What is a Jumbo Reverse Mortgage?

Many homeowners wonder how they can access the wealth they’ve built through home equity in the past, so they can improve their financial circumstances in the present. A jumbo reverse mortgage offers a unique solution that can be leveraged in several different ways.

Key Takeaways

- Jumbo reverse mortgages allow homeowners to take out a reverse mortgage on a home larger than the HECM limit.

- The HECM limit for 2022 is $970,800.

- The size of a jumbo reverse mortgage depends on your age, current interest rates, and your appraised property value.

- Eligibility can depend on the lender, but common requirements include the borrower being over 62, owning over 50% of home equity, and living in the home as their primary residence.

- Benefits include a higher borrow limit than HECM, but drawbacks include that there might be fewer regulations & protections.

If you own a property that’s appraised at a value higher than the current loan limit for a traditional reverse mortgage (also known as a home equity conversion mortgage, or HECM), then read on to learn how this alternative product may help you take greater advantage of your home’s financial worth.

Let’s start by answering a simple question: what is a jumbo reverse mortgage?

The Definition of a Jumbo Reverse Mortgage

A jumbo reverse mortgage is often defined as a “proprietary” reverse mortgage loan because they’re designed and offered by individual financial institutions with fewer government regulations. Different lenders offer their own versions of jumbo reverse mortgages that carry unique guidelines for cost, loan value, interest rate, and so forth.

This is in contrast to the HECM program, which offers reverse mortgages regulated by the Department of Housing and Urban Development (HUD) and insured by the Federal Housing Administration (FHA). These loans allow eligible homeowners to tap into a portion of home equity and convert it into loan proceeds issued by FHA-approved lenders.

HECM borrowers are not required to make monthly payments toward the principal loan balance plus accumulated interest that may be assessed at a fixed or adjustable rate; the loan only becomes due and payable when it reaches a maturity event, such as selling the home or moving away.

However, HECM borrowers are required to pay for upfront and ongoing mortgage insurance (in addition to all mandatory financial obligations). This reduces risk for lenders because in the event of loan default, the insurance would offset their losses up to the current maximum claim amount (MCA).

By contrast, reverse mortgage jumbo loans lack federal insurance and are, therefore, exempt from the same lending limits set for HECM loans — as of 2022, $970,800.

Instead, jumbo reverse mortgage loan limits are higher, allowing homeowners to access more equity in a high-value property that exceeds the 2022 FHA lending limit of $970,800. This allows homeowners who own high-value homes to access a similar suite of benefits to those available through a HECM loan, without the federally mandated limits.

Jumbo Reverse Mortgage Limits

The lending limit for a jumbo reverse mortgage varies by lender. Proprietary reverse mortgages are referred to as “jumbo loans” because the value often exceeds the limit set by federal guidelines.

Historically, the HECM product was designed to help senior homeowners finance the cost of living in retirement. Recent findings indicate that as few as one in three Americans have less than $5,000 in retirement savings, although many people have wealth stored in the equity of their homes.

Reverse mortgages can be used as a tool to access this wealth without the need to sell or move off the property. Loan approval is not contingent upon creditworthiness nor earned wages, so homeowners who might experience difficulty qualifying for alternative financing may qualify

