Medicare—the federal health insurance program created in 1965—is available to those 65 and older regardless of income, medical history, or health status. Over 15% of the U.S. population relies upon this system for health security and as Baby Boomers turn 65, enrollment is expected to reach 64 million by 2020 and 80 million by 3030, according to AARP.

While the program is undeniably large and beneficial, it can’t cover all medical expenses for such a large number of participants, which is why many seniors turn to Medicare Supplement plans for additional assistance. Also known as Medigap plans, this form of supplemental insurance helps cover expenses that Original Medicare plans do not.

If you find yourself struggling to afford medical bills due to your current coverage, read on to learn more about Medicare Supplement plans in 2019 and how an additional Medigap policy can help you achieve The GoodLife in Retirement.

What is Medicare Supplement Insurance (Medigap)?

According to Medicare.gov, a Medicare Supplement Insurance plan is sometimes referred to as a “Medigap policy” because it does exactly that: it bridges the “gap” in coverage between medical expenses that a patient incurs, but that are not covered by the Original Medicare plan.

According to how Original Medicare works, coverage is divided into two different parts (Part A and Part B), each of which umbrella includes certain categories of expenses. Note: Medicare Part D adds prescription drug coverage to Original Medicare plans.

What does Medicare Part A cover?

In general, Medicare Part A covers cost relating to treatment such as:

- In-patient hospital care

- Skilled nursing facility care

- In-patient care within a skilled nursing facility (not long-term care or custodial care)

- Hospice care

- Home health care

What does Medicare Part B cover?

Alternatively, Medicare Part B covers costs related to preventative services and medically-necessary services. Some common examples include:

- Clinical research

- Getting a second opinion before surgery

- Mental health services (In-patient, out-patient, and partial hospitalization)

- Durable medical equipment

- Ambulance services

What is not covered by Medicare Parts A and B?

Although there are many expenses that fall within traditional Part A and B coverage, Medicare doesn’t cover everything. Bear in mind that even if a service falls within a coverage category, the beneficiary is still generally responsible for paying their deductible, coinsurance, and copayment.

Additionally, there are several services, treatments, and items that are not covered at all. Common examples typically excluded from Original Medicare coverage include:

- Long-term care (also called custodial care)

- Most dental care

- Eye exams related to prescription glasses

- Dentures

- Cosmetic surgery

- Hearing aids and exams for fitting them

- Routine foot care

So if you require any of the above items, or you need some other service that your Original Medicare plan does not include, you’ll have to pay for it out of pocket—unless you have a specific Medicare health plan that covers the cost (such as a Medicare Advantage, also known as Medicare Part C, discussed in further detail below), or another insurance plan offered by a third-party company (such as Medigap).

What is the definition of Medigap?

Medigap is defined as a bridge for financial assistance; these insurance policies close the gap between expenses that Medicare does cover and those they do not, which the beneficiary must pay themselves otherwise. Medigap is an extra health insurance policy, purchased from third-party companies, designed to supplement Medicare coverage.

Although these companies have the right to control which Medigap policies they choose to offer, each plan must be standardized, clearly identified as Medicare Supplement Insurance (labeled in most states by letters A-N), and adhere to all state and local laws which are designed to protect consumers.

Note: This means that not all insurance plans offered to seniors outside of traditional Medicare coverage are automatically considered to be Medigap policies or Medicare Supplement Insurance. Some examples of alternative insurance programs include:

- Medicaid

- Employer or union plans, including the Federal Employees Health Benefits Program (FEHBP)

- TRICARE

- Veterans’ benefits

- Long-term care insurance policies*

- Indian Health Service, Tribal, and Urban Indian Health plans

Most of the above programs (*with the exception of long-term care policies) are government-sponsored and offer distinct benefits to seniors who qualify. Medigap policies, alternatively, are sold by third-party companies who operate independently of the federal government.

What do Medicare Supplement plans cover?

