KEY TAKEAWAYS

- Eligible senior homeowners can get a reverse mortgage on a condo. However, certain conditions have to be met first.

- On top of satisfying HUD reverse mortgage requirements, borrowers must also own and live in a FHA-approved condo.

- An appraisal will have to be completed in order to determine if a condominium unit qualifies for a reverse mortgage.

- Updates to the reverse mortgage guidelines regarding condos include spot approval, mixed-use projects, occupancy rations, and insurance maximums.

If you are eligible for a reverse mortgage, you may be able to obtain one on a condominium unit depending on certain rules and restrictions. Reverse mortgages allow seniors age 62 years and up to tap into a portion of their home equity and convert loan proceeds into disposable income during retirement. Because of the way that reverse mortgages work, there are specific rules that pertain to the types of properties that are eligible for this government-backed program.

Also known as a home equity conversion mortgage (HECM), reverse mortgage loans are insured by the Federal Housing Administration (FHA) and overseen by the Department of Housing and Urban Development (HUD). Until recently, it was difficult to get a reverse mortgage on a condo but, fortunately for senior homeowners, the guidelines have changed. Thanks to the revised policy that went into effect on October 15, 2019, it is now substantially easier to get approved for an FHA condo loan once the revised policy goes into effect on October 15, 2019.

If you’ve considered this form of financing and would like to learn more about how the recent reverse mortgage changes might affect your circumstances, click on a link below to navigate directly to your question at hand.

Can you get a reverse mortgage on a condominium?

Yes, you may obtain a reverse mortgage for a condo as long as you meet the requirements outlined by the HUD. A reverse mortgage allows senior homeowners to take advantage of their property’s equity and use it to settle debts, fund their retirement travel, or complete home renovations. This also provides an additional source of income for retirees to enjoy their retirement in their own homes.

Reverse mortgage condo eligibility

Your property must meet specific criteria in order to be eligible for this form of financing. The HUD reverse mortgage guidelines require that the borrower must:

- Be at least 62 years old

- Own the property outright or have a considerable portion of the property’s equity

- Occupy the property as the primary residence

- Have no delinquency on federal debt

- Participate in mandatory HECM counseling

To confirm a senior homeowner meets the requirements above, a lender will verify the applicant’s income, assets, monthly living expenses, and credit history. They will also check for timely payments of property taxes and homeowner insurance premiums.

FHA & HUD guidelines for condo reverse mortgages

There are several guidelines set forth by the FHA and HUD that determine whether or not a condo is eligible for a reverse mortgage. Not all condominiums will qualify for a reverse mortgage, so it’s important to be aware of the specifications if you’re considering applying for one.

FHA guidelines for condo reverse mortgages

Yes, prior to obtaining a reverse mortgage on a condo, the property must meet all FHA appraisal. To do this, an appraiser will visit your condo and determine the value of the property in addition to inspecting it for health and safety concerns to ensure it satisfies basic property standards such as:

- Electricity and heating

- Running water

- Bathroom

- Roofing

- Structural soundness

- Absence of hazards

Property inspections include an Individual Condominium Unit Appraisal Report, which is an appraisal form specifically created to assess condominiums.

