Reverse mortgages can be a great way to fund your retirement, whether as your primary form of retirement cash flow or as a supplement to retirement savings, Social Security, or pensions.

However, not everyone is eligible for a reverse mortgage, also known as a home equity conversion mortgage (HECM). One important requirement to keep in mind is age. Borrowers must be 62 years old or older in order to qualify for an HECM. However, the way that age requirements work — especially when considering spouses — can be a little more complicated.

In this article, we will explain what you need to know about reverse mortgage age requirements. Plus, we’ve included a reverse mortgage age chart, and we’ll cover some of the other eligibility requirements that are good to keep in mind.

KEY TAKEAWAYS

- The minimum age for a reverse mortgage — or home equity conversion mortgage (HECM) — is 62.

- However, non-borrowing spouses may be younger than 62 and still enjoy some benefits, such as living in the home even after the passing of the borrower.

- Some proprietary mortgages, which are not HECM loans, may not have the same age requirements as an HECM loan.

- Age can also affect how much you can get out of your reverse mortgage — the older you are, the more you’re likely to receive.

- In addition to age requirements, HECM loans have a number of other eligibility criteria that are important to know about.

Is there a minimum age requirement for reverse mortgages?

Yes, the reverse mortgage age requirement is 62 or older. However, spouses younger than 62 are eligible if the primary borrower is 62 or older. According to rules put in place by the FHA in 2017, spouses younger than 62 are permitted to file as a non-borrowing spouse.

Reverse mortgage spousal requirements

Spouses may sign into the HECM loan as borrowers if they are over the age of 62. Borrowers under the age of 62 may file as a non-borrowing spouse, which permits them certain privileges and rights over the property, even if they are not a co-borrower.

In the past, if a partner under the age of 62 was identified on the title of the property, that person’s name had to be omitted in order for the qualifying borrower to obtain a reverse mortgage loan. However, in their 2017 amendment to the rules, the HUD made changes to the HECM program that overturned this provision. Even if they do not apply for the loan, HUD now allows non-borrowing spouses to stay on the title. This eliminates the requirement that non-qualified partners be excluded from the title before a couple can apply for an HECM.

If the borrowing mortgagee passes away while the loan is still active, qualified non-borrowing spouses listed on the reverse mortgage loan file will be allowed to stay in the home. However, they must meet HUD conditions and confirm annually that they are the late mortgagee’s non-borrowing spouse, and are still occupying the home.

Proprietary reverse mortgages

The 62 year old reverse mortgage age requirement applies to HECM loans. That’s because the HECM program is administered through and regulated by the FHA, which also insures this form of reverse mortgage. However, not all reverse mortgages are HECM loans: there are also proprietary reverse mortgages.

- Note: Since they allow homeowners with homes priced above the HECM claim limits to take out a reverse mortgage on their house, proprietary reverse mortgages are also known as jumbo reverse mortgages. Proprietary reverse mortgages can be beneficial for borrowers in certain cases, so it’s a good idea to look at these loan options if you’re thinking about getting a reverse mortgage.

The rules governing HECM reverse mortgages are not always applicable to proprietary reverse mortgages.

The FHA insures HECM loans, which guarantees that if the borrower defaults, the lender will not lose as much money as they would otherwise. This insurance enables HECM loans, such as those provided by GoodLife Home Loans, to have low interest rates and favorable terms, but it also locks them into a certain set of rules.

Getting Started with Reverse Mortgages

If you’re looking to get started with a reverse mortgage, these articles can help guide you through all aspects of the process.

Guide to HECM Loan Reverse Mortgage Limits

Proprietary reverse mortgages are administered through individual lending companies, so they can determine for themselves what their policies and rates are. And, depending on the company, some lenders might allow borrowers younger than the 62 year old HECM limit.

If you think a proprietary reverse mortgage might work best for your financial situation, consider speaking with a GoodLife Reverse Mortgage Specialist, who will be happy to walk you through the process and your eligibility.

Does age affect the amount I receive from my reverse mortgage?

Yes, in addition to determining your reverse mortgage eligibility, your age will also affect the amount that you are likely to be able to access using your reverse mortgage. The older you are, the more money you are likely to have access to — along with some other factors, like the appraised value of your home.

