Reverse mortgages can be an effective way to fund your retirement, allowing you to tap into the home equity you’ve accrued over the years and use it as a new source of cash flow. However, many people wonder, are reverse mortgages safe? Is a reverse mortgage a good idea?

Reverse mortgages are safe for consumers, as they are overseen by the Federal Housing Administration (FHA) and the Department of Housing and Urban Development (HUD). In this post, we’ll explain what a reverse mortgage is, how it works, and what safety precautions are put in place to ensure that consumers get a high-quality financial product.

KEY TAKEAWAYS

- Reverse mortgages allow retirees to tap into home equity as a source of retirement funding.

- The Home Equity Conversion Mortgages (HECM) Program, insured and overseen by the FHA, maintains rules and regulations to keep borrowers safe.

- Proprietary mortgages are not overseen by the FHA, but some companies, like GoodLife, maintain strict standards to keep borrowers safe as well.

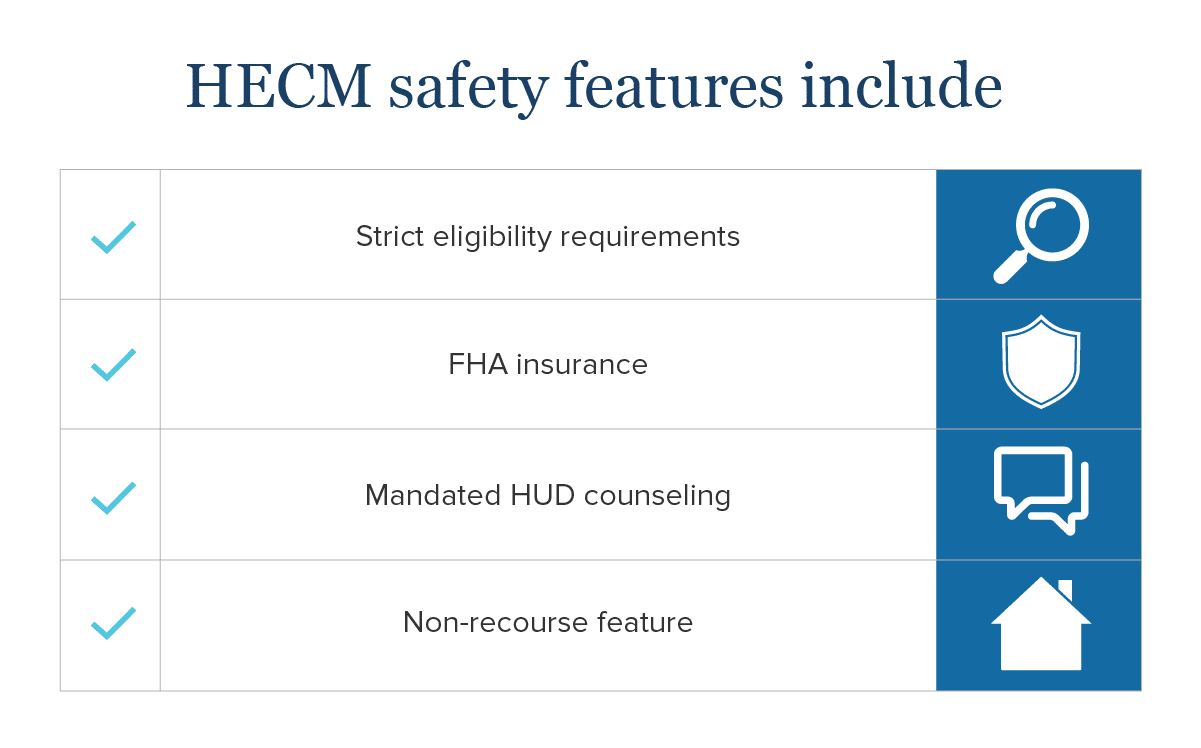

- Reverse mortgage protections include strict eligibility requirements, FHA insurance, HUD counseling, and a non-recourse feature.

- Eligible candidates can use reverse mortgage proceeds to fund a wide range of retirement expenses, from leisure to medical expenses.

What is a reverse mortgage?

Reverse mortgages allow eligible borrowers to convert the equity in their homes into a monthly stream of income, a lump sum of cash, or an available line of credit. A Home Equity Conversion Mortgage (HECM) is a reverse mortgage that is federally insured by the FHA. HECM reverse mortgages are eligible to homeowners aged 62 and up who want to supplement their retirement income, or use reverse mortgage proceeds as their primary form of retirement cash flow. The Federal Housing Administration (FHA) insures and regulates this form of loan, so these loans must also abide by FHA reverse mortgage guidelines.

- Find out how much you might be able to access with our free reverse mortgage calculator.

