In a multigenerational home, parents, grandparents, and children might all live together. While this was standard for most of history, the past century saw a dramatic increase in the number of nuclear family homes.

Now, due to high housing costs among other factors, multigenerational housing is back on the rise. Seniors may benefit from this trend if it helps them cover the cost of living while also enjoying time with their family.

However, some seniors may find that lack of their own space makes it harder to enjoy their retirement. In this post, we’ll report on the increase in multigenerational homes, as well as provide some of the pros and cons seniors may want to consider before choosing this option. Read from start to finish for a thorough walk-through or click one of the links below to jump straight to your topic of interest.

What is a Multigenerational Home?

A multigenerational home is one where several generations in a family live together. The most common examples include adult children living with parents, or aging parents living with children. Some multifamily homes might have up to four generations, with children, parents, grandparents, and great-grandparents all living under the same roof.

A family might choose to live in a multigenerational home for a variety of reasons: cutting costs, spending time with loved ones, and giving special care to aging relatives are common examples of why families choose this living arrangement. Before we look at the pros and cons, it’s a good idea to have some context.

History of Multigenerational Housing

For much of human history, families lived in groups that hunted, farmed, or gathered together. However, the past century has seen a steady decrease in the share of families living in a multi-generational home.

There are a few reasons for this, but one significant cause was the rapid growth of the economy after the second World War. With more jobs available in cities, many younger people left home in search of higher wages—which they often found. The post-war boom allowed young people to work, get married, and live away from their family homes in large numbers.

This continued until the 1980’s, as the economy steadily grew. However, following an era of financial deregulation, the situation started to worsen for younger Americans economically. It came to a head in 2008 with the financial crash, when a large portion of millennials was just starting or graduating from college.

Manywere unable to afford rent, and with declining job prospects, have continued living with their parents. Pew Research1 reports that, as of 2018, a record 64 million Americans live in multigenerational housing.

Why are Multigenerational Homes Becoming More Common?

Even as the situation improved after the 2008 recession, multigenerational homes have continued to grow in popularity. This is most common among adults age 25 – 29, where one in three lives in multigenerational housing. However, it isn’t just young generations that are contributing to the trend.

Rates of multigenerational living among adults of retirement age are also increasing, with as many as one in five adults over the age of 65 living with younger family members. The reasons for this are in large part economic although circumstances often extend beyond finances.

The desire for community may also be a factor affecting multigenerational living. When a family decides to live together, with multiple generations under one roof, they are able to benefit from each other’s companionship and care—something many seniors find especially rewarding in retirement.

Benefits of Multigenerational Households

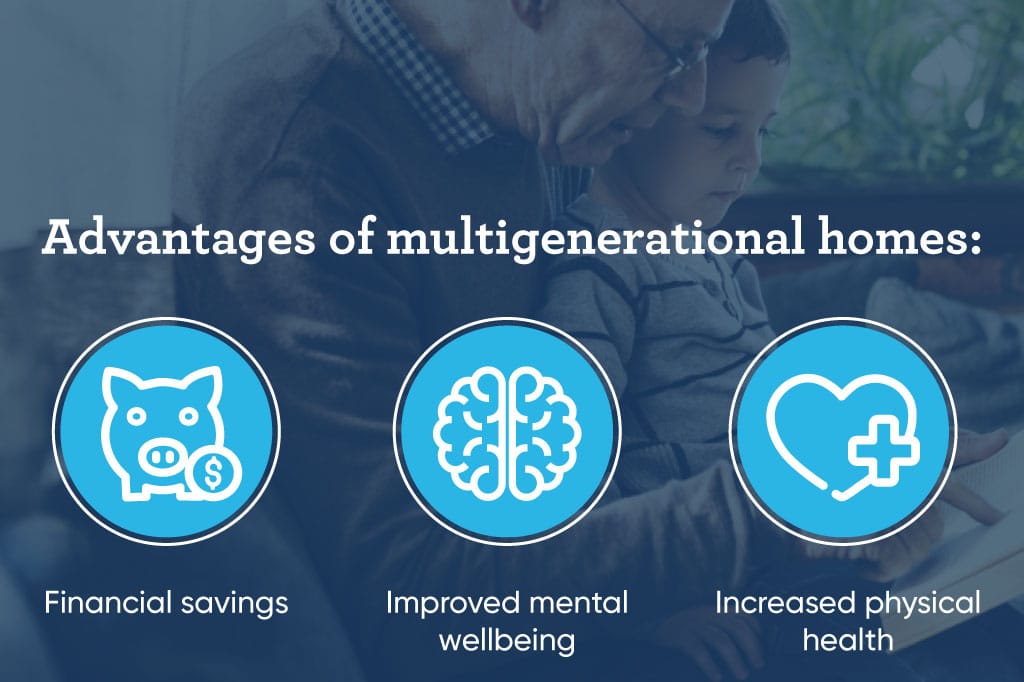

As the share of multigenerational homes in the US continues to rise, many find themselves considering living with family members. Especially in retirement, living close to family can come with significant advantages. Think through the items on this list as you weigh your living arrangement options:

- Financial savings: Perhaps one of the most significant reasons why seniors consider multigenerational living is the huge potential for financial savings. With many seniors struggling to cover retirement expenses, moving in with a younger generation can increase the amount of disposable cash they have available. By knowing they can afford housing and medical care, shared living may be able to alleviate the anxiety and fear seniors commonly face.