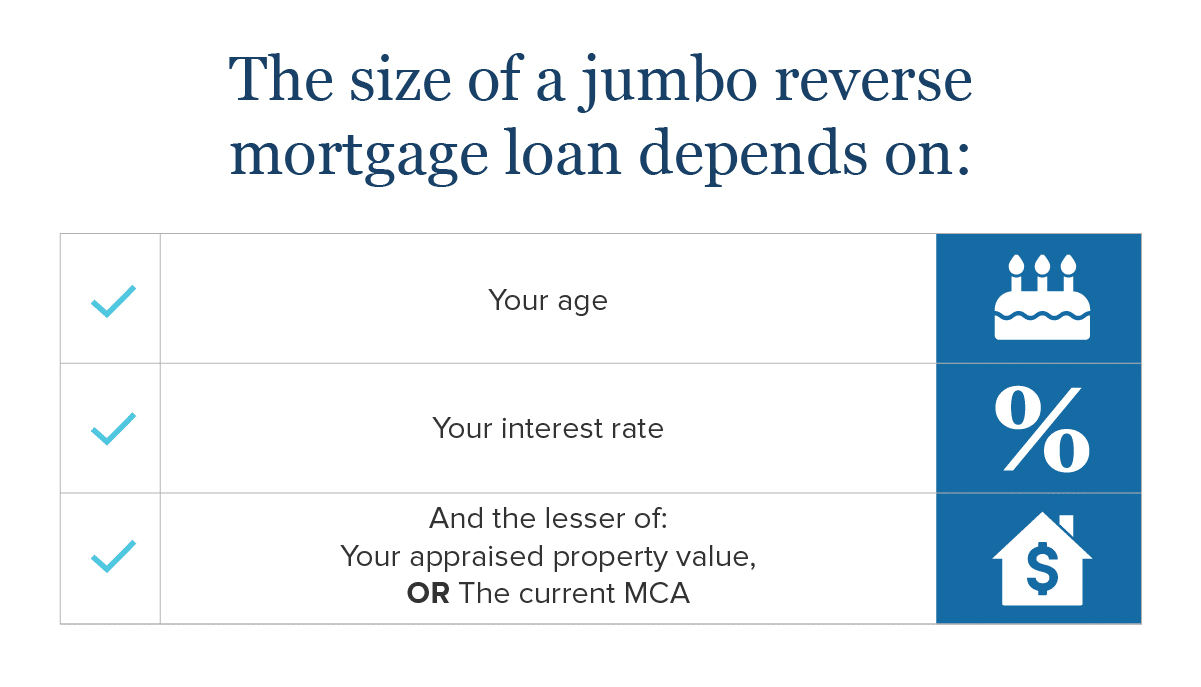

However, the size of a jumbo reverse mortgage depends on several factors, such as:

- Your age

- Your interest rate,

- And the lesser of:

a. Your appraised property value, OR

b. The current MCA

In order to get an accurate appraisal of the size of your loan, be sure to speak with a GoodLife professional, who can walk you through your options. You can also get a sneak peak at the amount you may be able to borrow with our jumbo reverse mortgage calculator.

Jumbo Reverse Mortgage Requirements

The requirements for a reverse mortgage jumbo loans can vary significantly depending on the lender, as they are not overseen by the HUD and FHA the way that HECM reverse mortgages are. Goodlife has three primary requirements that borrowers must meet in order to qualify for a reverse mortgage, as found on our reverse mortgage eligibility page.

- Age: Borrowers must be at least 62 years old in order to apply for a reverse mortgage. Spouses of borrowers may be under 62 years old, however.

- Home equity; Typically, GoodLife requires that borrowers own at least 50% of the equity in their homes in order to qualify for a reverse mortgage.

- Primary residence: The owner of the home must occupy the property as their primary residence in order to be eligible. Vacation homes and rentals are not eligible for reverse mortgage funding.

To gain more specific insights into whether your home qualifies for a jumbo reverse mortgage, be sure to speak with a GoodLife Reverse Mortgage Specialist. We are always happy to walk you through your lending process to help you find the financial product best suited to your retirement needs.

