Although you may no longer earn a traditional paycheck during retirement, you’re more than likely subject to income tax on the money that does come through the door. Failing to budget for state and federal retirement income taxes can cause headaches and stress, so it’s important that retirees learn about their financial obligations prior to owing penalties and late fees.

Today, we discuss how retirement income is taxed so you can plan for your future appropriately. Keep reading for a breakdown of federal taxes on retirement income or navigate using the links below.

Is retirement income taxable?

The short answer is yes, retirement income is taxable. The longer, more complicated answer which we’ll explore in today’s post is: yes, but it depends on the type(s) of income you receive, how much overall income you have, and the state in which you live.

What is considered retirement income?

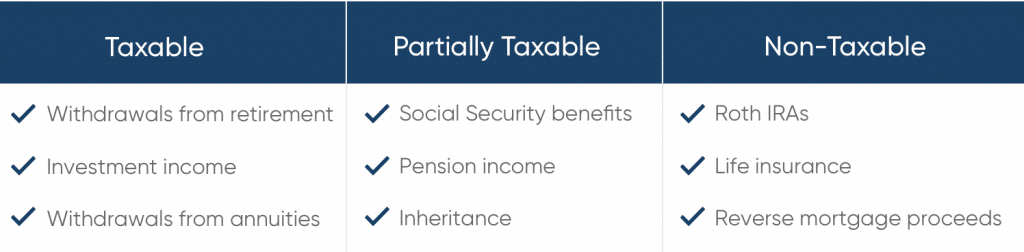

If you’re wondering whether retirement income is taxable, you first need to delineate the different types of income you might receive once you no longer earn income from employment. Many retirees continue to work for wages post-retirement, but there are several additional types of retirement income which may or may not be subject to taxation.

- Social Security benefits

- Withdrawals from retirement plans

- Pension income

- CDs, savings accounts, and money market accounts

- Stocks, bonds, and mutual funds

- Municipal bonds

- Annuities

- Dividends

- Rental income

- Reverse mortgage proceeds

- Life Insurance

- Inheritances

How is retirement income taxed?

Federal taxes on retirement income differ depending on the source. Each state has its own tax laws as well, so be sure to research your obligations according to where you live. Below is a guide to common types of retirement income, including the taxation rules for each; use this information to budget accordingly and to set up your tax withholdings in advance.

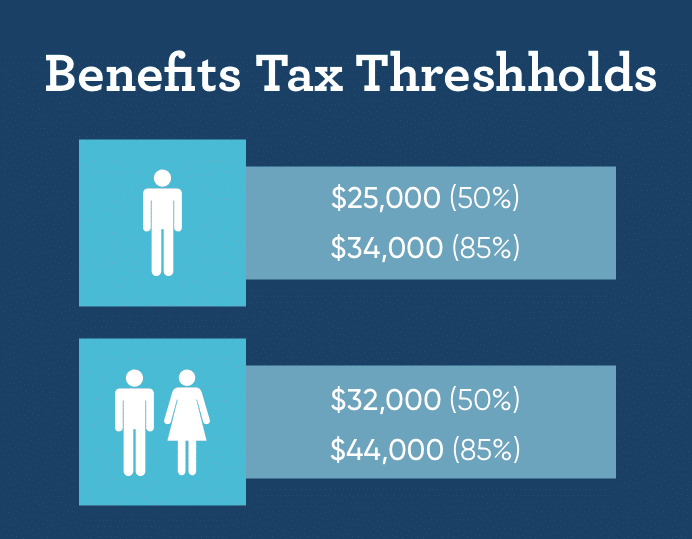

Social Security Benefits

If you fall below the income threshold, your benefits will not be taxed. However, you must pay some tax (up to 50% of benefit amount) on Social Security if your income is more than $25,000 for an individual or $32,000 for a married couple filing jointly. You’ll be taxed on up to 85% of your benefits if your income is more than $34,000 (per individual) or $44,000 (per couple). The tax rate also applies to Social Security spousal benefits, survivor benefits, and disability benefits.

To determine whether you’re required to pay taxes on your benefits, add up your adjusted gross income (AGI), nontaxable interest accounts, and 50% of your monthly benefit amount. If you fall above the threshold and you do owe retirement tax, you can pay either by filing quarterly estimated tax returns with the IRS or by requesting the Social Security Administration (SSA) to withhold federal taxes from your benefit payment.

As of 2019, 13 states also tax Social Security to varying degrees, in addition to the federal income tax: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Vermont, Utah, and West Virginia. Contact your state tax agency for more details regarding your obligation.

Traditional IRAs, 401(k)s, and Pensions

These retirement accounts are tax-deferred, meaning that the savings, dividends, and gains grow overtime prior to taxation. However, many retirees tend to forget that those taxes are applied later down the road when it comes time to make withdrawals. Required minimum distributions (RMDs) start at age 70½ and will be taxed at your standard income tax rate.