- Improved mental wellbeing: Many seniors may find that living with family heightens their feeling of belonging and companionship. This may help ease the feelings of isolation that can sometimes come with retirement. Additionally, if there are children in the home, living with family can give seniors a feeling of hope for the future. They can also share stories, wisdom, and advice with younger family members, which may help seniors feel needed while acting as wise role models for younger family members.

- Increased physical health: Living in isolation can be dangerous for seniors, as the mental health issues associated with this can lead to poor health outcomes. In addition, not having people around to regularly check in with a senior could put them at risk. If left unattended, an unexpected fall or sudden illness might cause serious harm.

By living with family, there is a better chance that someone will be nearby if a senior becomes imperiled. And, family can help in making sure that regular prescription medications are kept up with, as well as routine exercise and doctor’s checkups. In fact, the National Center for Biotechnology Information (NCBI) has found that seniors who live in multigenerational homes have longer life expectancies than those that live alone.

Disadvantages of Multigenerational Households

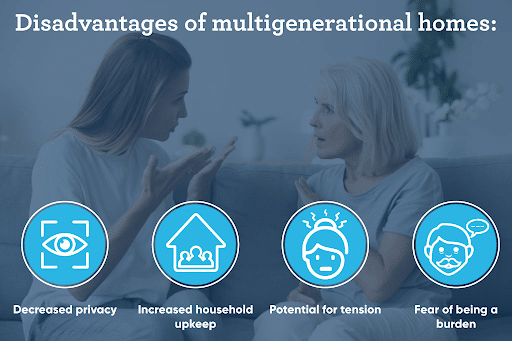

While you think through the benefits of multigenerational homes, it’s also important to weigh the possible disadvantages.

- Decreased privacy: Many seniors find that, in retirement, they look forward to time spent alone or with their partners. For those who want to live in a quiet house and experience the serenity of retirement without constant interaction with others, a multigenerational home may seem loud and chaotic.

- Potential for tension: Those who have strained relationships with their family may find that multigenerational homes heighten tension. When you live directly with people, it’s likely that disagreements will occur. This can be on topics ranging from family finances and childrearing to politics and career choices. If this could harm your family’s wellbeing, it may be worth factoring into your decision on whether to live in a multigenerational home.

- Increased household upkeep: Having more people living in a home means that there will be more chores to complete and as well as more upkeep, plus modifications may be required for seniors’ safety. Those with disabilities might require wheelchair ramps be installed on outdoor steps, bathrooms may need to be fitted with handrails, and stair-elevators may be added to indoor staircases. On top of this, cleaning can become a burden with many people occupying space. If daily tasks aren’t carefully delegated, family tension could potentially rise.

- Fear of being a burden: Some seniors may struggle with feeling that they are a burden on their families. Sadly, many in retirement fear this, which is why so many seniors are hesitant to ask for help—financially or otherwise. While this fear can be assuaged by family, it’s something to factor in when considering multigenerational housing.

Exploring Funding for Senior Living

Living in a multigenerational home may be a viable and attractive option for many retirees, however, it’s not for everyone. If adult children live far away, or are financially insecure, living together may prove too much trouble. And, of course, many seniors simply do not have any children they could live with. If that’s the case, other housing options are worthy of consideration.

GoodLife helps seniors who would like to stay in their home and age in place secure funding that can help make their retirement dream a reality. How does a reverse mortgage work? Essentially, it allows eligible seniors to tap into a portion of the equity they own in their homes and convert it into loan proceeds that can be used as a source of cashflow in retirement.

Reverse mortgage eligibility requirements do apply, including requirements both for the borrower and the property they hope to mortgage. Those with questions about the reverse mortgage application process can direct their queries toward a GoodLife Reverse Mortgage Specialist, who will be happy to go over all the details in full.

Choosing the right living arrangement can pose challenges for seniors, but we’re committed to helping retirees and their families live The GoodLife in Retirement however they see fit.

Sources:

Pew Research [1], [2] | National Museum of American History | NCBI

1-866-840-0279

1-866-840-0279