your retirement plans can depend on your income sources, habits, and more. For instance, while Alaska has no income tax and no sales tax, it does have high property taxes.

Additionally, a state like Nebraska may not be tax-friendly for retirees, but the general cost of living is low enough that taxes are less of a concern than they might be in a state like Colorado, where cost of living can be high.

Ultimately, it’s important to do your research. Here are a few questions you can ask yourself as you consider which state might have the most advantageous taxes for your retirement:

- Does the state have income tax?

-

-

- If so, how high is the income tax?

- Is retirement income taxable, and are there any deductions available?

-

- How high is the property tax?

-

-

- Will high property taxes be difficult for me to manage on my retirement income?

-

- Are there other taxes that are important to my finances?

-

-

- Consider sales and use tax, excise tax, and inheritance taxes

-

- What other financial factors should I consider?

-

-

- Cost of living, quality of life, and proximity to family should also be part of the decision

-

Getting Started with Reverse Mortgages

If you’re looking to get started with a reverse mortgage, these articles can help guide you through all aspects of the process.

Guide to HECM Loan Reverse Mortgage Limits

Property tax relief: what you should know

Another important factor to consider when deciding which states are most friendly for retirees is what deductions or exemptions they have on property taxes. For retirees working with a limited income, property taxes can be tough. For instance, if your income was high enough to purchase a high-value home before retiring, but your retirement income is much lower, the property taxes might no longer be manageable.

Many states offer exemptions and deductions for retirees and people over the age of 65. However, this can vary significantly by state, and even by county, as property taxes are assessed by local authorities. Here are a few states with low property taxes that retirees may consider moving to:

It’s important to remember, however, that there are plenty of other factors that should go into your retirement relocation decision — not just which tax friendly states for retirees are best.

Finding the right state & living The GoodLife in retirement

Choosing the right state to settle down in based on taxes can be a helpful tool to make the most of your retirement finances, but it’s important to remember that there are plenty of other factors to consider. Be sure to review each of these items before committing to relocating to a new state for retirement.

- Total cost of living: As mentioned before, taxes are far from the end of the story. Other factors, like the cost of groceries, gas, restaurant dining, property, senior care, and other goods and services can make a state more expensive, even if it has low taxes. For example, though Texas might have no income tax, cost of living near Austin might make it overall less affordable than, say, Lincoln Nebraska.

- Available services: Some states might have fewer services that you require. For instance, advanced medical facilities might be more common in some states than others. It’s a good idea to research factors like this as you consider where you want to move.

- Proximity to family: This almost goes without saying, but it’s still worth mentioning. Even if you might be able to afford a larger home in another state, living closer to family might make it worth it to stay where you are — or to move where they are.

- Quality of life: Alaska may be one of the top contenders for the most tax-friendly state, but that doesn’t necessarily mean it’s the overall best state for retirees. Being snowed in for half the year might be enough of a detriment to your quality of life that high-tax California becomes more desirable. Be sure to weigh pros and cons like these as you make your decisions.

Living in one of the most tax friendly states for retirees isn’t the only way to ensure that your retirement finances remain secure and sufficient to have the quality of life you deserve. Even for those who have not saved up the ideal amount, there are options.

GoodLife reverse mortgages allow retirees to age in place, living in their home and receiving a steady stream of cash flow. Reverse mortgages allow you to access the equity in your home, converting into monthly payments, a lump sum, or a line of credit that you can use to cover a variety of retirement expenses.

Even if the cost of living and taxes in your state are difficult to handle, a reverse mortgage can help staying in your home state make more sense. By supplementing other retirement income sources, a reverse mortgage loan allows retirees a higher degree of financial freedom while also making it easier to stay right where they are.

If you’re not sure whether a reverse mortgage is right for you, a GoodLife Reverse Mortgage Specialist is happy to help. We can walk you through everything from terms and conditions to refinancing a reverse mortgage — whatever you need to know to ensure you’re making the right decision for your specific situation.

Tax-friendly state takeaways

As you consider whether you want to relocate in retirement, you might want to focus on which states are most tax friendly for retirees. States that are tax-friendly often include:

- Low to no income tax

- Deductions and exemptions on retirement income

- Low property tax

- Deductions and exemptions on property taxes for retirees

- Low sales tax, inheritance tax, and other taxes

Some states that are highly tax-friendly for retirees include:

- Florida

- Georgia

- Nevada

- Colorado

- Illinois

- Texas

- Virginia

However, it’s important to remember that just because a state is tax-friendly doesn’t always mean it’s the right financial fit for your retirement. Other factors, like cost of living, proximity to family, and quality of life should all be considered when making decisions about relocating.

If you would rather stay in place during retirement, and are uncertain about where your best cash flow options lie, a reverse mortgage can be a sensible solution. For more information, read our Reverse Mortgage Process page to see whether this form of financing can help you in retirement. If you still have questions, a GoodLife Reverse Mortgage Specialist will be happy to discuss your options with you in detail.

Sources:

1-866-840-0279

1-866-840-0279