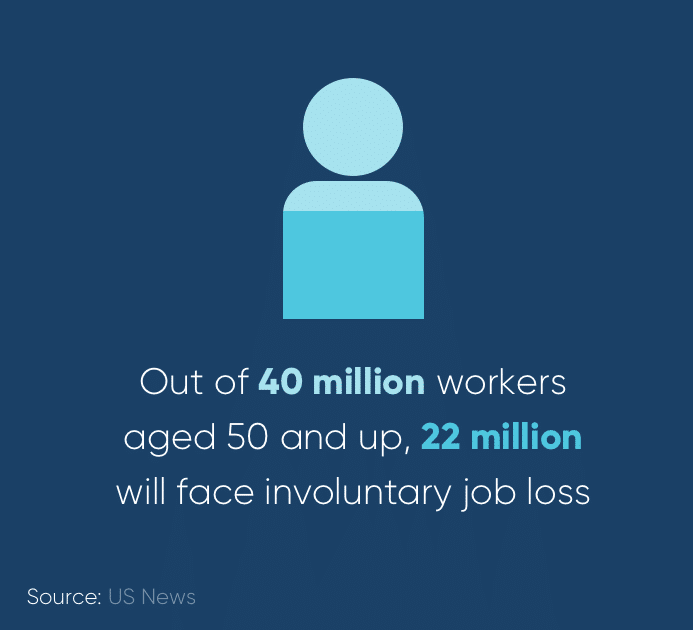

In 1986, it became illegal in almost all professions—with some caveats in the aviation and legal industries—to have a mandatory retirement age. Being forced into retirement is patently illegal beyond certain professions (for example, pilots). With that said, age discrimination is still a big problem for seniors in the workplace. Surveys have shown that 74% of Americans plan to work past retirement age, which is traditionally at 65 years old. According to the US Census Bureau, there are currently 40 million Americans aged 50 and older in the workforce and as many as 22 million will be laid off, forced into retirement or face another kind of involuntary job loss.

An unexpected end to your employment might also be due to a health condition or disability. Unfortunately, forced retirement could also be the result of age discrimination. For example, a company might try to force you into retirement early to save on healthcare costs and because it’s likely your employer can pay a younger employee a lower salary

Whatever the reason for your early entrance into retirement, it is prudent to strategize how you’ll deal with the aftermath. Below, we’ve laid out the steps you should take after forced retirement.

Steps to take if you’re a victim of forced retirement

Steps to take if you’re a victim of forced retirement

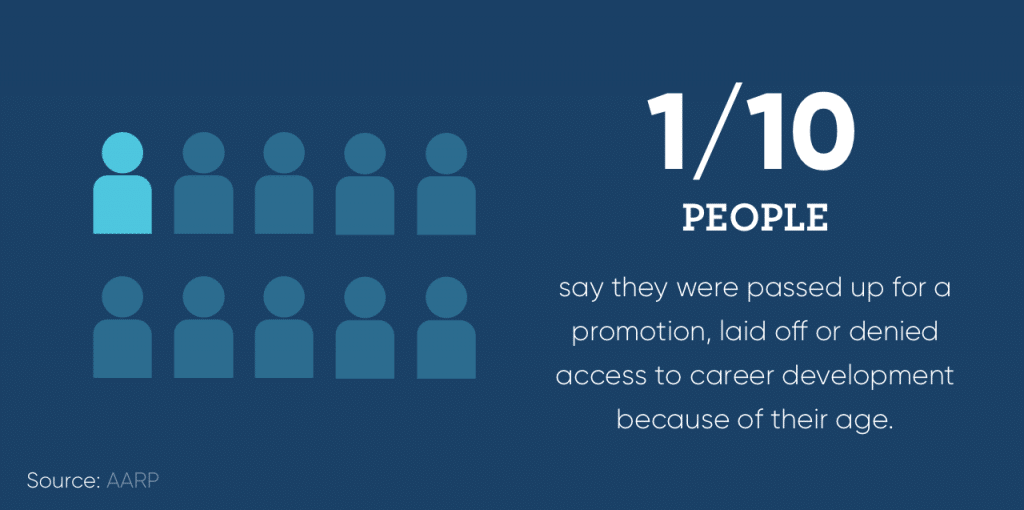

Employer-based job loss (meaning the job is terminated on the employer’s behalf) for workers over the age of 50 has risen from just over 10% in 1998 to close to 30% in 2016. With numbers like these, it’s important to be prepared for the unexpected as you’re heading toward retirement.

If you’re laid off from your job, your initial reaction might be to panic. Don’t be too discouraged; there are some benefits of an early retirement, including the ability to pursue interests you didn’t have time to actively pursue before or spending more time with family.

That said, in the immediate time period after a job loss, you might not know where to start or what to do. We’ve laid out guidelines so you can get your bearings and navigate your way to a successful retirement.

1. Evaluate your financial health

Make a list of all of your savings accounts, investments, and other income sources you may have. Then, add up your monthly bills and expenses. This will give you a better sense of where you stand financially. Once you know your current financial health, you can make appropriate steps to either supplement your income, cut down on your expenses, or both. Another option would be to explore the benefits of a reverse mortgage.

It is prudent to contact a financial planning expert if you don’t feel you have the skills or knowledge to evaluate your financial circumstances. In addition, a finance professional can help you more objectively plan for the future and may offer more nuanced advice that better guides you toward a sustainable retirement plan.

