Reverse mortgages are becoming an increasingly popular way to tap into your home’s equity. In fact, in 2021, reports showed that a national reverse mortgage lenders association saw a 34% year-over-year increase in interest in these types of loans.

What’s driving this increase in popularity? These federally-regulated and insured loans provide you with greater financial flexibility than many other types of loans.

Not only are you able to stay in your home without making mortgage payments, but reverse mortgage loans allow you to use the money to offset challenging macroeconomic conditions all while improving your quality of life.

Despite their growing popularity, though, when it comes to reverse mortgages, there is a lot of confusing and conflicting information online about how they work. Some people think that they are only for the elderly, while others assume you must be a millionaire to qualify.

So what is a reverse mortgage and how does it work? Keep reading for answers to those questions and more!

What Is a Reverse Mortgage and How Does It Work?

A reverse mortgage is an insured loan from a federally-backed program by the Federal Housing Agency. These loans allow homeowners 62 years of age or older to borrow against the equity in their homes.

With a reverse mortgage, the homeowner doesn’t have to make any monthly payments; instead, the loan is repaid when the home is sold or when the homeowner passes away.

However, the homeowner is responsible for paying homeowners insurance, property taxes, and maintenance.

Although you won’t be required to make payments, it is important to know that the interest on a reverse mortgage accumulates over time. On the other hand, if your home appreciates over the years, that appreciation could offset, in whole or in part, the increase in the loan balance.

As with any major financial decision, it’s important to think carefully before taking out a reverse mortgage and do your homework.Fortunately, there are several Federal protections in place to protect the interests of borrowers. (Non-recourse. Mandatory Counseling. Maximum origination fees. Programs for borrowers in distress).

- A reverse mortgage is a non-recourse loan. So, you’ll never owe more than the value of your home.

- To protect borrowers, the federal government requires that all borrowers meet with an independent consultant who will make sure they are well-informed.

How Does a Reverse Mortgage Work?

As mentioned above, a reverse mortgage is a type of loan that allows seniors to access the equity in their homes without having to make monthly mortgage payments.

If you take out a reverse mortgage you can use the money any way you wish. For example, you can use it to supplement retirement income, pay for healthcare expenses, or make home improvements.

To qualify for this type of loan, the youngest borrower must be at least 62 years old and have significant equity in your home (this means that you must have paid off a good portion of your existing mortgage).

What’s that entire process look like from start to finish?

Step 1 is to do your research. Reach out to a reverse mortgage loan specialist and learn about all the options available to you. Once you’ve determined that a reverse mortgage is right for you you will need to attend a mandatory reverse mortgage counseling session. Upon completion of the counseling you can then apply for a reverse mortgage.

After applying an appraiser will appraise your home to determine its value and how much money you can borrow against it. Once they approve the loan, you will receive the money. We’ll get into this below, but there are several ways in which you can receive that money.

With a reverse mortgage, you remain the homeowner and can continue to live in your home without having to make any monthly payments on the loan.

Remember, that money isn’t due unless you sell your home, move out permanently, or pass away.

Types of Reverse Mortgages

As you might have noted above, there are different ways that you can receive your payments from a reverse mortgage loan. However, before getting into those, it’s important to establish that there are three different types of reverse mortgage loans:

- HECM (Home Equity Conversion Mortgage)

- Single-purpose reverse mortgage

- Proprietary reverse mortgage

The HECM is by far the most common that you’ll see. They are federally insured and generally have the most flexible terms. Current HECM lending limits for 2022 are $970,800.

Single-purpose reverse mortgages are typically offered by government agencies or nonprofits and can only be used for a specific purpose, such as repairing your home or paying property taxes.

Proprietary reverse mortgages (JUMBOs) are private loans that are backed by the equity in your home. These loans tend to have higher loan limits than HECMs and offer numerous benefits.

Some of those benefits include lower down payments, competitive interest rates, home financing consolidation, and more.

Now, aside from the type of reverse mortgage loan you choose, you can also choose to receive cash in several ways.