Note: Unlike traditional IRAs, Roth IRAs are funded with after-tax dollars, so therefore you do not pay taxes on withdrawals during retirement (so long as your account was opened at least five years before you started taking distributions).

Pensions are also funded with pre-tax income, which means the full amount of your pension income will be taxed at the time you receive the funds, according to IRS.gov. However, some types of military pensions or disability pensions may be partially or entirely tax-free. Furthermore, some states do not require you to pay pension tax, or they limit the amount you may owe, which is why many retirees consider moving to tax-friendlier states at the end of their careers or during their actual retirement.

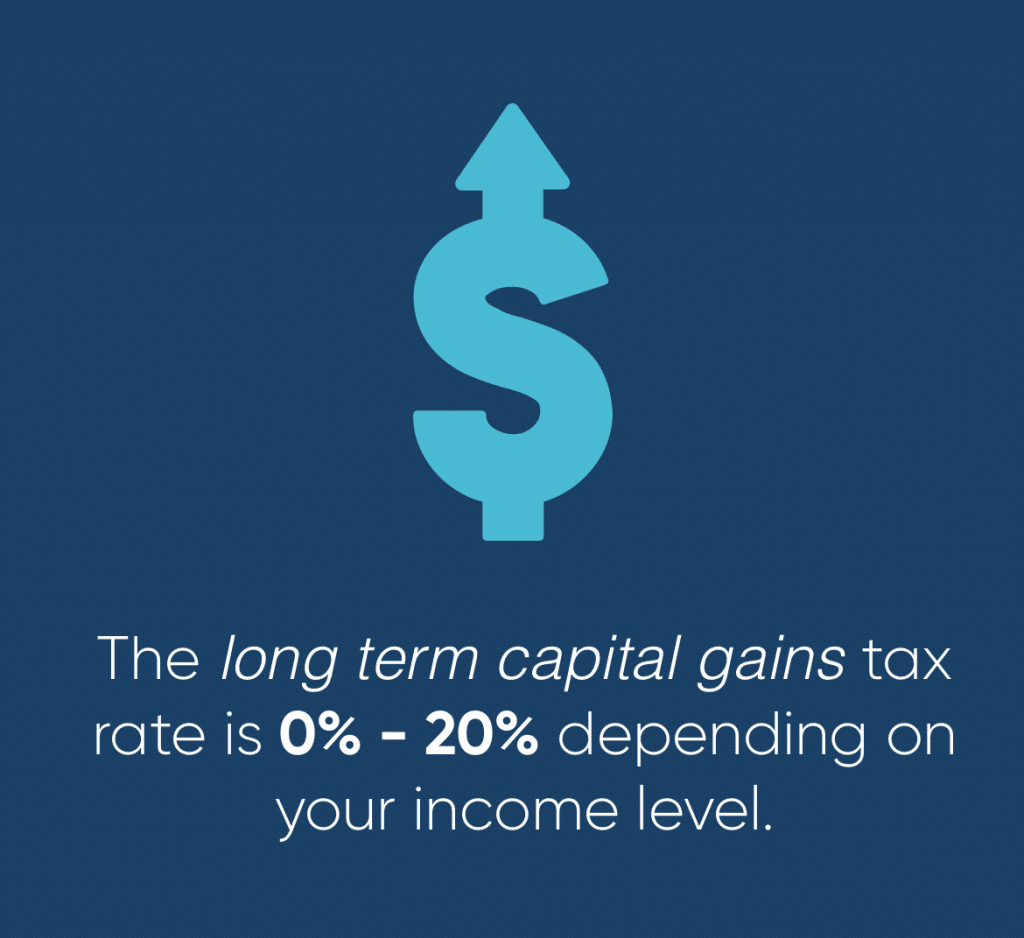

Investment Gains

When you make money on an investment (such as stocks, bonds, or mutual funds) you’re required to pay taxes on your earnings—even in retirement. The tax rate you’ll pay depends on how long you’ve held the asset. If you’ve owned it for one year or less and sell it for profit, it’s considered a short term capital gain and is taxed as ordinary income. Investments held for over a year and sold for profit are called long term capital gains and have a much more favorable tax rate between 0 and 20% depending on your income.

Annuities

If you purchased an annuity with after-tax dollars, you will only be required to pay taxes on the earned interest. For example, if you purchased it for $100,000 and it then became worth $150,000 in five years, you would pay taxes on the $50,000 you earned, but the portion of the payment that represents your principal will be tax-free. Annuities that are purchased with pre-tax dollars will be 100% taxed at your ordinary income tax rate, not the preferred capital gains rate.