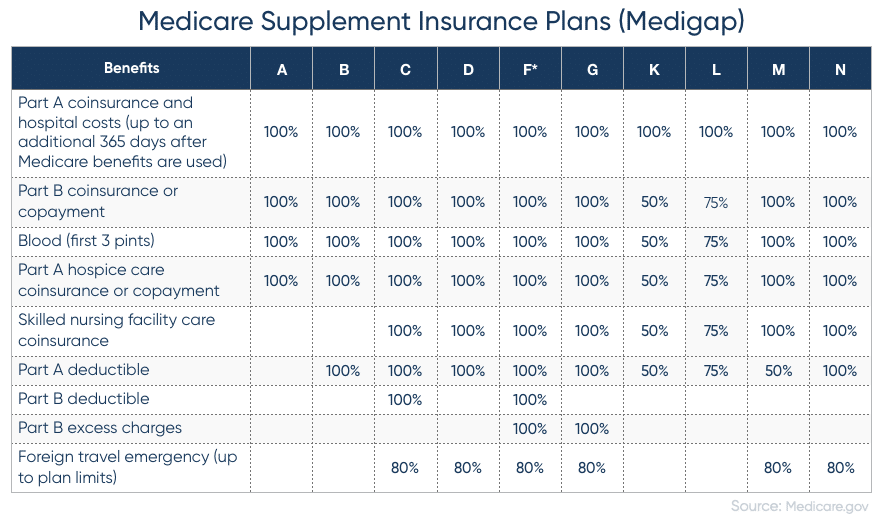

Medicare Supplement plans may help cover deductibles, coinsurance, and copays, thereby saving you money otherwise spent out-of-pocket under Original Medicare. Insurance companies must standardize their Medigap policies and offer the same basic benefits, although some may offer additional benefits to ensure you find the right coverage that meets your needs. At a minimum, any third-party who offers Medicare Supplement Insurance must by default offer Medigap Plan A, C, and F. There may be additional policies to choose from, but insurance companies can decide whether or not to include these within their range of offerings. Take a look at the chart of Medicare Supplement plans for 2019 below.

If a percentage appears in the chart, then the Medigap plan covers that percentage of the benefit and you’re responsible to pay the rest. Although benefits are standardized across insurance companies, there are a number of plans that differ in how much and what type of coverage they offer.

For example, Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits which do not result in an in-patient admission.

Alternatively, Plans K and L require you to meet your out-of-pocket annual limit ($5,560 and $2,780, respectively, for 2019)—as well as your annual Part B deductible ($185 in 2019)—after which time the Medigap plan will pay for 100% of covered services for the rest of the year.

It’s important to compare different Medigap policies since the costs can vary and premiums can go up as you get older. Here are seven additional facts about Medicare Supplement Insurance to keep in mind.

7 Things You Need to Know About Medigap Policies

- Starting January 1, 2020, Medigap plans C and F (which cover the Part B deductible) won’t be available to people new to Medicare. If you were eligible for Medicare before January 1, 2020, but not yet enrolled, you may buy one of these plans with the Part B deductible coverage.

- Medicare Supplement plans E, H, I and J are no longer available to buy, but if you have already purchased one of these policies (as well as Part C or F), then you will be able to keep it.

- You must have Medicare Part A and B in order to purchase an additional Medigap policy from a private company. Your Original Medicare plan will first cover the approved amount for covered health care costs, then your supplemental insurance pays its shares, and then you pay your premium.

- You pay the private third-party a monthly premium in addition to the monthly Part B premium that you pay to Medicare.

- A Medigap policy only covers one person; each spouse must purchase separate policies.

- Some state laws may affect which Medigap policies an insurance company can offer. In particular, Massachusetts, Minnesota, and Wisconsin supplement plans are standardized in a different way.

- Medicare coverage is based on three main factors:

- Federal and state laws

- National coverage decision made by Medicare about whether something is covered

- Local coverage decisions made by companies in each state that process claims for Medicare (these companies decide whether something is medically necessary and should/should not be covered in their area)

What’s the difference between a Medicare Advantage Plan and a Medigap policy?

A Medicare Advantage Plan (like an HMO or PPO) is a way to get your Medicare benefits; a Medigap policy is different in that it supplements your Original Medicare benefits. The table below highlights the major differences between a Medicare Advantage Plan and a Medigap policy; see what will work better for your preferences and health situation.

Is it better to have a Medicare Advantage Plan or a Medigap policy?

It’s technically illegal for an insurance company to sell anyone a Medigap policy if they’re already enrolled in a Medicare Advantage Plan. This means you’ll have to choose between one or the other, and that’s a decision that you and your family will make based on your unique circumstances.

As you can see from the chart above, there are certain pros and cons between Medigap policies and Medicare Advantage plans; you and your family must decide which is better for your health needs. For example, is it more important to have high premiums and low deductibles? Or, Part D prescription drug coverage but more limited network? Only you can decide which is better.

Note: If you have a Medigap policy and switch to a Medicare Advantage Plan for the first time, you have the right to change your mind and re-purchase your Medigap policy within 12 months of switching, as protected by federal law.

Takeaways

Many seniors find themselves considering Medicare Supplement plans to pay for mounting medical bills and offset health care costs. If you’d like to improve your cash flow during retirement, reverse mortgage benefits may be able to help.

Use our free reverse mortgage calculator to see what portion of home equity you may be able to tap and convert into loan proceeds. Our team is happy to answer any questions you may have regarding your eligibility for this form of financing and can walk you through the reverse mortgage application process.

Reach out to learn how a reverse mortgage may be able to help cover your medical costs, free up your financials, and allow you to live The GoodLife in Retirement.

1-866-840-0279

1-866-840-0279