Medicare is a government-run insurance system available to seniors who are no longer working. Most Americans get their healthcare through their employers, so once you retire, you might need to find alternative coverage for help with medical expenses. Original Medicare (parts A and B), as well as supplemental Medigap and Medicare Advantage, are programs that may help you keep medical insurance coverage even after you retire.

If you’re asking yourself, “what does Medicare Part A cover?”, then spend a few minutes reading through this guide to help you find the information you need to move forward confidently. Or, if you know what you’re looking for, click on one of the links below to jump straight to the section you need.

Overview

The first thing you should know is that Medicare is split into a number of different sub-plans that cover different aspects of health care. Within Medicare, there’s Original Medicare, which is parts A and B, as well as supplemental Medicare, which includes Part D (drug coverage), Medigap, which is a privately run supplemental part of Medicare that covers things Original Medicare doesn’t, and Medicare Advantage, which is a hybrid plan that covers most medical expenses, as well as what Medicare Part A and Part B cover.

Medicare is not to be confused with Medicaid, which is a program for low earners. If you want more info on Medicaid, check out our guide to a reverse mortgage and Medicaid.

Right now, let’s focus on Medicare A. Part A is the hospital insurance coverage portion of Original Medicare. It covers hospital services, while Part B covers medically necessary services, like outpatient services, mental health, and some medical devices.

According to Medicare.gov, Medicare Part A covers the following:

- Inpatient care in a hospital

- Skilled nursing facility care

- Hospice care

- Home health care

We’ll go through what each of these items entails in more detail below, but first, you may want to know if you’re eligible.

Eligibility

You may be eligible if you meet any of these conditions:

- You are 65 years old or older.

- You are disabled.

- You have an end-stage renal (i.e. kidney) disease.

Medicare is a plan created for those who cannot work, so, most commonly that includes retirees and people with disabilities that make it impossible for them to work and gain health insurance through their employer. If you’re uncertain if your own situation counts, be sure to call and speak with a Medicare representative. You can call their hotline at 1-800-633-4227.

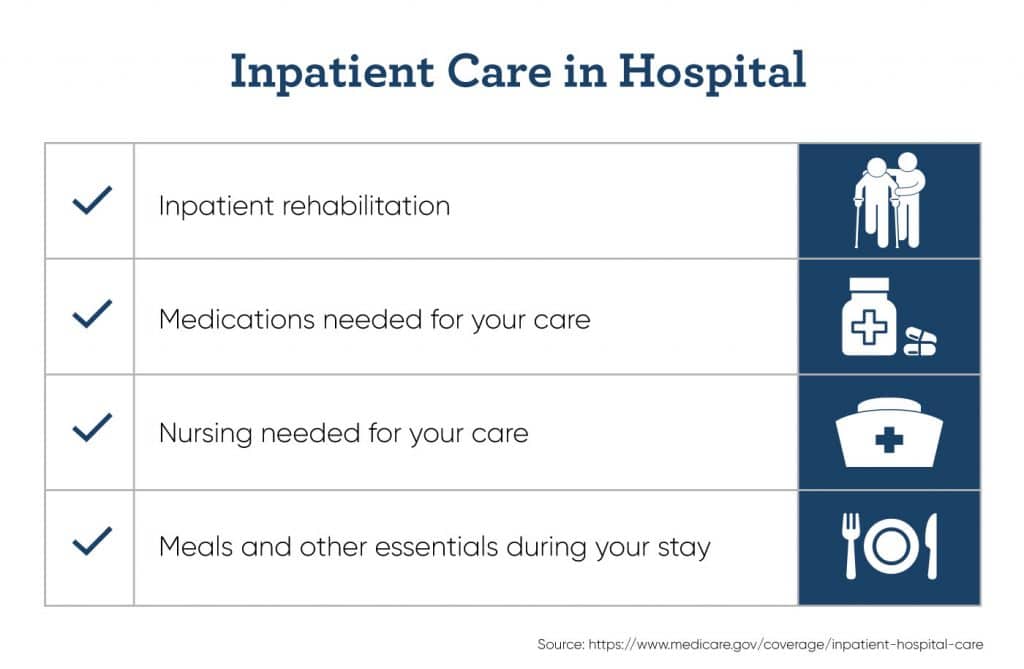

Inpatient Care in a Hospital

One thing Medicare A covers is inpatient hospital care. This kind of care is for acute illnesses that require extended stays in the hospital.