Advantages of a Jumbo Reverse Mortgage

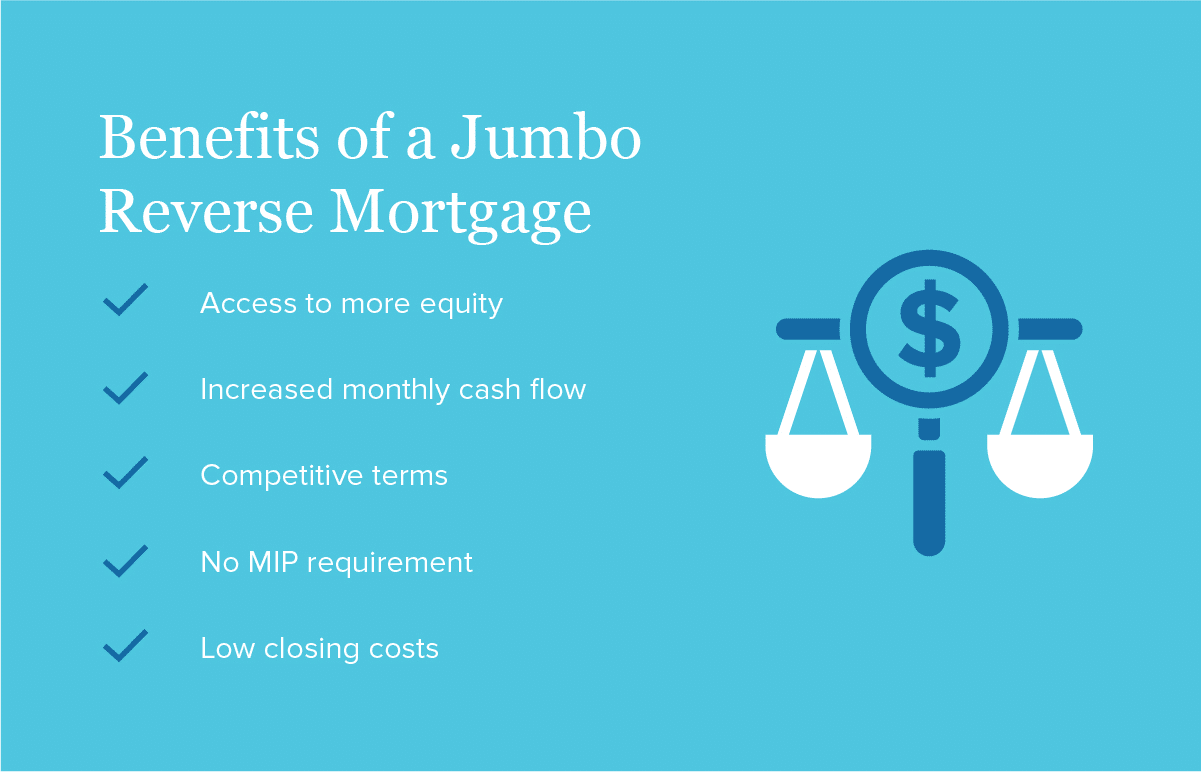

There are a number of benefits of a jumbo reverse mortgage that are worth considering:

- Access to more equity. A higher value home often means a larger pool of equity to draw from when receiving reverse mortgage cash flow, increasing monthly payments.

- Competitive terms. GoodLife offers competitive terms, including industry-leading rates and a trusted business model that retirees can count on.

- No MIP requirement. Unlike some other mortgage products, GoodLife jumbo reverse mortgages do not require a mortgage insurance premium.

- Low closing costs. Low closing costs on jumbo reverse mortgages make them an attractive and effective way to secure retirement financing.

Drawbacks of a Jumbo Reverse Mortgage

As with any financial product or retirement solution, there are several drawbacks to consider when deciding whether a jumbo reverse mortgage works for your personal financial situation. Here are just a few potential downsides you may want to keep in mind:

- Fewer protections. Because jumbo loans are not FHA-insured, there may be fewer borrower protections in place if you are unable to satisfy your debt. It’s a good idea to talk through what borrower protections your lender has in place before committing to a jumbo loan.

- Other payments continue. Jumbo loans can offer a source of monthly cash flow, but it’s important to keep in mind that insurance, property taxes, and home maintenance costs continue even if you qualify for jumbo reverse mortgage funding. Remember that retirement income is taxable, which could also contribute to your total monthly expenses.

Reverse mortgages, including reverse mortgage jumbo loans, can be a useful solution for a variety of retirement funding needs. The key is to ensure that you research your options and discuss available paths with a professional, like GoodLife Reverse Mortgage Specialist, before making any final decisions.

Getting Started with Reverse Mortgages

If you’re looking to get started with a reverse mortgage, these articles can help guide you through all aspects of the process.

Guide to HECM Loan Reverse Mortgage Limits

Jumbo Reverse Mortgage FAQ

How does a jumbo reverse mortgage differ from a reverse mortgage?

Jumbo reverse mortgages differ from traditional HECMs because they are not insured by the Federal Housing Administration (FHA) under the management of the Department of Housing and Urban Development (HUD).

The FHA maximum claim amount (MCA) for HECMs is $970,800 as of Jan. 1, 2022. Jumbo reverse mortgage loans allow you to borrow a maximum amount larger than the amount allowed for HECM loans

Are there restrictions on how to spend your jumbo reverse mortgage?

No, once your jumbo reverse mortgage has been funded, you can use the cash flow for whatever retirement needs you might have. Some of the most common uses for reverse mortgages include:

- Covering retirement cost of living (like food, utilities, and other necessities)

- Paying for medical expenses

- Funding retirement leisure, travel, and hobbies

- Supplementing cash flow from other sources, like retirement accounts and pensions

Note, however, that while there are no limits on how you use your reverse mortgage cash, the balance will still be due once the loan reaches a maturation event (like the death of the borrower).

How do I qualify for a jumbo reverse mortgage?

Qualifying for a jumbo reverse mortgage depends on a few factors, like those listed above:

- The primary borrower must be at least 62 years old.

- You must own substantial equity (usually over 50%) in your home.

- The home must serve as your primary residence

For more information, be sure to read through our reverse mortgage eligibility page.

What types of properties are eligible for a reverse mortgage?

A number of different properties are eligible for reverse mortgages per changes in FHA regulations. However, jumbo reverse mortgages may have different eligibility requirements than HECM loans overseen by the FHA. To find out more about whether your property is eligible for a jumbo reverse mortgage, be sure to speak with a GoodLife Reverse Mortgage Specialist.

What are the interest rates on jumbo reverse mortgages?

Your interest rate will depend on a few factors:

- The size of the loan

- The equity you own in your home

- Current interest rates

- Other personal financial details

GoodLife is proud to offer low, competitive interest rates on all our reverse mortgage products. To find out how low your rate might be, be sure to speak with a representative for a quote.

Sources:

1-866-840-0279

1-866-840-0279