Lump Sum

If you would prefer a fixed interest rate on your loan, then you will want to choose the lump sum option. This is the only option that comes with a fixed interest rate. As the name suggests, you get all of the cash in one lump sum as soon as the loan closes.

Equal Monthly Payment

If you would rather receive payments over time and don’t want the risk of having access to all of that cash in your bank account then opting for equal monthly payments might be a better option. With this one, you receive the same monthly payment for as long as someone lives in the home.

Term Payments

This option is similar to the option above. However, the main difference is that you’ll receive payments over a set period. Let’s say that’s ten years. The total value of your reverse mortgage will get paid out to you equally over those ten years.

Line of Credit

For those who feel like they might need to tap into emergency money at some point, a line of credit is a great option to have. You can receive monthly payments just the same. However, on top of that, if you ever need to you can tap into a line of credit as well.

Keep in mind that the previous four options come with adjustable interest rates. The lump sum option is the only one that allows a fixed interest rate.

Reverse Mortgage Benefits

Reverse mortgages can offer several benefits to senior homeowners in need of supplemental income or extra cash during retirement.

One reverse mortgage benefit is that you don’t have to make any regular payments as you would with a traditional forward mortgage. That means that you can stay in your home as long as you want and don’t have to worry about making monthly payments.

And because the loan is repaid from the proceeds of the sale of the home, there’s no risk of owing more than the value of the home. This means that for seniors who want to stay in their homes but need financial assistance, a reverse mortgage can be a great option.

Additionally, reverse mortgages have tax advantages. The money you receive from a reverse mortgage is not considered taxable income. And, as long as you live in your home, you don’t have to pay taxes on the reverse mortgage proceeds.

These types of loans are incredibly flexible compared to other types of loans as well. As mentioned above, you can choose to receive the money in a variety of ways. On top of that, the proceeds from a reverse mortgage can be used for any purpose, including home improvements, medical expenses, or everyday living expenses.

All in all, reverse mortgages can be a great option if you want to live in your current home but need access to extra cash. However, it’s important to understand all of the risks and costs before taking out a reverse mortgage.

Is a Reverse Mortgage Right for You?

Now that you know what a reverse mortgage is and how they work, it’s time to answer the big question. Is a reverse mortgage right for you?

That’s ultimately a personal question. Speaking with one of our financial advisors can help. However, here are a few things to consider before taking out a reverse mortgage:

- Do you have enough equity in your home to qualify for a reverse mortgage?

- Do you have any outstanding debts that would need to be paid off with a reverse mortgage?

- Are you up to date on all of your IRS payments?

- Are you prepared to give up some of the equity in your home?

- Is your home in good enough condition to qualify for a reverse mortgage?

Answering these questions honestly will help you determine if a reverse mortgage is right for you.

How Much Can I Get With a Reverse Mortgage Loan?

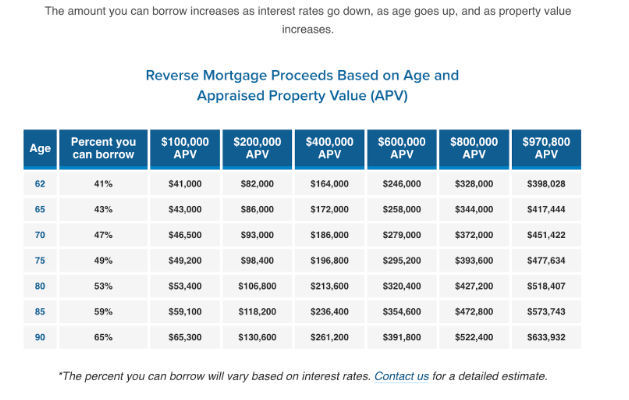

The amount you can borrow is based on the age of the youngest borrower and the value of your home. The best way to get a general idea of the loan amount you qualify for is to look at the Principal Limit Factors table.

Use Our Reverse Mortgage Calculator

If you think a reverse mortgage sounds like a great financial tool for you then your next step is to use our reverse mortgage calculator to help estimate how much money you could potentially receive from a reverse mortgage loan or contact Good Life Home Loans today 1-866-588-1692.

1-866-840-0279

1-866-840-0279