Wondering if a reverse mortgage is the right option for you? More people opted for a reverse mortgage in 2022 than ever before and this article will explain some reasons why. One of the biggest benefits of a reverse mortgage is that they allow you to turn your home’s equity into income. But what are some of the other benefits of a reverse mortgage?

Keep reading if you’d like to learn more about these types of loan options and the advantages of a reverse mortgage.

Forward Mortgages, HELOCs, and Reverse Mortgages

We’ve got a lot to cover in this section. First, we’re going to discuss forward mortgages. Understanding forward mortgages will help if you want to know the differences between them and reverse mortgages.

Next, we’ll talk about home equity. Home equity is a term we mentioned earlier in our summarized explanation of reverse mortgages. Home equity is essential in reverse mortgages, so you should know what it is.

Finally, we’ll get into everything you need to know about reverse mortgages. We’ll talk about how reverse mortgages work and who these mortgages best suit.

What Is a Forward Mortgage?

A forward mortgage is a loan you get to pay off a house, land, or any other real estate. The borrower – let’s say you, for the sake of the article – agrees to pay off the lender over time.

The borrower makes monthly or bi-monthly payments toward their mortgage, divided into principal and interest. “Principal” means the original loan amount, and “interest” is the price you pay for borrowing the money.

Your house is then used as collateral to ensure the loan. Think of collateral as an exchange – in exchange for paying off the loan; you get to keep your house. It’s an assurance that you’ll continue making payments.

How to Attain a Forward Mortgage

To attain a mortgage, you’ll need to seek a “preferred lender.” This is whoever you think has the best loan options that will allow you to purchase your home.

Preferred or mortgage lenders are banks and other financial institutions where you can attain home loans. Your mortgage lender is the one that sets the loan terms, interest rates, and payment schedule.

Getting a home loan, however, is more complicated than simply asking for the money. There are strict qualifications a person has to meet to qualify for a loan.

Underwriting is when the mortgage lender assesses a borrower’s qualifications for a loan. Underwriting accounts for a person’s financial situation, credit score, and value of offered collateral.

Underwriting tells lenders if a person is a financial risk worth taking. Forward mortgage underwriting usually takes a week or less.

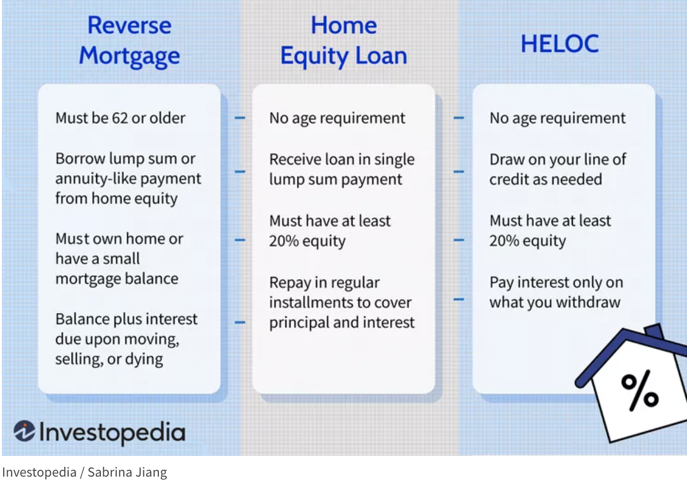

What Is A HELOC?

What Is a Reverse Mortgage?

Simply put, a reverse mortgage is the opposite of a forward mortgage. Unlike forward mortgages, reverse mortgages allow homeowners to borrow against their home equity.

How Do Reverse Mortgages Work?

Homeowners 62 and older with plenty of home equity can cash in and receive payments, a line of credit, or a lump sum of money in exchange. You’re not making payments; the lenders pay you instead.

Taking out a reverse mortgage doesn’t revoke your ownership of your residence. Technically, you still owe the lender for your home loan, though. The entire loan balance comes due when:

- The borrower dies

- Permanently moves out of their home

- Sells their home

If the homeowner dies or sells their home, the sale funds go toward repaying the loan. If the sale nets more money than is required to pay the home loan, the rest goes to the homeowner or their estate if deceased.

Federal regulations usually keep the loan amount from being more than the value of your home. If the loan amount exceeds the home’s value, neither the borrower nor their estate is responsible for paying the difference.

How You Receive Reverse Mortgage Proceeds

There are three loan options for reverse mortgages: single-purpose, federally insured, and proprietary. The type we’re referring to here is the home equity conversion mortgage, or HECM.

An HECM is a federally insured reverse mortgage backed by the U.S. Department of Housing and Urban Development (HUD). HECMs are the most common type of reverse mortgage.