Reverse mortgages, unlike conventional loans, delay both principal and interest payments until the loan matures — usually when the borrower moves out of the house, or passes on. Before then, reverse mortgage funds can be used for a range of things, from travel to home repairs, greatly increasing a borrower’s quality of life and independence throughout retirement by allowing them to retire in comfort without having to move out of their homes.

In addition to the HECM program, some companies offer proprietary reverse mortgages, sometimes called jumbo reverse mortgages. Private lender proprietary reverse mortgage guidelines often vary from an HECM, which is federally guaranteed and overseen. The HUD reverse mortgage guidelines, like all government-sponsored loans, are heavily regulated, with guidelines in place to protect both borrowers and lenders. We’ll cover a bit more about proprietary reverse mortgages further down.

How do reverse mortgages work?

A reverse mortgage allows retired homeowners to tap into their home equity as a way to add a source of cash flow to their retirement portfolio. Home equity refers to the portion of a home’s value that the homeowner owns rather than the portion held by their mortgage lender. Homeowners who want to remain in their homes but want to take advantage of the value they’ve built up in the property often struggle to decide whether to stay or sell and take advantage of their equity.

A reverse mortgage, or HECM, allows homeowners to tap into their accrued equity without requiring them to move out. That makes reverse mortgages a great option for retirees who wish to stay in place, whether because they wish to remain close to family, simply because they wish to keep their homes.

As mentioned, one important feature of HECM loans is that they only become due and payable after a maturation event. This includes the death of the borrower, the borrower moving out of the home, the property being sold, or the borrower no longer using the property as their primary residence.

After a maturation event, the homeowner or their heirs will decide whether to sell the house to pay off the mortgage or pay it off directly if they want to retain it. Borrowers or heirs owe either the loan’s value or 95% of the home’s appraised value, whichever is less.

HECM vs proprietary reverse mortgage

As mentioned above, in addition to HECM loans, there are also proprietary (or jumbo) reverse mortgages. Proprietary reverse mortgages are not restricted by the same regulations put in place to govern HECM reverse mortgages. They are called jumbo reverse mortgages because they can be used to finance claim amounts higher than the yearly HECM claim limit.

The FHA insures HECM loans, which guarantees that if the borrower defaults, the lender would not lose as much money as they would otherwise. This insurance enables HECM loans, such as those provided by GoodLife Home Loans, to have low interest rates and favorable terms.

Private reverse mortgages, alternatively, are not backed by the FHA. That means the lender and borrower are solely responsible for them; the government does not step in if the borrower defaults. As a result, there are fewer regulations and the possibility of higher interest rates.

However, at GoodLife, we only offer reverse mortgage solutions that we are proud of. Our jumbo reverse mortgages come with protections and standards to keep borrowers safe. If you think your property might be better suited for a jumbo reverse mortgage, contact us to find out how we can help.

What makes a reverse mortgage safe?

Are reverse mortgages safe? Reverse mortgages are considered a safe and secure financial product for a number of reasons. At GoodLife, we are committed to our clients’ security and satisfaction when purchasing a reverse mortgage product. These are a few of the features that make HECM loans a safe option for retirement funding.

1. Strict eligibility requirements

Getting a reverse mortgage requires borrowers to meet certain eligibility requirements, helping to guarantee that it’s the best option for their retirement funding.

Eligibility requirements include:

- Borrowers must be at least 62 years old or older.

- Borrowers must own substantial equity in their home, usually over 50%.

- Borrowers must meet with a HUD-approved third-party counselor as part of the reverse mortgage application process.

- Borrowers must live in the property as their primary residence.

- Borrowers must be current on all outstanding debts and other financial obligations.

- Borrowers must maintain their home to all FHA standards throughout the term of the loan.

2. FHA insurance

The FHA insures reverse mortgages administered through the HECM program. That means that HECM loans come with protections for buyers as well as lenders. Plus, lenders can offer lower, more favorable rates to borrowers. That’s because, thanks to FHA insurance, lenders have more security that they won’t lose out if a borrower defaults. That, in turn, makes reverse mortgages more affordable for borrowers.

Getting Started with Reverse Mortgages

If you’re looking to get started with a reverse mortgage, these articles can help guide you through all aspects of the process.

Guide to HECM Loan Reverse Mortgage Limits

3. HUD counseling requirement

The Department of Housing and Urban Development requires that borrowers meet with an approved counselor before purchasing a reverse mortgage. This allows borrowers to review their personal finances thoroughly, and consult with a third-party professional — not someone who works at the reverse mortgage lender — about whether a reverse mortgage works best for their finances, ensuring they make their decision informed and with confidence.

