Retired life should be about travel, family, and leisure. Unfortunately, many seniors find that they are not financially prepared to live the retirement they’ve dreamt of. In addition to the growing cost of living, retirees may face unexpected medical expenses or necessary home renovations that turn their budget sideways.

Even with careful retirement income planning, surprises can happen, and Social Security benefits might not provide enough money to make ends meet. This can cause seniors to seek out loans available to a retired person so that they may be able to live more comfortably.

Borrowing when retired can prove difficult, though, as lenders may find it risky to lend to someone on a fixed, limited income. However, there are several loans for retired seniors that might be able to provide you with the resources you need to live the retirement you deserve. Today’s post goes over seven borrowing strategies; click on a specific loan for retirees below, or read all the way through to learn all your options.

1. Personal Loan

The Social Security Administration (SSA) suggests applying for retirement benefits three months prior to the date you would like them to commence. Failure to do so could create a window of time in which you experience financial hardship; this, in turn, might make an elderly person unable to pay for food or important medical bills as they wait for the money to come in.

According to recent numbers, one out of 12 adults age 60 and over — or 5.5 million people — didn’t have enough money for food. Personal loans for seniors may be able to close the window of missing income until the delayed Social Security or 401(k) distributions arrive.

You should only consider this type of loan for a retired person in emergency situations, and if you are confident that you will have the funds to repay it on time. Personal loans for seniors tend to have high interest rates and fees; if you miss a single payment, the interest can rapidly increase.

If you’ve exhausted all other options, be sure to consider the following prior to taking out a personal loan.

- Secured or unsecured? A secured loan requires you to put up collateral, such as your home or your investment portfolio, to guarantee it. If you fail to repay the loan, the lender can seize the collateral. Unsecured loans are harder to obtain and typically have higher interest rates, but they do not require collateral.

- Fixed or variable interest? Be sure that your loan is structured with a fixed interest rate, not a variable one. Otherwise, your required payment could suddenly spike in the event that interest rates increase.

- Good or bad credit? To get the best possible rate, you need a high credit score at the time of application. Check your score ahead of time and verify that everything is correct; older adults often have great credit history, which makes them more vulnerable to identity theft. If your score is low, take the time to build it back up prior to taking out a personal loan in retirement.

If you don’t have enough money in your savings account to afford a large expense, consider saving up for it before borrowing money you don’t have. There are many jobs for retirees that could supplement your income and boost your savings; you might even find that you enjoy spending your time in a productive way.

Getting Started with Reverse Mortgages

If you’re looking to get started with a reverse mortgage, these articles can help guide you through all aspects of the process.

Guide to HECM Loan Reverse Mortgage Limits

2. Peer-to-Peer Loan

These are similar to personal loans for retirees, but they’re funded through independent investors rather than financial institutions. They offer borrowers an alternative to traditional banks and may be able to offer a better rate, however an analysis by the Cleveland Federal Reserve warned that peer-to-peer (P2P) lending is beginning to resemble the subprime mortgage lending system that caused the 2008 financial crisis.

3. Line of Credit

If you can’t predict how much money you need to borrow in retirement, or need to cover ongoing costs, then a line of credit might be the right solution. Many banks, credit unions, and private lenders offer them, which could be used to finance home improvement projects, enabling you to age in place and live more comfortably.

