Planning for Taxes in Retirement

Many changes come when you retire—no more rush hour commute or 9 to 5 workday. One thing that does remain constant when you enter retirement is taxes. Most retirees will have to pay taxes in retirement, and the taxes you pay depend on your income. There are three primary sources of income in retirement: Social Security benefits, distributions from retirement plans like IRAs and 401(k)s, and income from savings and investments.

It’s important to begin planning for taxes in retirement soon, as you’ll be able to strategize ways to reduce the amount of taxes you owe to the government. Below, we’ll go over what taxes you will pay in retirement, how to reduce taxes paid in retirement, and more. Read end-to-end for a full scope on retirement and taxes, or use the links below to jump to a section of your choice.

- Key takeaways

- Taxes in retirement

- What taxes are paid in retirement

- How to reduce taxes paid in retirement

- Living in a tax-friendly state

- Wrapping up

Key takeaways

- Planning for taxes in retirement is crucial, as it allows you to better manage your income.

- Retirees typically have multiple sources of income, all subject to various taxes.

- Social Security benefits, retirement plan benefits, investment income, and pension and annuities income can be taxed.

- The best ways to reduce the amount of tax paid in retirement are planning for RMDs (required minimum distributions), transferring funds to a Roth IRA, reducing withdrawals from pre-tax retirement accounts, and managing Social Security benefits.

- Moving to a tax-friendly state is another popular strategy to reduce the amount of taxes paid in retirement.

Taxes in retirement

Planning for retirement is one of the most important things to do as you near the end of your career. As that day comes closer, many Americans wonder how long their retirement income will last to determine whether they’ll be able to afford expenses like medical bills, travel, and housing.

If you’re getting closer to the age of retirement, it’s important to understand how taxes will affect your finances. Once you enter retirement, you might think you’re done paying taxes to the government since you’re no longer working. However, depending on your income, along with your spouse’s (if applicable), you might be responsible for paying taxes in retirement.

When saving for retirement, various plans and options are available, such as IRAs, 401(k)s, investments, savings accounts, and Social Security benefits. Once you enter retirement and begin making withdrawals from these accounts, you might be taxed — it depends on the type of account, how much money you’re withdrawing, and the number of accounts you’re withdrawing from. Fortunately, there are ways you can restructure your payment strategies to limit the amount of taxes you owe in retirement.

In order to minimize your taxes in retirement, it’s important to know how each type of income is taxed. Let’s take a look at what taxes you will pay in retirement in the following section.

What taxes are paid in retirement

What taxes will I pay in retirement? That’s a common question for many Americans getting ready to finish their career. When it comes to retirement and taxes, there are a few sources of income that can be subject to taxes. Below are the most common taxes in retirement you might be responsible for paying.

Social Security taxes

You probably noticed the government took a portion of your income to fund Social Security during your career. Social Security provides benefits to older Americans, disabled workers, and families in which a spouse dies. Social Security benefits are meant to replace a percentage of a worker’s pre-retirement income based on their lifetime earnings in retirement. Workers can begin claiming Social Security benefits when they reach their full retirement age, which is 67 years old for those born in 1960 or later. However, workers can begin claiming Social Security benefits before reaching their full retirement age but will receive a reduced benefit amount.