4. HECM loans are non-recourse

If the loan balance is more than the appraised value of the home, heirs will not have to pay the difference. This is called a non-recourse loan. Instead, the Federal Housing Administration insurance that we previously mentioned is in place to cover that extra cost. Note that the borrower pays into the FHA federal insurance fund during the closing process of the loan, as well as each month.

Additionally, reverse mortgage heirs are not responsible for the remainder of the loan balance, and do not have to pay back the loan in the event that the borrower passes away still holding a balance.

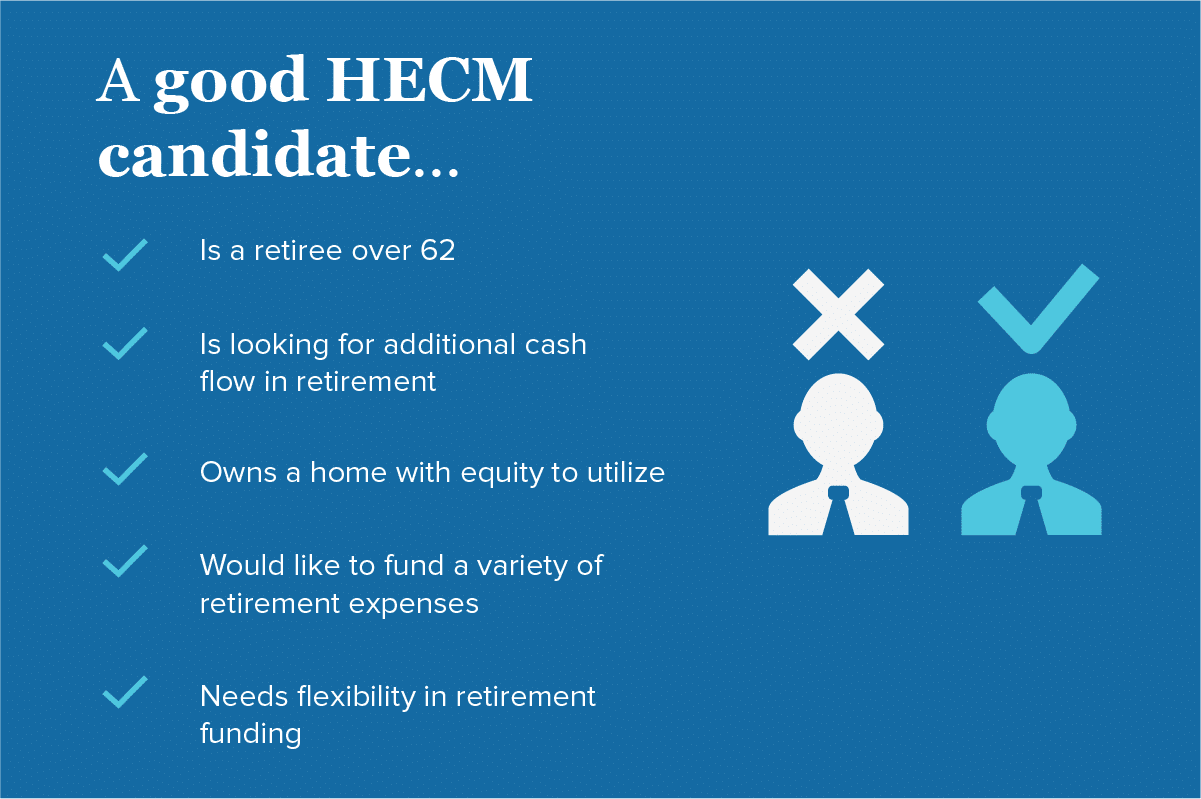

What makes a good candidate for a reverse mortgage?

A good candidate for a reverse mortgage is a retiree over 62 years old who owns substantial equity in their home and wants to benefit from tapping into that equity. Reverse mortgages are suitable for a wide variety of circumstances due to the flexible way that you can spend your proceeds:

- Supplement fixed sources of income such as retirement savings, pensions, and Social Security

- Cover routine medical costs, bills, and expenses as well as larger surgeries or procedures

- Fun daily expenses such as groceries, utilities, gas, and car payments

- Finance important home renovations and repairs, as well as accessibility modifications

- Spend cash on fun, like hobbies, travel, and leisure

If you’re not sure whether your financial situation calls for a reverse mortgage, don’t worry. A GoodLife Reverse Mortgage Specialist will be happy to walk you through the basics, as well as help you determine whether this form of financing is suitable for your retirement plans.

You can also download our HECM guide for a full guide to HECM loans, our most popular reverse mortgage product. It’s totally free with an email address, and will explain what you need to know about the reverse mortgage process so you can make financial decisions with confidence.

1-866-840-0279

1-866-840-0279