Inpatient care includes inpatient rehabilitation services, like physical therapy and medical treatments. You may also be provided with medications needed for any illnesses you may have, and nursing needed for your care. Of course, while you’re in the inpatient facility, meals, and other essentials during your stay are covered.

Qualifications for inpatient care depend on features of your specific situation. Qualifications for inpatient care under Medicare Part A include:

- Having been ordered to inpatient care by a doctor.

- The hospital accepts Medicare Part A coverage.

- A review committee has accepted your case (in rare cases).

You’re probably curious about the costs. While Medicare does cover the majority of the costs incurred by an inpatient hospital stay, you may still be responsible for a portion of the costs. Patient cost burden is broken down like this:

- Medicare Part A offers a $1,364 deductible each benefit period: the period from the start of your stay until 60 days after your last day of in-patient care.

- The first 60 days, there are no copays.

- The next 30 days (up to your 90th day) require a $341 copay per day.

- After day 90, it’s $682 per day for up to 60 lifetime reserve days — this is a standing stock of days that Medicare will help pay for.

- Any day after the first 90 days plus 60 reserve days, patients are responsible for the full cost of their stay.

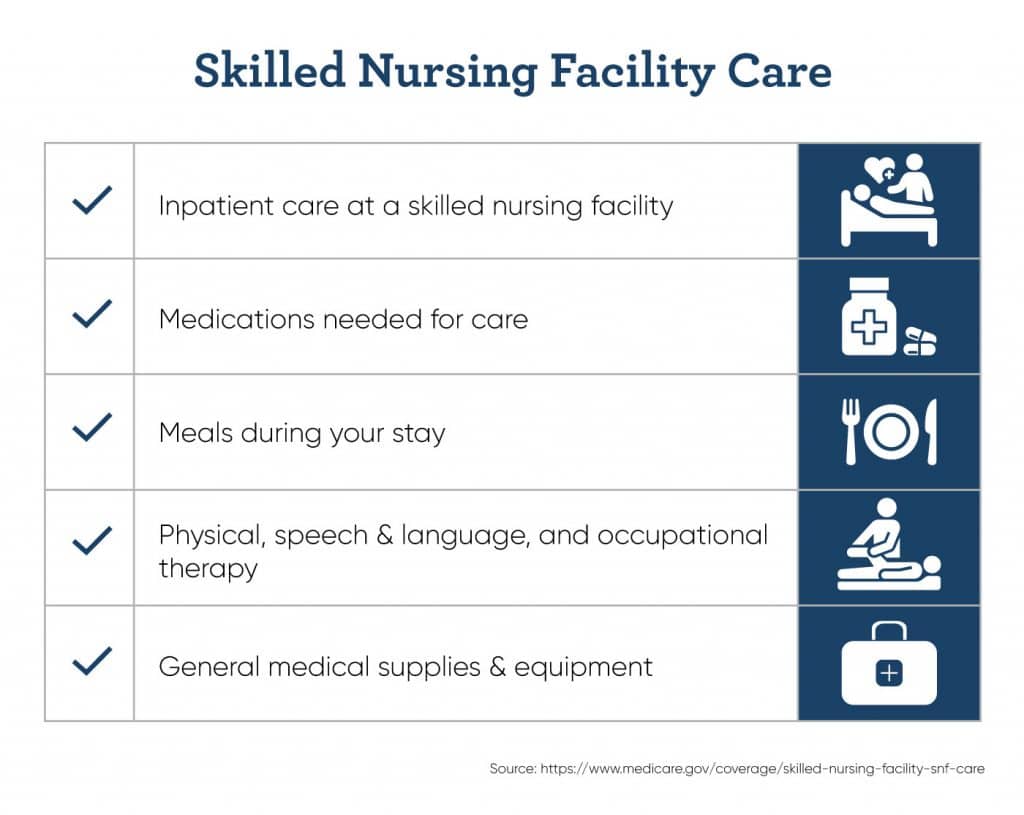

Skilled Nursing Facility Care

Medicare Part A also covers care in a skilled nursing facility. Skilled nursing facilities are not to be confused with what’s known as custodial care, which is the more general and basic kind of nursing facility you might think of. Skilled nursing facilities are more medically focused and have more medical staff, and so are better suited to inpatient care.

Medicare Part A coverage includes rehabilitation and medical treatments. While in the facility, you will also be provided with medications needed for illness and rehabilitation, as well as meals and other living necessities during your stay.

If your care calls for it, physical, speech, and language, and occupational therapy will be covered to get you on the move again. General medical supplies and equipment necessary for your treatment plan may also covered as part of Medicare Plan A.

You may qualify for skilled nursing care under these conditions:

- You have days left in your benefit period.

- You’ve received approval from a doctor and a qualifying reason for your stay.

- Your skilled nursing facility is approved by Medicare.

Medicare covers the majority of the costs of your stay. Patients may, however, still be responsible for sharing some of the costs:

- $0 for the first 20 days of your benefit period.

- The next 80 days (up until day 100) are 170.50 per day copay.

- After day 100, you’re responsible for all costs.