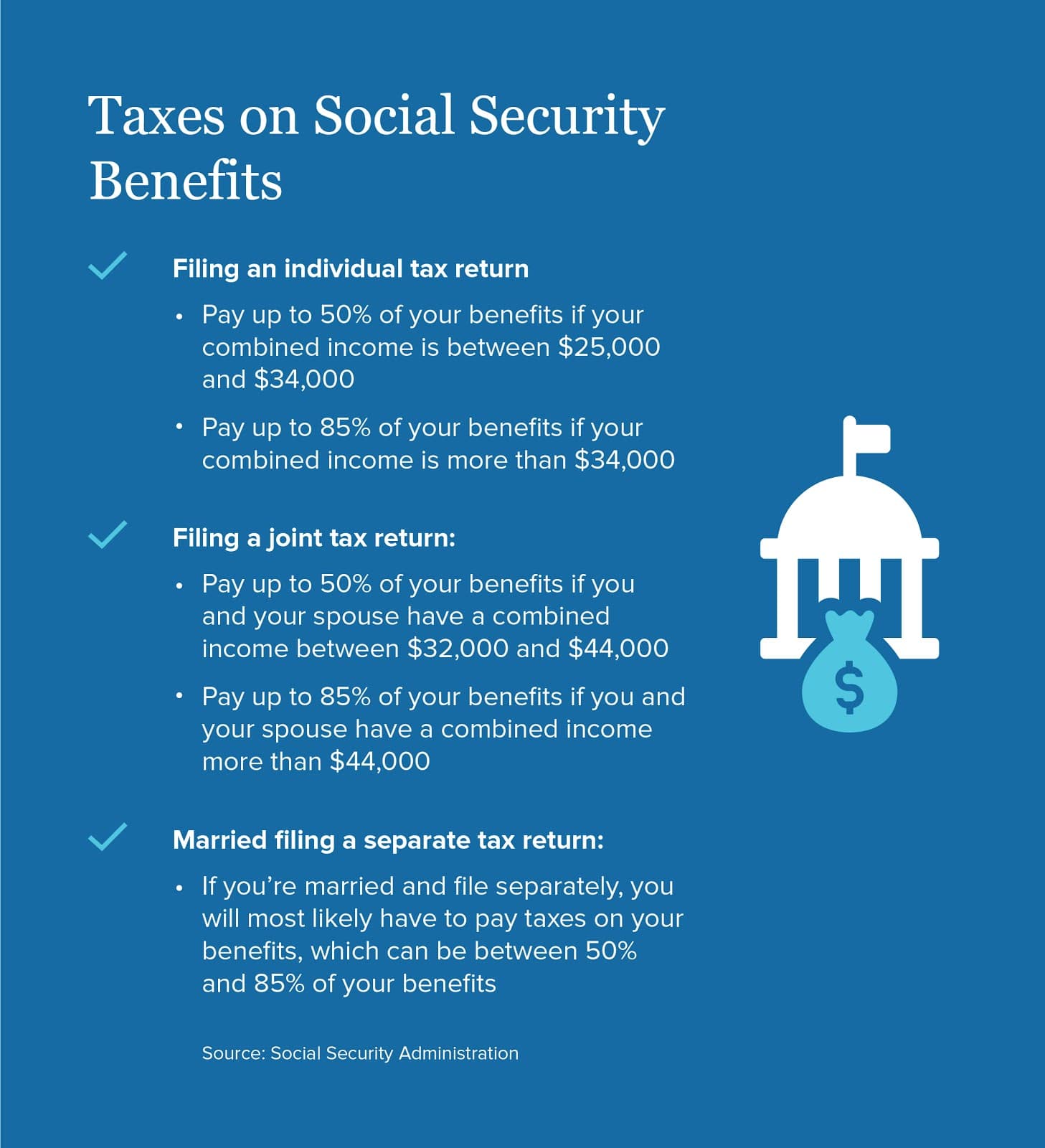

If Social Security is your only source of income in retirement, you most likely won’t have to pay taxes. However, because Social Security benefits weren’t intended to be the sole source of income for retirees, many have additional income streams, such as retirement plans and savings. The IRS uses a formula to determine how much you’ll pay in taxes, which is typically between 50% and 85%. The breakdown of taxes on Social Security benefits goes as follows:

- Filing an individual tax return: You may have to pay up to 50% of your benefits if your combined income is between $25,000 and $34,000, or up to 85% of your benefits if your combined income is more than $34,000. Combined income is the total of your adjusted gross income and nontaxable interest, plus one-half of your Social Security benefits.

- Filing a joint tax return: You may have to pay up to 50% of your benefits if you and your spouse have a combined income between $32,000 and $44,000, or up to 85% of your benefits if you and your spouse have a combined income more than $44,000.

- Married filing a separate tax return: If you’re married and file separately, you will most likely have to pay taxes on your benefits, which can be between 50% and 85% of your benefits.

To calculate your combined income, take your adjusted gross income and add nontaxable interest and half of your Social Security benefits. You can also use IRS Notice 703 to see if your Social Security benefits are taxable.

Retirement plan withdrawals

Retirement plans, such as traditional employer-sponsored 401(k)s and traditional individual retirement accounts (IRAs), are taxed as ordinary income. These retirement accounts are tax-deferred, which means you don’t pay income taxes on your contributions. However, you’ll be responsible for paying taxes on any withdrawals when you reach retirement. The same goes for other types of accounts, such as 403(b) plans and 457 plans. The amount of taxes you pay on withdrawals from these retirement accounts depends on your income, deductions, and tax bracket.

The only exception comes with Roth IRAs and Roth 401(k)s. Roth IRAs and Roth 401(k)s are similar to their respective counterparts but differ when it comes to taxes. Contributions made to these retirement accounts are made after taxes are taken out, so you can’t take a tax deduction for those contributions made during that year. However, once you enter retirement and begin making withdrawals, you won’t have to pay any taxes, even on earnings made. To qualify for tax-free provisions, you must have your account for at least five years and meet all of the IRS requirements.

In order to make withdrawals from your retirement accounts penalty-free, you need to reach the age of 59½. To calculate how much you owe the IRS in taxes for retirement plans, you can refer to IRS Publication 590.

