As time passes, one’s financial priorities inevitably shift. Retirees are often left with two choices: sell their home or be stuck trying to pay off the mortgage.

To help avoid these difficulties, it’s essential to explore all financing options. You may be surprised to know that millions of seniors have opted for a reverse mortgage, discovering that this unique type of loan can be an excellent source of extra cash and financial flexibility.

One of the first questions that people ask is “how much can I get from a reverse mortgage?” Read on, and we’ll walk you through everything you need to know to understand how much money you can borrow.

Four Key Factors: Age, Home Value, Home Equity and Interest Rate

The Federal Government has developed rules to determine the amount of home equity people can borrow with a reverse mortgage. The amount depends on the age of the youngest borrower, the market value of the home, the amount of equity in the home, and the prevailing interest rate.

Age.

Generally speaking, the older you are, the more you are elible to borrow from your home’s equity. A 75-year-old homeowner will be able to access a higher percentage of her home equity than a 65 year old borrower.

More specifically, the amount you can borrow from a reverse mortgage depends on the age of the youngest borrower. If the youngest borrower is at least 62 years old, then you are eligible for a HECM loan. HECM stands for Home Equity Conversion Mortgage. It is the most common form of reverse mortgage and is insured by the Federal Government. For more on how HECMs work, visit (link).

If the youngest borrower is younger than 62 years old, you should consider a Jumbo (proprietary) reverse mortgage. These loans tend to be more flexible than HECMs with respect to age and home value. For more on how Jumbo Reverse Mortgages work, visit (link).

Home Value.

Reverse mortgage lenders will require that you obtain an appraisal prior to financing your loan. But, to get a general idea of how much you can borrow, simply estimate the market value of your home. The higher your home’s value, the more you’ll be able to borrow.

Home Equity

The third thing you’ll need to know is the amount of money (if any) that you owe on your mortgage. That amount will be considered when calculating how much you’ll be able to borrow.

Interest Rate

According to FHA guidelines, borrowers can access more home equity with lower rates. When rates are climbing,

Use a Reverse Mortgage Calculator

Most reverse mortgage calculators are very easy to use. All you’ll need to do is enter the age of the youngest borrower, estimated market value, and the amount (if any) that you owe on your mortgage. Some lenders require that you add your personal information before you can use their calculator. At GoodLife, we welcome you to “kick the tires” and access all of our tools and resources without having to leave your personal information.

When you enter your information, the calculator will give you a pretty good idea of the amount of home equity you’d be able to access through a reverse mortgage. The exact amount will depend on several other factors. For example, you’ll need to use some of the loan proceeds to pay for mortgage insurance and other fees. Also, changes in interest rates can affect the amount you can borrow. Once you’ve decided to move forward, it makes sense to contact a reverse mortgage loan officer to lock in a rate.

Use a PLF Table

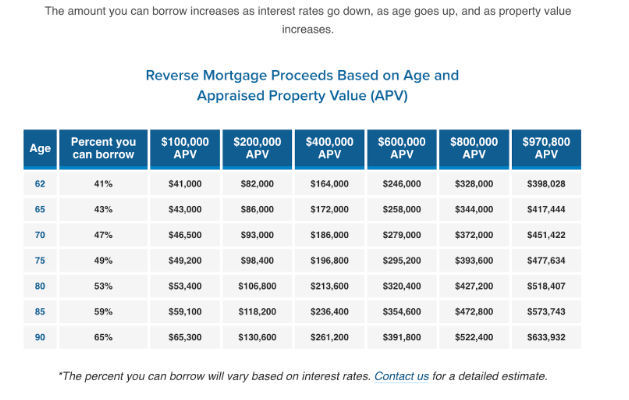

PLF stands for Principal Limit Factor. The table below gives you a “back of the envelope” idea of how much home equity you can borrow, based on the youngest borrower’s age. As you’ll see in the table below, older people are eligible to borrow a higher percentage of their home’s value.

Other Factors to Consider

We’ve already discussed the four key factors that affect how much you can borrow with a reverse mortgage. Those are: 1) age of the youngest borrower; 2) market value of the home; 3) amount of home equity; and 4) interest rates. Armed with those inputs, you can use a reverse mortgage calculator to get a pretty solid estimate of the amount you’ll be able to borrow.

However, there are other factors to consider, including mortgage insurance and fees that will typically be added to the loan balance (and deducted from the loan proceeds). Also, the amount you can borrow depends on whether you choose an adjustable-rate reverse mortgage or fixed rate. Let’s look at these in greater detail.

Mortgage Insurance

Mortgage insurance is a type of insurance that protects against default on home loans. Because private mortgage insurance (PMI) mitigates risk to the investors who own mortgages, it allows folks with down payments less than 20% to purchase a home. This, in addition to other measures taken by lenders, such as including a mortgagee clause within your homeowners insurance policy, all help to protect mortgage investors.

You can calculate your mortgage insurance by taking the PMI percentage your lender provided and multiply it by the total loan amount. If you don’t know your PMI percentage, calculate for the high and low ends of the standard range. Use 0.22% to figure out the low end and use 2.25% to calculate the high end of the range. The result is your annual premium.

Origination Fees

An origination fee is a payment associated with the establishment of an account with a bank, broker or other company providing services handling the processing associated with taking out a loan. An origination fee is typically a set amount for any account.

Origination fees are calculated based upon a percentage of the loan amount. Typically, this can range anywhere between 0.5%– 1%. For example, on a $100,000 loan, an origination fee of 1% would be $1,000. Keep in mind, while you may see a loan advertised as having no origination fee, this usually means that the mortgage interest rate will be slightly higher. Basically, the mortgage lender will make its money somehow.

Title Insurance and Credit Report Fees

Title insurance is a form of indemnity insurance that protects lenders and homebuyers from financial loss sustained from defects in a title to a property. Title insurance costs are calculated by multiplying the purchase price of your home by the rate per thousand your insurance company uses.

The only fee a lender can ask you to pay prior to providing a Loan Estimate is a fee for obtaining your credit report. Credit report fees are typically less than $30.

Summary

Reverse mortgages make a lot of sense for many seniors and can be a step towards financial freedom.

- Reverse mortgages allow you to continue to own your home..

- No monthly mortgage payments are required (although you do need to keep up with property taxes, home insurance, and maintenance.)

- The proceeds are not taxable, and they won’t affect Social Security and Medicare

- You can use the proceeds however you’d like.

- Your loan is Federally insured, which means lenders take on less risk and they are able to offer more loans to more consumers.

- Your loan is a non-recourse loan, meaning if the borrower defaults, the issuer can seize the collateral but cannot seek out the borrower for any further compensation, even if the collateral does not cover the full value of the defaulted amount.

As you can see, there are plenty of advantages. But, before you get started, it is logical to ask how much you’ll be able to borrow with a reverse mortgage. Hopefully, this article will help you understand the factors that are used to determine how much you can borrow. As a starting point, use our reverse mortgage calculator. Then, if you have questions, speak with one of our licensed loan officers by calling 1-866-588-1692.Best of luck on your journey to a fulfilling retirement and greater financial flexibility.

1-866-840-0279

1-866-840-0279