As you examine your retirement options, you may consider using a Home Equity Conversion Mortgage, commonly called a HECM loan or a reverse mortgage. HECMs are designed to free up home equity and add cash flow for homeowners 62 and over who have considerable equity in their homes. HECM terms vary based on factors like borrower age and the loan’s interest rate, but generally, the less you owe on your home, the more cash you will have available to use. Find out how much you qualify for with our free reverse mortgage calculator.

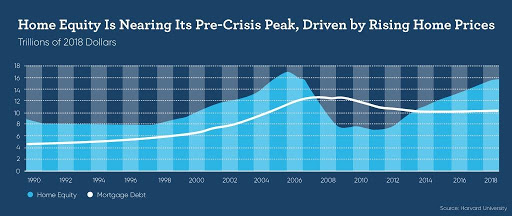

HECM loans can often add substantial cashflow to your retirement. In fact, one recent Harvard study found that 86% of Americans own at least 20% equity in their homes, and 61% own at least 50% equity. That means a substantial number of seniors may have untapped revenue potential in their homes. Plus, this option allows seniors to use home equity without having to move out of their houses or relinquish ownership.

You might be wondering if a reverse mortgage is right for you. Below, we will explore some of the alternatives to reverse mortgages and whether they might be a good fit for your particular situation. You can navigate directly to the reverse mortgage alternative you’re interested in learning more about by clicking one of the links below, or keep reading for a full overview, including pros and cons of each funding method.

Find out more about reverse mortgages by clicking the link below.

Downsizing

When you’re examining reverse mortgage alternatives, you might consider downsizing.

The idea behind downsizing is simple: you sell your primary residence, buy a new one for a significantly lower price and then use the leftover cash to supplement your retirement income. Let’s take a look at the advantages and disadvantages of downsizing in retirement.

Pros:

- You could spend the money from the sale of your home slowly over time.

- You have the option to invest the sum that you get from the sale of your property.

- You might also buy an annuity which pays out a fixed income over the course of the rest of your lifetime.

- The main benefit of downsizing is that you’ll have cash you can spend outright, invest, or pass on to your heirs.

Cons:

- Downsizing forces you to leave your home.

- There is less space for visiting family.

- You may have to give up many of your belongings to fit in the smaller space.

- The money you make from the sale of your home might not be enough for both the new, smaller place, and your monthly living expenses.

Seniors who are looking to keep their home and continue living there, rather than downsizing in retirement, may find that downsizing is not as appealing as a HECM loan—discussed in more detail below. The latter option allows you to free up critical cash flow that you won’t have to pay back until you move out or pass away—and you still live in and own your home until the loan matures.

Selling to a family member

Another alternative to reverse mortgages for seniors is selling the property to family members. What are the upsides and downsides of this option?

Pros:

- You can set up a sale-leaseback agreement, in which you sell the home to relatives and rent it back with the funds from the sale of the house.

- This provides your heirs with rental income.

- You are able to remain in your home.

- The equity you own remains within the family.

Cons:

- If you decide to go this route, you’ll have to make sure that you have a written contract to ensure everyone understands the terms of the agreement.

- Mixing business with family, especially with something as valuable as a home, may be risky for both your finances and your family relations.

- You may not have family members that are able to afford the purchase of your home.

- Additionally, if you give your loved one a good deal on the home, this could reduce the amount of cash available to you.

While keeping the wealth of your home in the family is good in theory, in practice, it can become quite a headache and may not be a viable alternative to a reverse mortgage.

Refinancing

If you currently have a high interest rate on your home mortgage, you might be able to save more money and free up cash by refinancing. Plus, you will still own your home and be able to pass it onto your heirs.

Pros:

- Refinancing might be a good option if you have a substantial amount of equity in your home and you don’t need a lot of money fast.

- A refi allows you to continue to build the equity in your home over time.

Cons:

- The drawbacks, however, include having to make mortgage payments every month.

- There’s a possibility you may end up having to pay more than the original loan. This is because, though your monthly payment is less, the duration of the loan is longer.

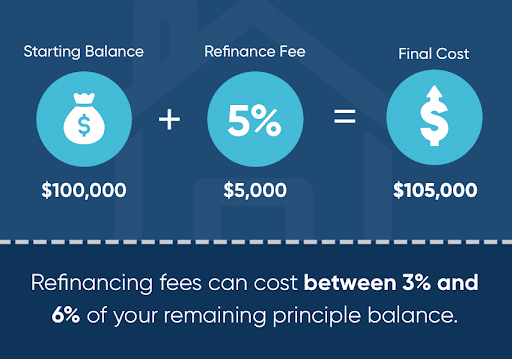

- Refinancing can often result in a higher overall cost – in fact, fees associated with a refi can cost between 3% and 6% of your outstanding principal balance.

