Understanding Retirement Mortgages

Many retirees find that, in retirement, they wish to move into a new home. And, for most, that means seeking out a mortgage. A mortgage is a loan that’s used to purchase a home, usually offered through a bank or lending agency.

However, there are many different kinds of mortgages, and some mortgage products are specifically designed for retirees, seniors, or those with limited income streams. So, can a retiree get a mortgage? In this post, we’ll walk you through what you need to know about the various kinds of retirement mortgages available on the market for retirees, as well as how to qualify for one.

Key takeaways

- Retirees can take out mortgages to purchase property — however, they may face some difficulties due to limited retirement income streams.

- Retirees can apply for conventional mortgages, federally backed mortgages (from the FHA, VA, and USDA), or reverse mortgages.

- Federally backed options are often a good choice for those with lower credit scores or who haven’t saved up enough for a 20% down payment.

- Qualifying for a mortgage depends on the specific type of mortgage you’re applying for, as well as your financial situation. In general, proof of assets, income, and credit history are helpful.

What are retirement mortgages?

Retirement mortgages are mortgages that can be obtained by retirees. Often, these mortgage products are the same as those offered to non-retirees. However, some banks and lending agencies may also offer products specifically geared more toward seniors. For example, mortgages offered through government enterprises like Fannie Mae and Freddie Mac often come with appealing perks.

- Mortgages are a type of loan. A mortgage is offered through a bank, credit union, or lending agency for the purpose of purchasing property. Typically, they have longer repayment periods than other loans. There are several varieties of mortgages that consumers have the option to choose from.

In addition to conventional and government-backed mortgage options, seniors may also have the option to take out a reverse mortgage. These mortgages, discussed in more detail further down, are intended for seniors who already own property, and wish to use their equity as a source of retirement income.

Can retirees get a mortgage?

Yes, retirees can get a mortgage just like anyone. However, there may be some obstacles that retirees run into when applying. For many retirees, their monthly income in retirement drops significantly. This is because, rather than bringing home a full paycheck from work, retirees rely on other income streams, like 401ks, IRAs, pensions, and Social Security. Often, the monthly payments from these sources amount to less than a late-career professional.

Why does this matter? Lenders look at a variety of factors when determining a potential borrower’s eligibility for a mortgage. One of those factors is monthly income; lenders want to know that you have the capital to cover the payments that will be expected of you. If your income is low because you have retired, lenders may be more hesitant to offer you a mortgage.

On the other hand, however, there are laws that prevent lenders from discriminating against people on the basis of age. The Equal Credit Opportunity Act prevents credit-based mortgage discrimination based on sex, age, race, ethnicity, national origin, marital status, and other factors.

However, it’s important to note that, while creditors cannot discriminate against borrowers based on age, they may use age to determine other factors. For example, if your age suggests that you are nearing retirement, creditors can infer from this that your income may drop soon, which could factor into their decision about your application.

So, can a senior citizen get a mortgage? It depends. Whether a retiree can successfully obtain a mortgage depends on a number of factors, many of which apply to anyone who applies for a mortgage. We will cover how to qualify for a mortgage in a later section. However, before you start thinking about applying, it’s important to know what types of retirement mortgages are available to retirees.

What types of retirement mortgages are there?

Retirees looking for a mortgage have a few different options. Before you start searching for the right loan for your next home, you can narrow your choices by understanding the types of mortgages available.

Conventional mortgages

Conventional mortgages are mortgage loans offered or guaranteed through a private entity, or through one of the two government-run enterprises, Fannie Mae and Freddie Mac. When searching for a conventional mortgage, there are a few places that you can look: banks (including large national banks as well as smaller local banks), credit unions (you can search for credit unions in your hometown), or lending agencies — these are businesses that are specifically set up to provide loans.