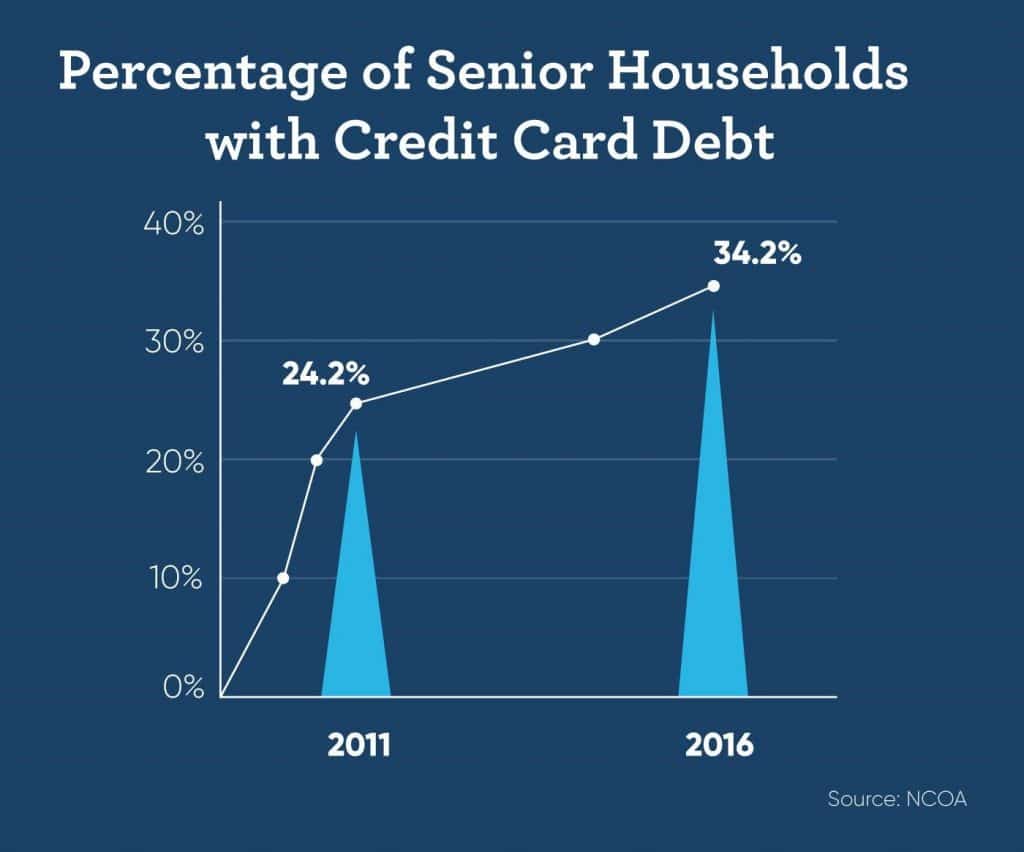

You could also use a credit card with 0% annual percentage rate (APR), but only use the card as a source of funds if you know you can pay it back before the low APR expires. Otherwise, you might join the 34.2% of senior household with credit card debt, which has steadily increased in recent years.

4. Debt Consolidation Loan

These loans are intended to consolidate debt, such as outstanding student loans you might have. If you think that America’s college loan crisis applies just to younger generations, think again — 3 million seniors age 65 and older are still paying off their student loans totaling up to $86 billion, according to CBS News.

Debt consolidation works by grouping all of your outstanding loans together so that they have one fixed interest rate. Typically, it means that you’re paying off your debt for a longer duration, but the monthly payments are lower. It’s also wise to first confirm that the new interest rate is lower, not higher, than the ones you had prior to consolidation.

5. Car Loan

If you have your driver’s license, a vehicle can be a wonderful way to travel in retirement. However, before you head on a drive to your state’s capitol or to a nearby National Park, you might consider stopping by the dealership first. It could be in your interest to upgrade to a greener vehicle that gets better gas mileage or invest in a reliable set of wheels that you can trust won’t break down.

Purchasing a vehicle can contribute to your quality of living, but be sure to budget your car payments in comparison to your retirement income to ensure that it won’t create a financial burden.

6. Title Loan

If you already own a car and need to borrow money, title lenders offer short-term loans (typically 30 days) while holding your vehicle as collateral. Borrowers are required to allow the lender to place a lien on their vehicle title and temporarily surrender the physical copy of the title in exchange for the loan.

The loan amount is based on the lender’s appraised value of the car, and they typically lend 25-50% of that value. In most cases, you’ll be required to obtain a title loan in-person so that your vehicle may be appraised.

Keep in mind, though, that the average interest charge is around 25%. Although they can provide fast access to cash, they’re incredibly expensive and can lead to major problems for seniors down the road. Your car is at risk of being repossessed, and if you decide to rollover a title loan, you can place yourself in a cycle of debt.

For that reason, this borrowing method should only be used to finance a quick purchase, such as a broken appliance — not to pull yourself out of poverty. If you’re one of the 25 million Americans age 60 and older who lives at or below 250% of the federal poverty level, then you should seek financial assistance for the elderly with government-backed support.

7. Home Equity Conversion Mortgage

Home equity conversion mortgage (HECM) loans allow eligible homeowners to tap into a portion of their home equity and convert it into loan proceeds that can be used as liquid cash. Commonly referred to as reverse mortgages, the HECM program is backed and insured by the U.S. Department of Housing and Urban Development (HUD) and the Federal Housing Administration (FHA).

Reverse mortgages benefit seniors by increasing their stream of cashflow in retirement without forcing them to sell the property. Loan proceeds can be applied however the borrower sees fit, whether that means financing a large purchase, covering medical costs, or renovating their home. You can use our free reverse mortgage calculator to estimate the amount you may be able to obtain, which is based on the assessed value of the property, the age of the youngest borrower, and current interest rates.

To qualify for reverse mortgage eligibility, borrowers must own a significant portion of home equity, be at least 62 years of age, and occupy the property as their primary residence. Loan proceeds may be dispersed in monthly installments, a line of credit, or in one lump sum. Borrowers do not need to worry about making monthly payments, as payment on a reverse mortgage is not required until the loan becomes due and payable.

Because HECMs are insured by the government, they are considered non-recourse loans, which means that once payment is required, borrowers (or their surviving heirs) will never owe more than the 95% of the appraised property value or the outstanding balance, whichever is less.

Takeaways

GoodLife Reverse Mortgage Specialists are also available to answer any questions you might have about the home equity conversion mortgage. To learn more about how our home loans for retired persons may provide the solution you need, contact us today. We’re committed to helping seniors live the GoodLife in Retirement and we look forward to helping you, too.

1-866-840-0279

1-866-840-0279