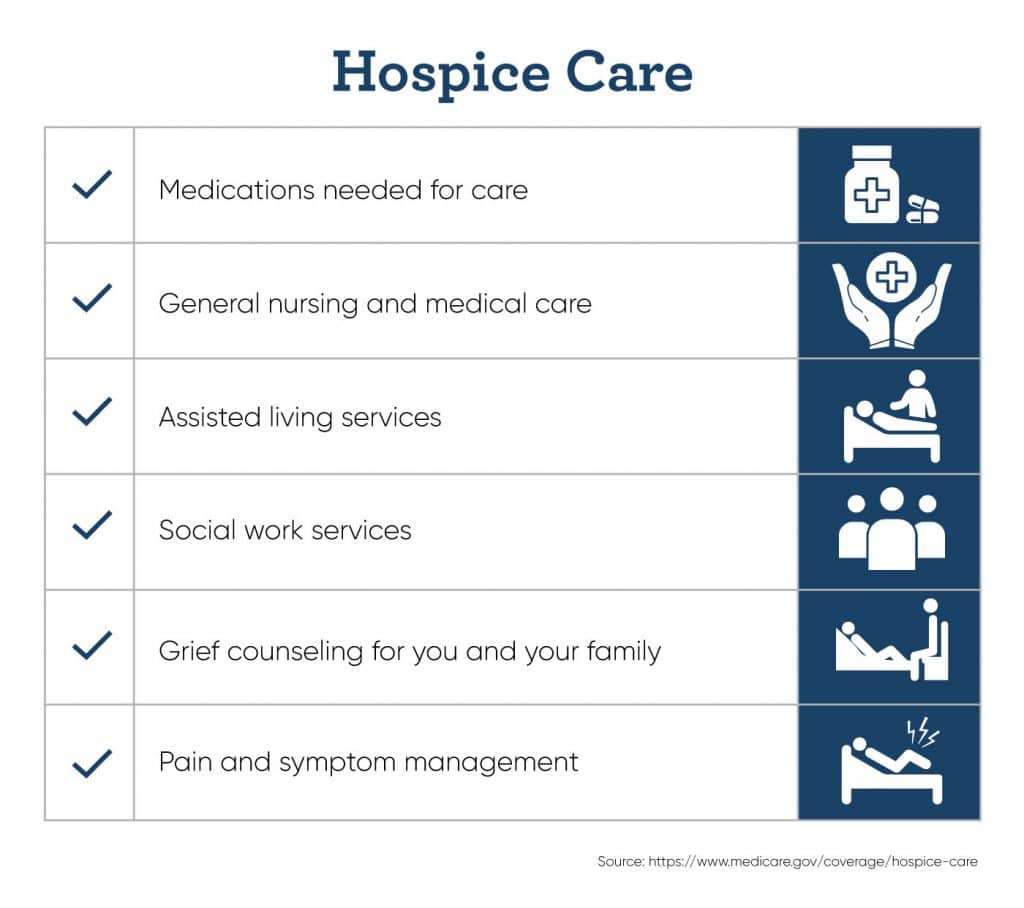

Hospice Care

Hospice care is also known as end-of-life care. If you or a loved one is terminally ill, Medicare A will nearly completely cover the expenses of hospice care.

Medicare A’s coverage includes medications needed for care and pain management — this does not, however, include curative care, as it would not be a hospice or end-of-life circumstance in that case. It also includes general nursing and medical care for quality of life, as well as assisted living services including bathroom help, cooking, and cleaning.

Hospice care covers some of the other parts of end-of-life care that you might not first think of. That means social work services to manage your affairs, and grief counseling for you and your family.

You may qualify for end-of-life or hospice care if you meet these conditions:

- You have been diagnosed with a terminal illness by a licensed doctor, and have 6 months or less remaining.

- You have accepted palliative (that is, care to treat pain and symptoms) care rather than curative medical care for your illness.

- You sign off on your preference to receive hospice care instead of care to treat and cure your illness.

In the case of hospice care, Medicare covers the majority of costs. Here’s the breakdown:

- In general, hospice care in a hospice facility is completely covered by Medicare.

- In the vast majority of cases, all drugs and related pain relief management will result in a copay of $5 or less.

- If you choose to receive hospice care in your own home or a custodial nursing facility, Medicare will not be responsible for paying for room and board, but will still cover the costs of nursing and medical treatment.

Home Healthcare Services

If you have a medical condition that requires occasional nursing visits, physical or speech therapy, or a similar kind of at-home care, Medicare may cover close to all of the related expenses. (Note that 24-hour home care is not covered, however.)