Dividends

Dividends are regular payments made by a corporation, typically a distribution of profits to the company’s shareholders. If a retiree is invested in stock, there are two types of dividends that might contribute to retirement income: qualified and nonqualified (or “ordinary”).

Most dividends are ordinary unless otherwise stated and are taxed at the standard federal income tax rate. Qualified dividends that meet certain requirements are taxed at the lower capital gains rate.

How can I avoid paying taxes on retirement income?

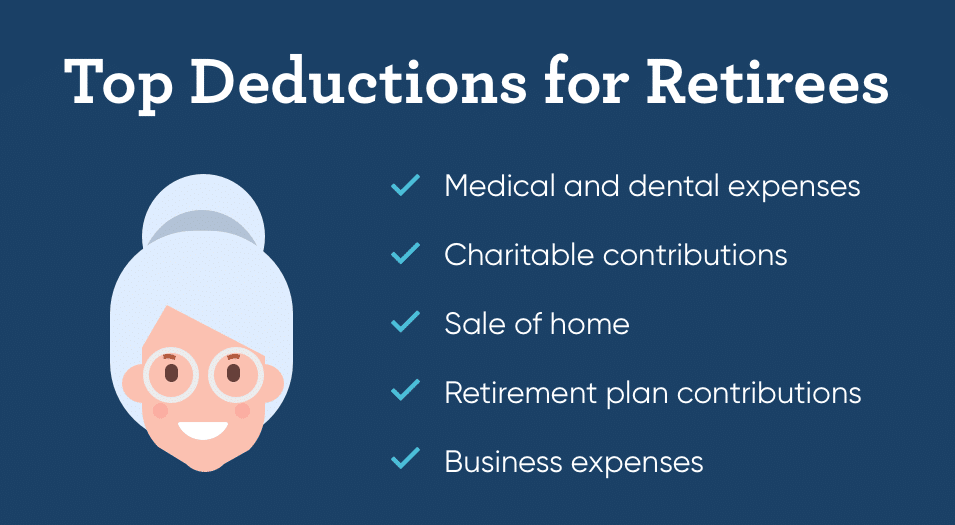

Relocating to tax-friendly states is one way to avoid paying taxes on retirement income, but chances are that you won’t be able to escape taxes altogether. However, when you decide to or are forced to retire and no longer earn ordinary income from working, you stop paying Social Security taxes—which can significantly add to your bottom line. There are also a number of deductions for federal taxes on retirement income that you may be entitled to.

● Medical and Dental Expenses

Medical and dental expenses tend to increases with age, but some of these expenses—including health insurance premiums, Medicare premiums, long-term care insurance premiums, nursing home care, prescription drugs, and most other out-of-pocket expenses—may be deductible when you pay taxes on retirement income. As of 2019, medical and dental expenses in excess of 7.5% of a taxpayer’s AGI are deductible.

● Charitable Contributions

Retirement offers many seniors the chance to connect and give back to the community. In some cases, charitable contributions may be deducted from retirement income taxes. Cash contributions of up to 60% of your AGI are deductible; if you donate property, you can generally deduct the fair market value.

● Selling Your House

It’s not uncommon for retired people to sell their homes in order to downsize, move into a retirement community, or relocate to a tax haven state. If you’ve lived in the home a long time, chances are that you may have considerable equity in the home and will earn a large profit on the sale. Fortunately, you may be able to avoid paying capital gains tax on the profit (up to $200,000 for single taxpayers or $500,000 for married couples filing jointly) so long as you meet certain conditions.

● Retirement Plan Contributions

Although you may be retired or semi-retired, you can still make tax-deductible contributions to retirement plans; those over 50 have higher contribution limits for traditional IRAs, Roth IRAs, and 401(k)s which can yield larger deductions. Note that if you take an early withdrawal from your retirement plan, you may be required to pay an additional 10% tax.

● Business Expenses

Many retirees run their own business or use their newfound free time despite the potential self-employment tax assessed. If you do own a business, you may deduct the necessary expenses you incur in order to operate (so long as they are reasonable in amount) from your business income; this includes the cost of equipment, office space, business travel, and so forth.

Key Takeaways

If you’re still wondering if retirement income is taxable, let’s recap the five most common retirement taxes you may be responsible for:

- Social Security benefits tax

- Federal income tax

- Capital gains tax

- Early withdrawal tax

- Self-employment tax

When you’re living on a fixed income in retirement, unexpected taxes can present a large financial burden. If you find that you want to improve your flow of income during your retired years, consider reverse mortgage benefits.

One distinct benefit of this form of financing is that loan proceeds from a reverse mortgage are tax-free because they do not fall under the category of earned income. You can use our reverse mortgage calculator to see how much equity you may be able to tap into. Contact us to learn more about how reverse mortgages work and how we may be able to help you live The GoodLife in Retirement.

1-866-840-0279

1-866-840-0279