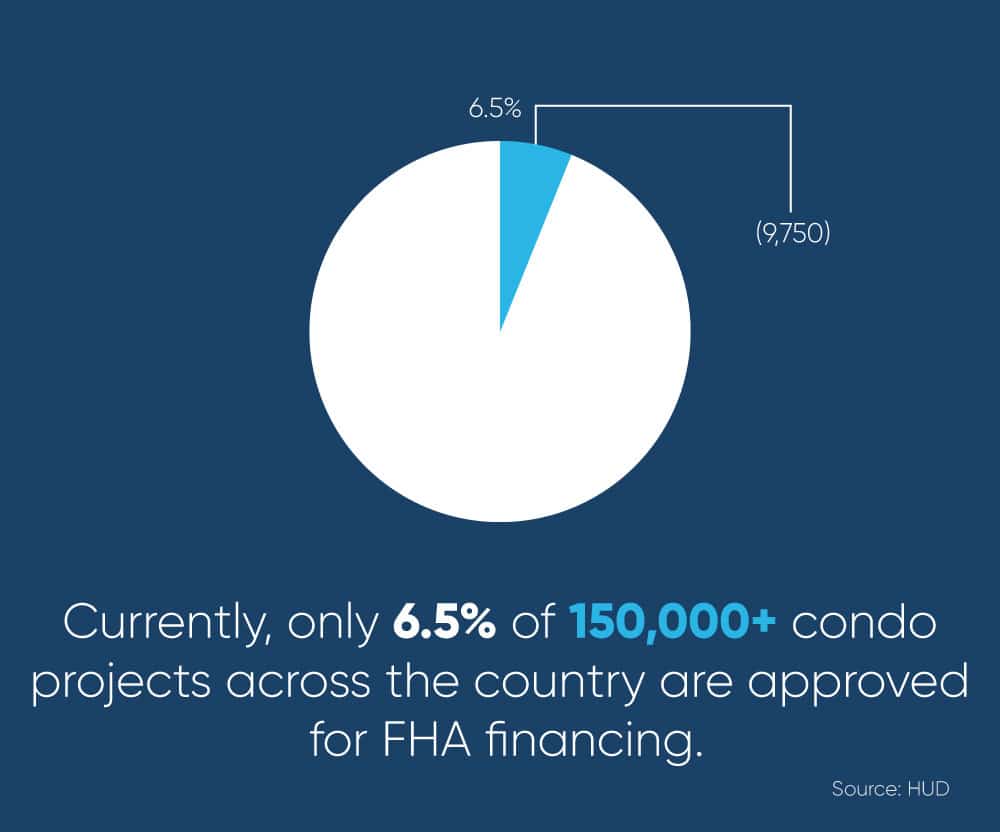

Many discrepancies or required repairs can be easily rectified, but until 2019, it was challenging to obtain an FHA loan on a condo due to restrictive lending policies. In fact, out of the 150,000+ condo projects across the country, only 6.5% are approved for FHA lending.

HUD & FHA reverse mortgage condo guidelines

In August 2019, HUD.gov published a press release announcing comprehensive HECM policy revisions that affect reverse mortgage condo eligibility. Up until now, it was difficult for senior homeowners to obtain a HECM on their condo because it meant that the entire complex would require FHA approval.

Hopeful borrowers were frequently met with resistance from Homeowner Associations (HOAs) who didn’t care to put in all the time, money, and documentation demanded by that FHA approval process. Even if they did provide proof of insurance payments and cash reserves, reverse mortgage condo approvals rely on specific owner-occupancy ratios and project details.

The reverse mortgage condo changes make it significantly easier for individual property owners to apply for and receive HECM approval. The changes also help in simplifying the process for condominium projects as a whole. Let’s take a deeper look at some of the new condominium approval rules.

Spot Approval

The biggest reverse mortgage condo change impacting property owners and aspiring borrowers is the new ability for spot approval. This allows certain individual condo units to receive approval for an FHA loan even if the entire condominium project is not FHA-approved.

You may be eligible for Single-Unit Approval if:

- The condominium project is completed.

- In projects with 10 or more units, no more than 10% of units are FHA-insured.

- In projects with fewer than 10 units, no more than two units are FHA-insured.

Mixed-Use Projects

Some complexes are considered mixed-use because they contain both commercial and residential spaces. For these to receive FHA approval, the commercial or non-residential space cannot exceed 35% of the project’s total floor area—which is a more generous allowance than former regulations allowed, opening up doors to more eligibility opportunities.

Occupancy Ratios

The FHA also loosened restrictions on owner-occupancy rules. New provisions state that eligible condo projects can now be occupied by just 50% of owners in most cases, although this may be lowered to as little as 35% if the project meets certain requirements. Prior to the passing of the Housing and Economic Recovery Act (HERA) in 2008, the owner-occupancy ratio was set as high as 80% for FHA insurance. This made it much more difficult to satisfy the conditions for an approval.

Insurance Maximums

Finally, the FHA stated that they will insure up to 50% of the total number of units in an approved condominium project. New rules extend the recertification process required for FHA approval from every two years to every three.

Getting Started with Reverse Mortgages

If you’re looking to get started with a reverse mortgage, these articles can help guide you through all aspects of the process.

Guide to HECM Loan Reverse Mortgage Limits

Is my condo FHA-approved?

For a condo to be approved by the FHA, specific requirements have to be met. This includes satisfying the general HUD reverse mortgage requirements for borrowers, such as:

- Being at least 62 years old

- Occupying the property as a primary residence

- Owning an eligible property

- Participating in HECM counseling

In addition to the provisions above, your condo must also fulfill several FHA requirements to be considered eligible for a reverse mortgage. This consists of:

- Condominium projects are primarily for residential use

- A minimum of 50% of units must be owner-occupied

- Condominium projects must have at least two units

- No more than 10% of units may be owned by a single entity

- No more than 15% of units can be overdue on their HOA fees for more than 60 days

If you’re unsure whether your condo is FHA-approved, you can visit the HUD website and search for your condo using the online form.