2. Budget wisely

Once, you’ve sorted through your income versus your bills, you can figure out your budget. If you’ve received severance pay from your job, it’s best to invest that or put it into savings instead of using it all at once. Track your spending with a budgeting app or set up a spreadsheet. This will help you be more financially responsible so you won’t be tempted to overspend.

Make sure you keep tabs on your regular credit cards, loans, store credit cards, and other sources of debt. Losing a job is stressful and that stress may be compounded by missed payments and collection agencies.

If you can, consult with a financial planner who may be better able to strategize your retirement and what your true costs of retirement will be. Keep these suggested numbers in mind when trying to figure out what your retirement savings should look like:

- A nest egg of $1 million to $1.5 million

- Savings amount about 10-12 times your current income

Your individual savings needs might be more or less based on the state you live in, your age and your health.

3. Take advantage of unemployment benefits.

If you were let go from your job, you might be eligible for unemployment benefits. Note that the government won’t hand out money on a whim; you’ll have to meet certain requirements. For example, if you were fired or quit on your own, you will likely be ineligible for unemployment compensation.

4. Look for health insurance

One of the major pitfalls of losing your job is suddenly losing your health insurance coverage. Before you panic, look into your options. Do you have a spouse that can provide health care coverage? Are you eligible for a low-income health plan like Medicaid?

You can also look into getting coverage through Affordable Care Act (ACA) plans. For many, this will be the best option for health care coverage at an economical price.

You might also be able to buy into your old employer’s health insurance through COBRA. You’ll have to pay the full cost of the plan but it may be a viable option for up to 18 months after losing your job.

5. Consider a reverse mortgage

Have you considered how a reverse mortgage works? It might be the answer to your cash flow needs in retirement, especially in the case of sudden job loss.

A reverse mortgage, otherwise known as a HECM loan, may be able to provide you with financial security so you can enjoy a retirement you deserve. To qualify for a reverse mortgage, you’ll need to meet certain conditions, such as:

- Permanently live in your home

- Be 62 years of age or older

- Own your home and have a substantial amount of equity

How can a HECM loan help you with your finances? Reverse mortgages allow you to convert your home equity into cash. The funds you receive from a reverse mortgage loan can be used as you wish and go toward expenses such as health care costs, house repairs, vacation costs, or day-to-day living expenses.

As long as you continue to pay your property taxes and homeowner’s insurance, you can stay in your house and live out your retirement in comfort. If you’re interested in using this financial product, you may want to research the reverse mortgage application process to better understand how it would affect your monthly income.

6. Consider another job

Unfortunately, it’s unlikely that you will be able to reenter the workforce as an older worker and procure the same salary and benefits as you did with your old job. However, if you can financially weather a lower-paying job, it might help keep you both actively engaged in your own life as well as provide a source of alternative income. If you have a hobby or activity you love, can you get a side job that involves that passion?

Do you love wine? Consider taking on some shifts in the tasting room of a winery. Bookworm? Work in a library. Want to help animals? Become an animal shelter worker and help needy pets get adopted. It takes a little creativity, but you might be able to find a way to make money while you’re preparing for a full retirement.

7. Consider freelancing or consulting work

Freelancing and consulting is a great way to continue to stay involved in your line of work without the full-time commitment of a regular job. It’s also a great way to build up your network. Can you reach out to old clients or old co-workers for freelance or consulting work?

This might be an option that eventually leads to longer-term employment. Or, you can simply use a freelance or consulting side job as additional income if you feel you need it.

8. Consider reducing financial support of your adult children

You love your kids, but if you have adult children who you’re still helping financially, it’s time to implement a plan to reduce their dependency. While we’re not suggesting you cut them off completely if you’ve been helping them out, it is wise to help your children strategize their financial independence. By doing so,you can focus on your own financial security.

For example, maybe your children can take over paying for monthly payments you’ve been responsible for in the past such as phone and internet bills. Or, if your children live with you, consider asking them for a modest rent to help cover utilities.

9. Figure out when you’re going to file Social Security

If you can avoid withdrawing Social Security early, you may be able to get bigger monthly payments later. However, you’ll need to figure out when the best time for you to start withdrawing benefits is for your particular situation. For example, if Social Security benefits help you avoid putting large debts on your credit cards, it may be a worthwhile solution.

10. Keep up your professional network

If you’re still interested in getting back into the workforce, don’t withdraw from your professional circles. Consider going to networking events or get a new skills certification to keep your resume updated and skill set sharp.

11. Pursue hobbies

If you’ve always loved painting or photography, your schedule just opened up! Take your newfound free time and put it toward productive hobbies. One of the risks of forced retirement is depression so it’s important you take care of your mental health as much as your physical health.

One way to keep your mental well-being buoyant is by keeping busy with creative pursuits. Start a blog, garden, or see your grandchildren. This is the time to do things that make you feel fulfilled and happy.

Final thoughts

If you’re the victim of forced retirement, there are steps you can take to make the best out of a bad situation. You’ll want to lay out a strategy that helps define your daily living expenses and set financial goals to help keep you in the best financial shape possible. While early retirement might come as an unexpected surprise, you can set yourself up for success by consulting a financial professional. Together, you can devise a plan that gives you peace of mind, freedom, and structured income during your retirement.

1-866-840-0279

1-866-840-0279