If you do end up missing payments on your house, banks can foreclose on your home.

Refinancing may free up cash as it can lower your month-to-month mortgage payments, but it ultimately may not be enough for seniors who need more comprehensive retirement funding, so this isn’t a good alternative to a reverse mortgage in some cases.

Getting Started with Reverse Mortgages

If you’re looking to get started with a reverse mortgage, these articles can help guide you through all aspects of the process.

Guide to HECM Loan Reverse Mortgage Limits

Home Equity Loan or Home Equity Line of Credit (HELOC)

A home equity loan: this alternative to a reverse mortgage delivers proceeds in the form of a lump sum based on the equity you have in your home. A Home Equity Line of Credit (HELOC) allows you to borrow money against the equity in your home for a certain period of time, in the form of revolving credit.

Why do seniors consider these loans a useful way to help fund retirement?

Pros:

- You can get upfront cash with this option.

- You can stay in your home.

- The homeownership remains in your name.

Cons:

- You immediately need to begin to pay back both the principal and the interest for a home equity loan.

- If HELOC interest rates increase over time, so could your monthly repayment.

- At the end of the draw period, you’ll enter the repayment period where your payment each month can be substantially higher than during the draw period.

- Missing payments may mean that your lender can foreclose on your home.

With a reverse mortgage, on the other hand, you don’t have to pay anything back until your loan matures.

A reverse mortgage line of credit works like a HELOC in that the proceeds can be drawn upon on an as-needed basis. However, the loan doesn’t require any repayment until the last homeowner or borrower living in the home passes away or moves out.

Renting

You may also choose to rent out a portion of your property. Ideally, you can choose to rent to someone you know, like a close friend or family member.

Pros:

- Renting may allow you to stay in your home because of the additional rental income.

- You might be able to pay off the mortgage you still owe with the rent payments, or put it toward property taxes or maintenance.

- It’s a potential win-win for you and your renter, as they get a place to live and you get an additional revenue stream.

Cons:

- Unfortunately, that rental income has to be reported for taxes as income.

- There’s also much more work involved in renting; you’ll need to continually screen and replace incoming and outgoing renters.

Sharing a space with renters during your retirement might not be your ideal living situation.

In addition to loans, renting, and other equity-based cash-flow solutions, there are some programs you might want to check out as you consider your retirement funding.

Social Security benefits & assistance programs

The earliest you can start drawing on Social Security benefits is at the age of 62. However, if you delay collecting your benefits, you could be increasing your monthly benefits in the future. Why? Starting to collect Social Security at age 62 means you will only collect 75% of your monthly benefit each month due to the longer period for which you will be collecting benefits. If you wait until you are 66, you’ll be able to collect the full 100% of your benefits monthly (the full retirement age might be later depending on your birth year).

You may also find that you qualify for assistance such as property tax relief, help to pay for your medical costs, or discounts on your energy bills. The National Council on Aging (NCOA) can help you find government benefits that will save you money.

Reduce the cost of living

Living within your means with a tight budget may be a hard adjustment for seniors accustomed to a particular way of living. But if you are considering a reverse mortgage to cover your basic costs of living, you may want to consider changing your lifestyle as an alternative option.

Reducing your cost of living could include the following:

- Sell one car to reduce gas, insurance, maintenance and registration costs

- If you’re going to travel, go during non-peak periods

- Look for stores and restaurants that offer senior discounts

How to make the best decision

Figuring out how you plan on funding your retirement can be stressful. With so many options and reverse mortgage alternatives available to seniors, knowing which one best suits your financial situation, lifestyle, and personal needs may seem impossible. However, by understanding the pros and cons of different funding methods, you gain valuable insight into the best reverse mortgage options and alternatives.

HECMs are one of the simplest and most reliable ways to add a potentially substantial revenue stream to your retirement.

- They offer a way to get cash from your home without the burdens associated with alternatives, such as monthly loan payments, or having to move out.

- While HECMs might not be the right solution for every situation, if you’re over 62 with a substantial amount of equity in your home, taking out a reverse mortgage may suit your needs.

- Downsizing retirement plans might not create as much cashflow as an option like an HECM.

- HECM loans often add a larger revenue stream than government assistance programs or Social Security benefits.

With the right plan, you can live out the retirement of your dreams without worrying about the hassle of monthly payments. Contact us today to learn more about our reverse mortgage application process.

Sources: FTC | Harvard University | Esquire Real Estate Brokerage | Discover | Federal Reserve | Social Security Administration | National Council on Aging |

1-866-840-0279

1-866-840-0279