What Does Executor of a Will Mean?

You may have heard of the executor of a will before — but what does being the executor of a will mean? The executor of a will ensures that everything the deceased specifies in their will is carried out according to their wishes. This includes ensuring heirs get their allotted inheritance, that debts are paid, and that property and other assets are distributed in the right way.

Often, trusted family members are called upon to be the executor of a will. However, this job can also fall to a court-appointed individual if no friend or family member is named in the will. Performing the job of executor is an important responsibility, and there’s a lot to know.

In this post, we’ll walk you through it. Read on for a thorough look at what being the executor of a will entails.

What is the executor of a will?

The executor of a will is assigned the duty to carry out the wishes described by the will of the deceased. Often, the executor is a family member familiar with the desires of the deceased, and familiar with the assets described in the will.

What is a will?

Not sure what a will is? A will is a legal document that specifies how a person wishes for their assets to be distributed after they die. It also includes information on what they wish to happen to their children if they are minors. Usually, those who are elderly or seriously ill plan a will to ensure that their wishes are carried out after they pass; without a will, those desires might not be carried out. Be sure to read our full guide to will and estate planning for more information.

An executor is often named in the will. Usually, executors are the children, siblings, spouses, or parents of the deceased. If no executor is specified, one can be appointed by a local court.

What does an executor do?

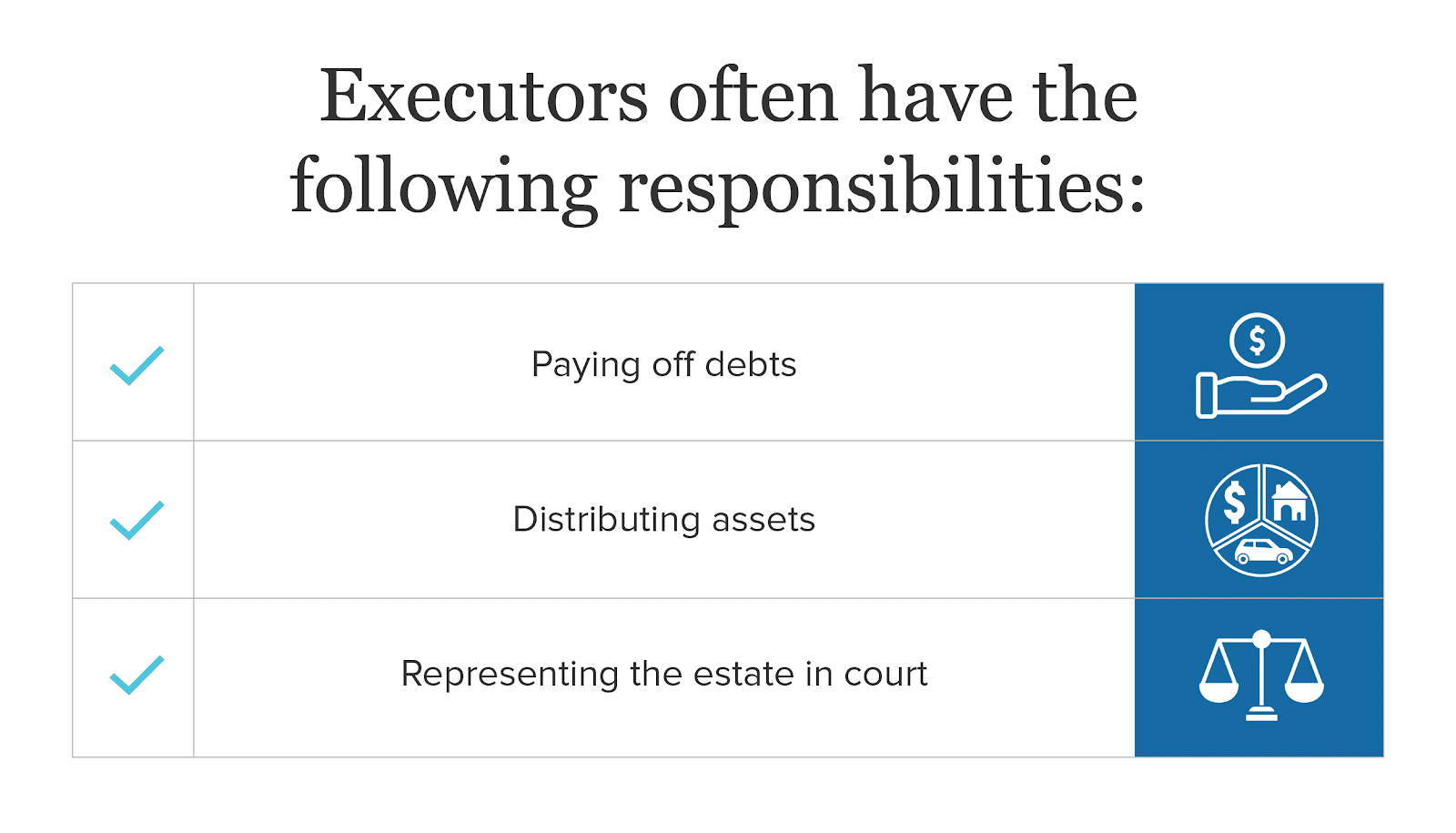

Executors are responsible for allocating the deceased individual’s assets wherever they are intended to go, as specified by the will itself. First, executors may be responsible for using the assets to pay off any remaining debts that the deceased left behind. Once these are settled, they can start distributing assets to the heirs the will identifies.