Investment income

If you earned income from dividends, interest income, or capital gains, you’re subject to paying taxes, which can be between 0% and 20%, depending on your taxable income. For each year you earn investment income in retirement, you’ll receive IRS Form 1099, which is sent from the financial institution that holds your account. Each sale will either be classified as a short-term or long-term capital gain or loss, which you must list on your tax return.

Investment accounts, such as mutual funds, exchange-traded funds, index funds, bonds, and individual stocks, come with a few benefits. For example, there are no tax penalties if you withdraw before the age of 59½, and can come with a lower tax rate depending on your tax bracket, compared to other sources of income.

Pension and annuity income

Pension income is also taxable if you withdraw money contributed with pre-tax dollars. Whether you receive periodic payments or a lump-sum payment, the taxes you owe on pension income will be calculated based on your tax bracket. However, you can have your employer withhold taxes from your pension check while you’re still working to make balancing your finances in retirement more manageable.

In addition to pensions, annuity income is also taxed, depending on whether you purchased your annuity with after-tax dollars. Annuity payments come with two portions: return of principal and interest. Only the interest portion is subject to taxes, and the annuity company will tell you how much of your annuity income can be excluded from your taxable income each year.

How to reduce taxes paid in retirement

As you can tell, there’s a fair share of taxes you might be responsible for paying in retirement. Now that you know what taxes you might owe, it’s time to begin planning for taxes in retirement, so you can find ways to reduce the amount you owe. Some ways to reduce taxes in retirement include:

Plan for RMDs

RMDs, short for required minimum distributions, are minimum amounts that a retirement plan owner must withdraw each year starting the year they turn 72. RMDs are required for retirement plans like traditional IRAs, traditional 401(k)s, and Roth 401(k)s, but not Roth IRAs. If you fail to withdraw the RMDs for your retirement plan, you can face a penalty worth 50% of the amount required to be taken out.

To reduce taxes paid, make sure to meet the RMD requirements. Or, if you’re still working, you can delay withdrawals from 401(k)s, but not IRAs. You can use the RMD worksheet on the IRS’s website to calculate how much you need to withdraw to avoid paying penalties.

Transfer funds to a Roth IRA

Another tactic to reduce the amount of taxes paid in retirement is to transfer funds from pre-tax retirement accounts like traditional 401(k) accounts and traditional IRAs to a Roth IRA. When you make this switch, you will avoid future tax liabilities in retirement. The reason many people switch to a Roth IRA is because taxes are likely to go up for you as you begin to earn more money. However, you will be responsible for paying taxes during the year you make the conversion.

Reduce withdrawals from pre-tax retirement accounts

If you have multiple sources of income in retirement, such as Social Security benefits, a 401(k), IRA, and investments, make an effort to reduce withdrawals from the accounts that are filled with pre-tax dollars, such as traditional 401(k)s and traditional IRAs. This is because the amount you withdraw will affect your taxable income. So, if you’re withdrawing a majority of your income from a pre-tax retirement plan, your taxable income for the year will be higher. By making larger withdrawals from post-tax retirement plans like Roth IRAs, your taxable income for the year will be lower.

Manage your Social Security benefits

If you don’t want to pay taxes on your Social Security benefits or want to reduce the amount of taxes you’re paying, limit your income from other retirement plans. For most of these tips, you’ll notice that lower income means lower taxes, so by limiting the amount of money you withdraw from various retirement plans and securities, you’ll pay less in taxes because you’ll fall under a lower tax bracket. However, making withdrawals from a Roth IRA won’t affect your taxable income, which means they won’t impact the tax on your Social Security benefits.