How do FHA-approved condo changes affect reverse mortgages?

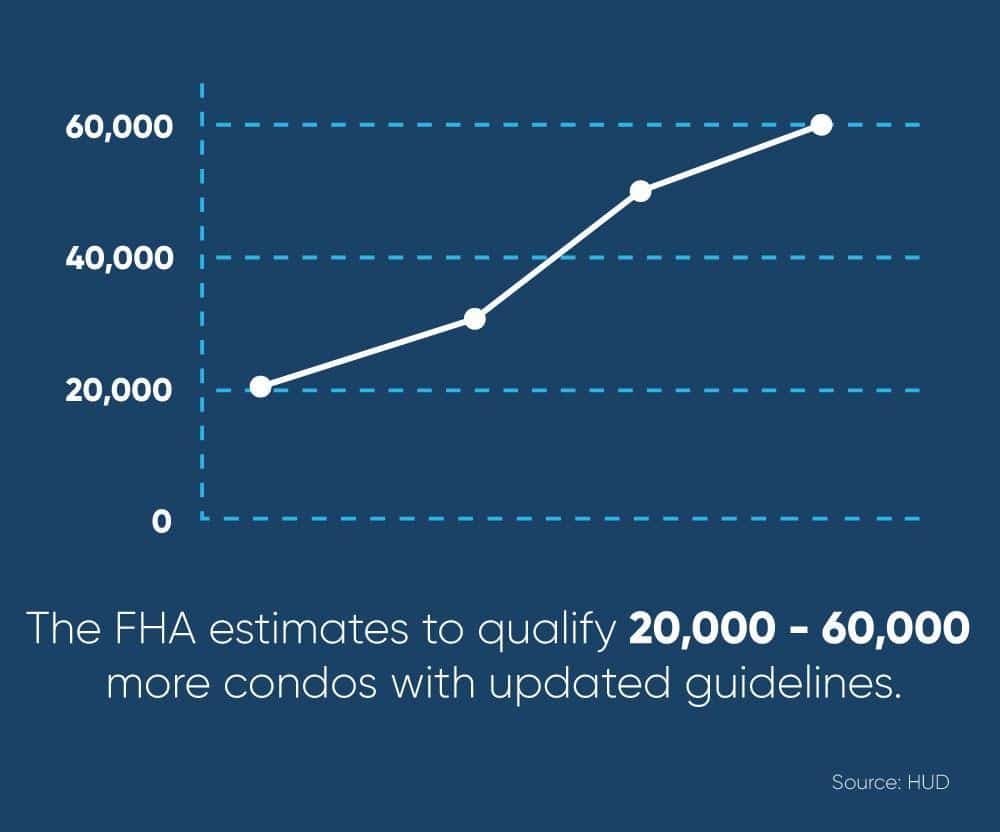

HUD’s press release announced that, once these provisions go into effect, an estimated 20,000 to 60,000 more condos will qualify for FHA approval. While that is significant news for homebuyers looking to purchase property using an FHA loan, it also bears a lot of importance for senior Americans who currently live and own equity in a condominium unit. The expanded FHA eligibility may enable you to obtain a HECM on your condo and apply the loan proceeds to your retirement planning.

The value of your reverse mortgage condo loan depends on a number of factors including:

- The appraised property value

- The age of the youngest borrower

- The outstanding mortgage balance if any

- The current interest rate

If you and your property meet the reverse mortgage eligibility requirements, then you may be able to obtain a HECM based on a property value of up to $1,209,750 which is HUD’s current borrowing limit in 2025.

The benefits of getting a reverse mortgage on a condo

There are many financial resources for seniors struggling to get by, including the government-sponsored HECM program. This program allows senior homeowners to take advantage of reverse mortgage benefits, which include:

- The ability to pay off an existing mortgage

- Supplement a fixed retirement income

- Payoff other outstanding debts

- Finance home improvements

- Afford large purchases

- Age independently at home

It’s recommended that senior adults plan to finance a retirement period of at least 20 years, which many retirees are not ready for. According to the National Council on Aging, over 15 million seniors living in the United States are economically insecure, making it difficult to pay for medical bills, housing expenses, food, transportation, and so forth.

If you find yourself struggling to make ends meet with your personal savings, Social Security benefits, and retirement distributions, then you may be able to increase your monthly cash flow with a HECM. Our reverse mortgage calculator can estimate how much you may be able to receive in loan proceeds.

How can I get a reverse mortgage on my condo?