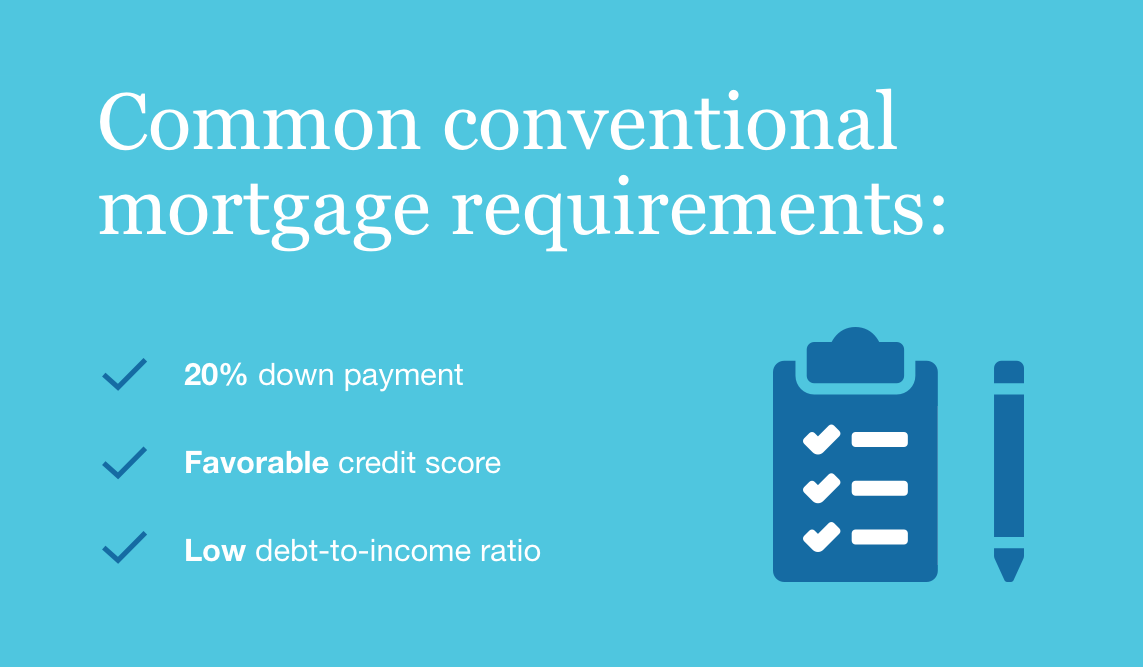

When applying for a conventional mortgage, it’s often necessary to provide a 20% down payment up front. If you cannot afford this, you may have to pay for mortgage insurance, essentially another cost added to your monthly mortgage payments. Some loans, such as some offered through Fannie Mae and Freddie Mac, may have lower requirements for down payments for lower-wage earners. These can be beneficial to retirees with limited income streams, so it’s worth asking about them when on the search for a retirement mortgage.

Conventional loans typically come in 15 and 30 year repayment options, and can have fixed or variable interest rates. It’s a good idea to search for loans with fixed interest rates, as variable interest rates may allow lenders to hike up the interest rate in some cases, increasing your monthly payments.

Before accepting you for a mortgage, in addition to a down payment, a conventional mortgage may ask for information about:

- Your credit history and credit score

- Your yearly and monthly income

- Other outstanding debts

- The value of your assets

If some of these requirements may pose a challenge, don’t worry; there are other options.

Government-backed mortgages

The federal government has several programs in place to help citizens who might otherwise have a difficult time acquiring a conventional mortgage. Government-backed mortgages are guaranteed by a few different federal institutions, but importantly, they are still administered through banks, credit unions, and lending agencies.

FHA mortgages

The FHA is the Federal Housing Administration. This administration seeks to make mortgages more widely available to consumers by approving mortgage lenders to offer FHA-backed loans — basically, the FHA insures the loan so that, if the borrower defaults, the lender is covered.

This means they can offer consumers loans even if they have lower credit scores or low down payments. In fact, some FHA loans allow you to put as little as 3.5% down when applying for a mortgage. This makes FHA mortgages easier to acquire, but they can also be costlier. Mortgage insurance is required for FHA loans, which increases the cost of your monthly payments.

VA mortgages

VA loans are available to veterans and active service members. They have many of the same perks that come with an FHA loan — in fact, depending on the lender, VA loans may have no down payment requirement at all. They also have flexible credit and debt requirements.

Like FHA loans, VA loans are not administered through the VA; they are approved and backed by the VA, then offered through traditional lenders.

USDA mortgages

Similar to FHA and VA loans, USDA (US Department of Agriculture) loans are a useful way to get a loan when your credit is a little on the low side, or you don’t have a high amount saved up for a down payment. USDA loans are targeted at those who want to purchase a home in a rural area, and make low to moderate income. They come with perks like limited to no down payment, and low credit requirements.

Like the other loans listed above, USDA loans are purchased through lenders, not directly through the USDA.

Reverse mortgages

Unlike the other loans mentioned so far, reverse mortgages are intended for retirees who are already homeowners. Reverse mortgages work by accessing the equity in a property and using it to fund direct payments or a line of credit for the homeowners. Homeowners must be over 62, own substantial equity in their home, and live in the home as their primary residence to be eligible.

While reverse mortgages, like those offered through GoodLife, are often used to fund retirement expenses and supplement other sources of retirement income, they can actually be used to purchase a home — for example, if you wanted to downsize, you can use your reverse mortgage proceeds to cover your new mortgage.

If you’re curious about the financial freedom offered by a reverse mortgage, you can speak with a Reverse Mortgage Specialist today. We are happy to help you understand how a reverse mortgage might fit into your retirement finances.

How do you qualify for a retirement mortgage?

Obtaining a mortgage in retirement often requires certain qualifications. Whether you qualify for a retirement mortgage depends on several factors, like the type of mortgage you’re applying for and your personal financial situation.

Conventional mortgages tend to have requirements that center around your borrowing history. For example, you may be required to prove you have high enough credit, show that your income is high enough to make monthly payments without an issue, and that your debts are not too significant.

- Note: Debt-to-income ratio (DTI) is a common metric used by lenders to measure your creditworthiness. If your monthly debt payments are close to or greater than your income, you might have a hard time getting approved for a loan.

In qualifying for a retirement mortgage, it’s likely that one of the greatest challenges you’ll face is demonstrating that you have a robust enough income stream to afford monthly mortgage payments. As mentioned before, many lenders know that retirees often have limited, fixed income streams, which can make them hesitant to lend.

However, there are ways to demonstrate your financial trustworthiness. For example, Fannie Mae and Freddie Mac allow retirement accounts like 401ks and IRAs to be used as assets when assessing the financial profile of a borrower. This means that lenders, knowing retirees have access to these assets, may feel more comfortable lending money.

Getting a mortgage when retired can be challenging, but it is possible. Ultimately, it’s best to speak with a representative from a lending institution to know what they look for when assessing a potential borrower. To find out more about reverse mortgages, you can contact a GoodLife Reverse Mortgage Specialist, or download our free HECM guide today.

1-866-840-0279

1-866-840-0279