The number of responsibilities that an executor accepts can vary significantly based on the size of the estate, as well as other factors. What are the executors of wills duties, most often? A few responsibilities that executors may encounter include:

- Using the estate to pay off debts

- Paying off remaining bills

- Paying taxes on the estate

- Maintaining the estate (upkeep of property, for example)

- Appearing in court on behalf of the deceased and their estate

- Distributing assets to those identified in the will

Not every executor will have to perform every responsibility listed here. For example, if the deceased carefully managed their finances and planned ahead before passing, there may be fewer debts or bills to worry about. Alternatively, if the deceased passed suddenly or otherwise was unable to make diligent preparations, there may be more for the executor to take care of.

What is the first thing an executor should do?

First, an executor should obtain a death certificate. They should also have a copy of the will to demonstrate that they are, in fact, the executor. Next, they can plan funeral arrangements. Once the funeral has been attended to, it’s time to file a copy of the will in probate court — this sets the ball rolling on distributing the assets.

Once that’s been settled, you can start to locate and obtain the assets for distribution. You should have access to bank accounts, mortgages, deeds, titles, and other assets that you’ll need to distribute to the beneficiaries listed in the will.

Does an executor have to accept the role?

The simple answer is no — an executor can decline to accept their role, at which point another option may be identified, or the court may have to appoint one instead. Executors can also choose to stop performing their role even once they have already started.

Because executors can decline or resign, it’s usually a good idea to name multiple executors who can be trusted to carry out the will. However, if you do this, it’s important to list them in order, so there is no dispute as to who gets the first claim to be the executor.

Does the executor of a will get paid?

The executor of a will might be paid under a few different circumstances. Court-appointed executors may be paid depending on the laws in place in your specific state or county.

Typically, family and friends who are designated to be the executor by the deceased in their will are not paid, though there may be some portion of the funds from the estate set aside to cover any expenses that the executor may encounter. Ultimately, it depends on the relationship between the deceased and the executor, as well as the size of the estate in question.

Getting Started with Reverse Mortgages

If you’re looking to get started with a reverse mortgage, these articles can help guide you through all aspects of the process.

Guide to HECM Loan Reverse Mortgage Limits

Can an executor be a beneficiary?

Yes, an executor can be a beneficiary on a will. A beneficiary is one of the people that the will names who is set to inherit some portion of the deceased person’s estate. Typically, the executor is someone who was close to the deceased, such as a child, sibling, or spouse. As such, it’s common for executors to also be beneficiaries.

Can beneficiaries dispute an executor?

Sometimes, beneficiaries may have an issue with the executor. For instance, if two siblings have a rivalry, one may be resentful that the other was chosen as executor. Alternatively, one beneficiary may be unhappy with the amount they are intended to receive.

In such cases, beneficiaries may be able to dispute the will or dispute the executor. However, successfully doing so is often difficult. The writer of the will must be shown to have been defrauded, impaired, or under some influence in order for the will to be contested. Similarly, the executor must be shown to have some misconduct or incompetence in order for a beneficiary to dispute them.

Can executors contest a will?

Contesting a will occurs when one of the interested parties (people who stand to benefit or be harmed) has an issue with the terms listed in a will. Laws that determine the legitimacy of contesting a will can vary by state, but in most cases, an executor can contest a will if they stand to benefit or be harmed by its current terms.

However, contesting a will is not an easy process. As mentioned above, it must be shown that the will is illegitimate in some way, such as the writer being under some influence while writing it.

Will executors: what you need to know

What is the executor of a will? If you have been designated the executor for an estate, you’re planning your own will, or you’re simply curious about what being an executor entails, here’s what you should keep in mind:

- An executor is someone whose duty it is to distribute the assets listed in a will.

-

- A will is simply a legal document that specifies where a deceased person wishes their estate to go after they die, usually to friends, family, or charity donations.

-

- The executor’s job is to ensure that the assets listed in the will go where they are supposed to. They might also be required to pay debts and bills using the money from the estate or settle any matters in court on behalf of the estate.

- Executors are not required to accept their role. For that reason, it’s smart to name a succession of possible executors so that if one or more decline, another is there to pick up their duty. If no one accepts, the court may appoint one.

- Typically, executors are not paid — though expenses may be covered by the will. Court-appointed executors may also be paid in accordance with local laws. There is no issue with executors being beneficiaries on a will, too.

- Beneficiaries can dispute a will or an executor, but in order for this to be successful, they will likely need to prove there was some misconduct or influence involved that delegitimizes the will.

Another factor many may wish to consider is how the existence of a reverse mortgage might affect the executor’s job. For example, if the deceased has left behind debt on a reverse mortgage loan, this may affect how their estate is distributed among the beneficiaries listed in the will.

For that, and for all other questions related to the reverse mortgage process, don’t hesitate to reach out to a GoodLife Reverse Mortgage Specialist. Our team is happy to help you better understand the ways that reverse mortgages can affect your finances.

Sources:

1-866-840-0279

1-866-840-0279