Lump Sum Payments

You can choose six payment methods when you cash out your reverse mortgage. The first type of payment is the lump sum amount.

A lump sum payment means you get the entirety of your equity’s worth once the loan closes. Lump sum payments are the only kind that has fixed interest rates.

Term Payments and Line of Credit

Term payments are when the homeowner receives money throughout a specified (by the borrower) period. Lines of credit allow borrowers to receive money whenever needed. You only pay interest on what you borrow.

Equal Monthly Payments and Equal Monthly Payments Plus a Line of Credit

Equal monthly payments (or an annuity) require the lender to pay the borrower consistent monthly payments.

Equal monthly payments plus a line of credit means the principal resident receives consistent monthly amounts but can access a line of credit if they need more funds.

Term Payments Plus a Line of Credit

The borrower gets payments from the lender for a duration of their choosing. If the borrower needs more money during payment, they can use their line of credit.

What Are the Benefits of a Reverse Mortgage?

We’ve gone on at length about forward and reverse mortgages. But what are the advantages of a reverse mortgage? Read on if you’re curious about the good taking out one of these types of mortgages can bring you.

You Don’t Have to Make Monthly Mortgage Payments

Perhaps the best thing about reverse mortgages is you don’t have to repay your home loan. Instead, you receive payments from lenders for having paid off a substantial amount of your mortgage.

You’re not responsible for your mortgage repayment unless you move or sell the home. You do still have to pay property taxes and homeowners insurance, though.

You Still Own Your Home Without Making Payments

Many people reading this may believe that the lender takes ownership of your home when you apply for a reverse mortgage. But as we’ve demonstrated earlier, you’re still the rightful owner of your home.

You still have to abide by your home loan terms and pay the property taxes and homeowners insurance. That aside, you still keep the title to your residence.

You Can Pick Various Payment Options

Another fantastic thing about taking out reverse mortgages is choosing how you want your money. Earlier, we discussed six ways you can receive your reverse mortgage payments.

It’s a good idea to speak with your mortgage lender about the payment options before deciding which to choose. Also, remember to account for your lifestyle before picking a disbursement choice.

You Don’t Have to Worry About a Declining Housing Market

The federal government manages reverse mortgages. So the government will pick up the tab if your house’s outstanding loan is worth more than its value when sold.

You have governmental assurances that you’re not stuck with paying off the remainder of your home loan in a declining housing market. You won’t have to worry about claims from lenders against your other assets and heirs.

They Provide a Tax-Free Source of Income

Although many people regard funds from reverse mortgages as “income,” the IRS doesn’t share that view. The IRS defines reverse mortgage payments as loan proceeds – not taxable income.

Specific other income sources, like Social Security, may require you to pay taxes on the issued funds. As far as the government is concerned, you don’t owe taxes on the money from your reverse mortgage.

You Can Supplement Your Income for Other Uses

It’s not uncommon for seniors to have reduced income when they retire. A monthly or bi-monthly mortgage can take up a considerable chunk of their income.

Cashing in on home equity could relieve some of the financial burdens. Instead of using the money to pay off monthly mortgage fees, you can use the funds elsewhere, like home maintenance.

Your Heirs Have Financial and Residential Options

Borrowers can pay off their reverse mortgages whenever they like. However, most people allow the mortgage to end when they move, sell the home, or pass away.

We mentioned earlier that the borrower’s estate isn’t responsible for paying the outstanding loan if the borrower dies. But they do have options regarding the reverse mortgage.

The estate can sell the house to pay off the remaining mortgage and keep leftover equity from the sale if they wish. They can also refinance the reverse mortgage and keep the house.

But the estate needs enough equity in the property to apply for refinancing. If the remaining loan balance exceeds the property’s value, the estate can give the title to the lender.

Who’s Best Suited for Reverse Mortgages?

There are two circumstances when a reverse mortgage is your best loan option. The first circumstance is if you will be in your home for a long time.

If you’re 62 and think your current residence is your forever home, a reverse mortgage might be for you. The second instance in which a reverse mortgage is worth the effort is if you need more money.

Managing retirement can be difficult if you’re low on funds. Cashing your home equity is a viable option to get you more money to help with everyday expenses.

Looking for Reverse Mortgage Loan Options?

Whether the benefits of a reverse mortgage are worth the effort depends on your circumstances. Generally, you can trade your home equity for extra money, provided you can still pay your taxes and insurance.

If you’d like to know more about reverse mortgages, speak with the Good Life Home Loans team.

Try our reverse mortgage calculator if you want to know how much home equity you can get out of a reverse mortgage.

1-866-840-0279

1-866-840-0279