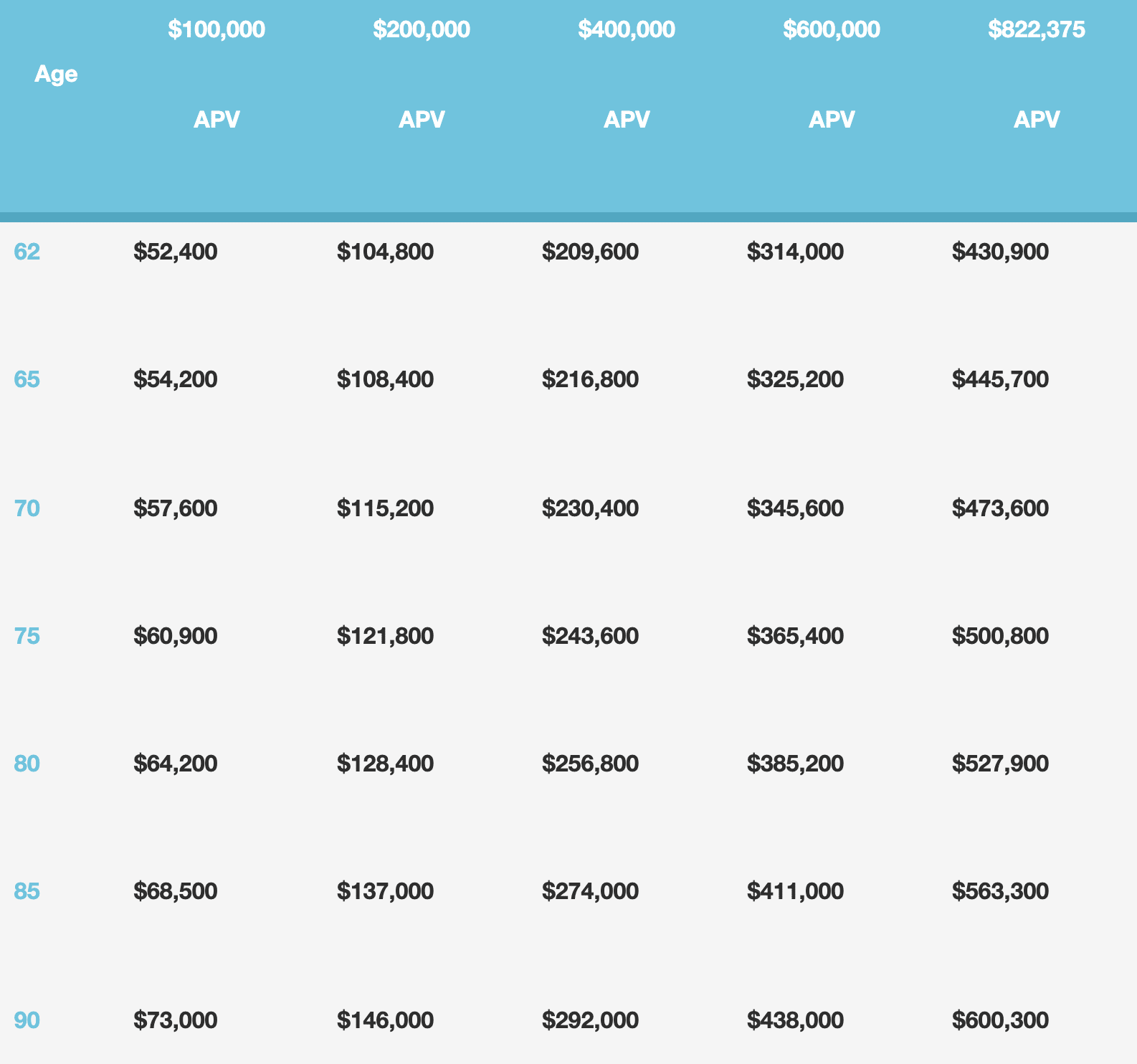

To gain a better idea of the amount you may be eligible for given your age, take a look at the reverse mortgage age chart.

Reverse Mortgage Proceeds Based on Age and Appraised Property Value (APV)

For more information on how a reverse mortgage might factor into your home finances, you can also try out our free reverse mortgage calculator.

Other HECM eligibility requirements to keep in mind

As mentioned, HECM reverse mortgages are federally regulated by the Department of Housing and Urban Development (HUD) and the Federal Housing Administration (FHA). So, in addition to the reverse mortgage age limit, borrowers must satisfy a few other specifications in order to be eligible:

- Borrowers must be at least 62 years of age

- Borrowers must have substantial equity in their home

- Borrowers must meet with a HUD-approved third-party counselor

- Borrowers must occupy the property as their primary residence

- Borrowers must be current on debts and other financial obligations

- Borrowers are required to maintain their home to all FHA standards

In addition to satisfying the requirements above, reverse mortgage applicants are required to proceed through our application process, which involves only 4 simple steps:

- Education: First, one of our Specialists will go over the reverse mortgage qualifications with you. We will also assist you in evaluating your retirement plans to determine if this type of funding is appropriate for you.

- Counseling: The HUD requires all HECM applicants to meet with an accredited third-party counselor. Borrowers consult with this counselor to better understand how a reverse mortgage can fit into their retirement budget and planning.

- Application: An FHA-approved appraiser can assess the worth of your home, as well as the amount of money you can borrow. They’ll also make sure the house meets FHA specifications.

- Funding: Applicants may opt to collect loan proceeds as a lump sum, a line of credit, or a series of monthly payments once they’ve been accepted. Because of our fast and painless process, disbursement will begin soon after your loan has been accepted.

If you’re curious about your own eligibility, feel free to review the reverse mortgage eligibility page. And if you still have questions, a GoodLife Reverse Mortgage Specialist is available to take your call — just contact us.

Funding your retirement and living the GoodLife

Retirement funding is one of the most important aspects of financial planning. This is even more important for those with little or no retirement savings, who account for nearly half of Americans over the age of 55, according to AARP.

A reverse mortgage can help. At GoodLife, our reverse mortgage application process is fast. It requires just four simple steps to complete. We help you get the funding you need quickly and efficiently, so you can focus on what matters most: enjoying your retirement. By tapping into your home equity and using it to power your retirement, you can add a critical line of cash flow to your retirement portfolio. To find out how much you may be eligible to receive in reverse mortgage proceeds, try out our free calculator — or speak with a GoodLife Reverse Mortgage Specialist to learn more about funding your retirement.

1-866-840-0279

1-866-840-0279