This includes at-home nursing, like administration of medicine and checkups on vitals and symptoms. Physical or occupational therapy to help you get mobile again are also covered under Medicare A.

Speech pathology care for any medical conditions that may have inhibited your ability to speak is covered — however, you may want to note that, similar to skilled nursing facility care, custodial and homemaking (personal shopping, meal delivery, etc.) services are not covered if that is the only care needed

You may qualify for at-home care if you meet these conditions:

- You are under a treatment plan mandated by a doctor.

- A doctor has certified that you require special at-home care, like physical therapy or occupational therapy. The extent, duration, and kind of services permitted under Medicare Part A are subject to many specific conditions. You can find a more extended list of such conditions on this page.

Costs:

- If you meet all the necessary qualifications, and if the home care service accepts Medicare A insurance, home health care is free.

- However, you may be required to pay 20% of the Medicare-approved cost of any medical equipment (like walkers, medical beds, or devices for physical therapy) your home care requires.

Navigating the Medicare system is difficult, and knowing what may or may not be covered within different Medicare plans can be confusing. By breaking it down into smaller pieces, you can make understanding Medicare Plan A much easier.

If you find that you are having trouble covering your medical bills, or you risk going into debt due to an unexpected medical need, you might want to supplement your income. Try our reverse mortgage calculator to see whether a reverse mortgage plan could help you make better sense of your finances. Medical expenses can be costly, but GoodLife is here to help.

1-866-840-0279

1-866-840-0279