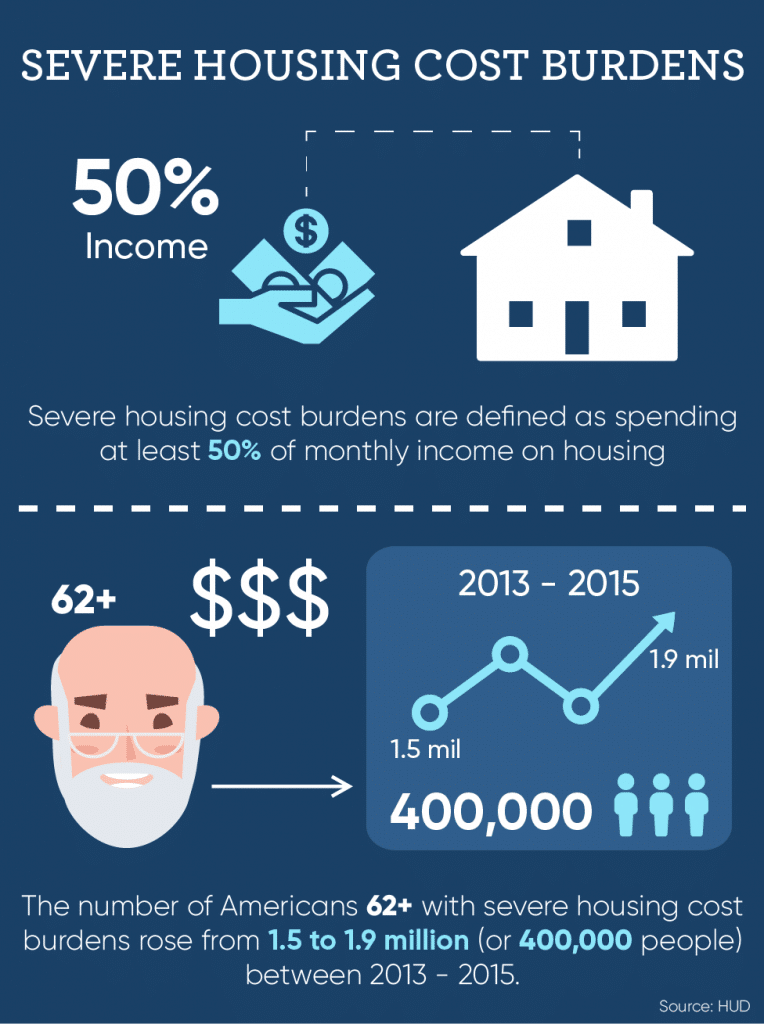

Many seniors find themselves unprepared to comfortably finance the retirement they’ve envisioned. Increased medical bills, basic living expenses, and unexpected retirement taxes all pose significant financial burdens on a limited income. In fact, the number of Americans age 62 and up who face severe housing cost burdens—defined as spending at least 50% of monthly income on housing—rose from 1.5 to 1.9 million between 2013 and 2015.

Using HUD’s data, that means as many as 400,000 more seniors now face financial hardship in the United States during the time in which they should be able to live their lives to the fullest following their working career. With their newfound freedom, senior adults should be able to pursue retirement hobbies and spend more time traveling without worrying about a tight budget.

There are many financial resources for seniors struggling to get by, including the government-sponsored HECM program. Some reverse mortgage benefits include:

- The ability to pay off an existing mortgage

- Supplement a fixed retirement income

- Payoff other outstanding debts

- Finance home improvements

- Afford large purchases

- Age independently at home

It’s recommended that senior adults plan to finance a retirement period of at least 20 years, which many retirees are unprepared for. If you find yourself struggling to make ends meet with your personal savings, Social Security benefits, and retirement distributions, then you may be able to increase your cash flow with a HECM. Our reverse mortgage calculator can estimate how much you may be able to receive in loan proceeds.

Borrowers have the choice in how they wish to receive their loan proceeds, either as a lump sum, line of credit, or monthly installments. This may significantly increase your retirement income, allowing you to afford your living expenses more easily or pursue retirement travel with less stress.

If you’ve considered getting a reverse mortgage on a condo, or you have been previously denied under the old FHA policy, now may be the time to take advantage of the loosened restrictions and expanded eligibility. Our experienced team of Reverse Mortgage Specialists is always well-apprised of industry rules and regulations, and is happy to answer any questions you may have regarding policy updates.

Contact us to learn more about the reverse mortgage application process and to see whether this form of financing fits your retirement goals.

1-866-840-0279

1-866-840-0279