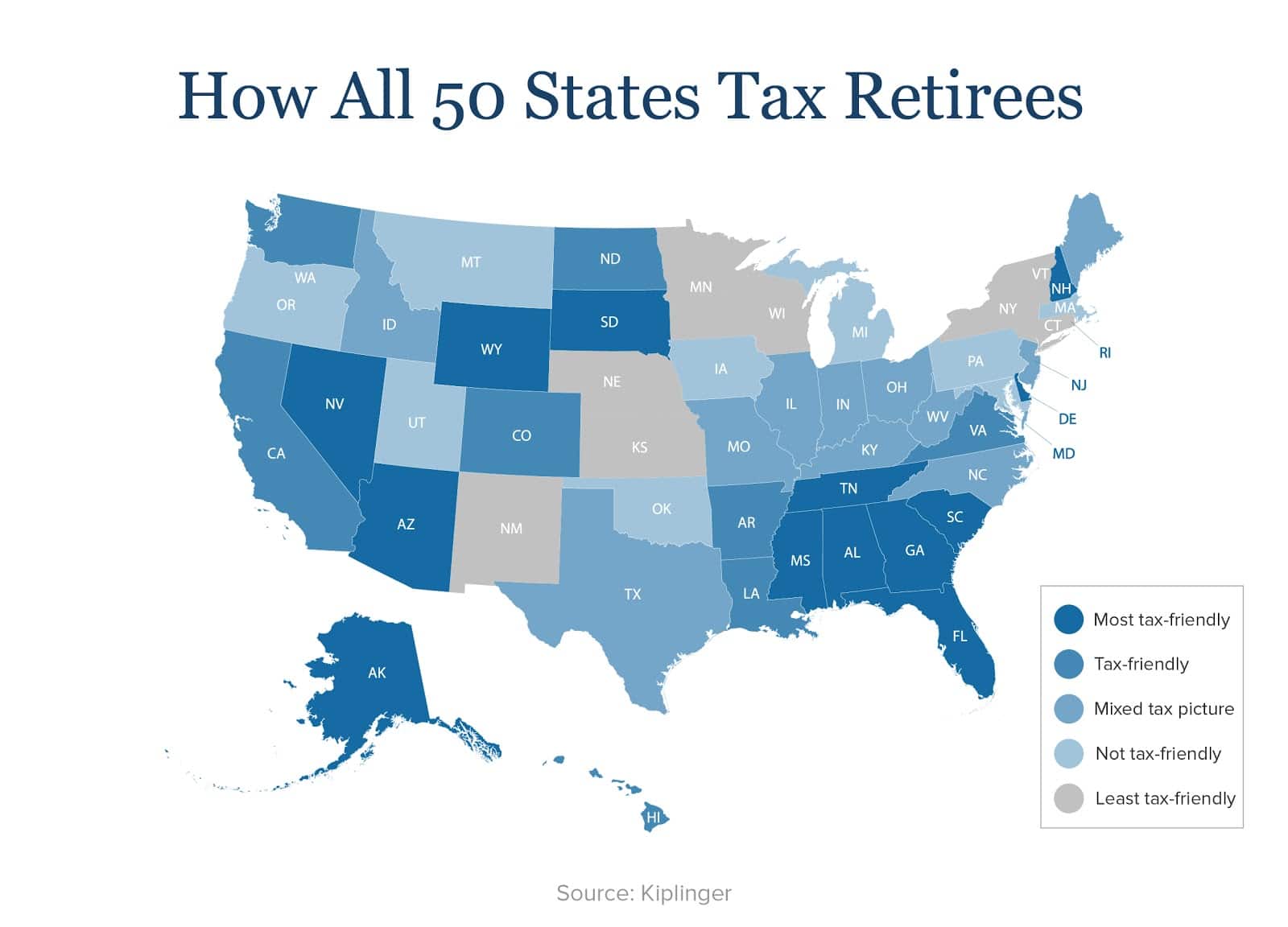

Living in a tax-friendly state

Moving to a tax-friendly state is a popular route many retirees take to reduce the amount they pay in taxes. For example, not every state taxes pension payments. So, if you change your permanent address to a state that doesn’t tax pension payments, you can take those payments without paying income taxes, even though your employer was in another state.

Currently, there are nine states without income taxes, including Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. However, New Hampshire currently collects income taxes on interest and dividends, and Tennessee began phasing this out in 2021. Federal law bans states from taxing residents on retirement benefits made in other states, which is why retirees can move from a state like New York or California to a tax-friendly state like Florida or Texas.

Additionally, some states might impose low-income taxes but offer other retirement benefits, such as tax breaks like not having to pay taxes on Social Security benefits or partial income from retirement plans like IRAs.

Wrapping up

Planning for taxes in retirement should be a top priority, as it can help you manage your finances better so you can live comfortably and stress-free. If you’re looking for sources of income in retirement, another option is taking out a reverse mortgage on your home. A reverse mortgage allows you to tap into your home’s equity and convert it to cash, so you can spend retirement how you planned. Even better, reverse mortgage payments typically aren’t taxable, meaning you’ll be able to receive payments without having to sell or leave your property.

Determining how to fund retirement can be complicated and stressful. However, knowing all of your options and which ones can help you live comfortably is important. At GoodLife, we’re here to help you navigate retirement funding, and offer many useful information on reverse mortgages. To learn more, check out the following guides:

- Current Reverse Mortgage Interest Rates—A Complete Guide

- Reverse Mortgage Pros and Cons

- Reverse Mortgage Benefits

Over on our blog, you can find valuable information to guide your decisions when it comes to financing retirement. Be sure to reach out to a GoodLife Reverse mortgage Specialist for detailed information about your situation.

1-866-840-0279

1-866-840-0279