As you consider whether a reverse mortgage is right for your financial circumstances, you should bear in mind how interest rates may affect your loan.

At GoodLife, we’re committed to providing you with all the information you need to make a sound decision for retirement.

Today’s post discusses the latest reverse mortgage interest rates to help you understand more about how reverse mortgage loans are structured. Keep reading to learn how interest is calculated on reverse mortgages or jump to a specific section by clicking on one of the links below.

What is the interest rate on a reverse mortgage?

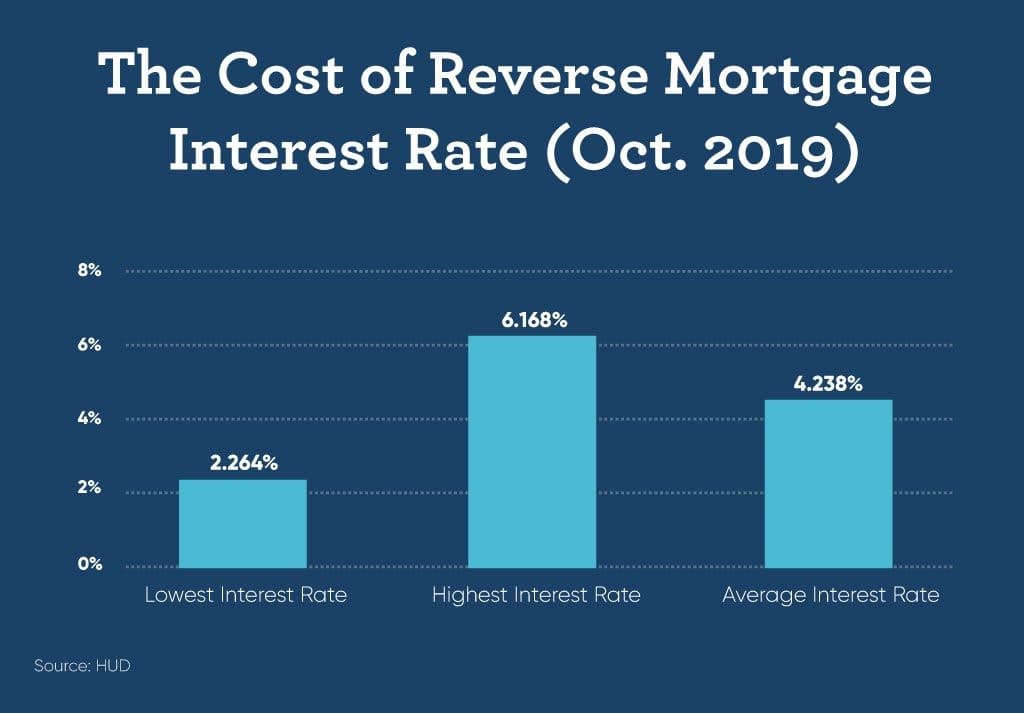

In the month of October 2019, the average interest rate on a reverse mortgage was 4.238% according to the statistics published by HUD.gov. Their data reveals that 2.264% was the lowest reverse mortgage interest rate during that time period and the highest was 6.168%. However, it’s important to note that reverse mortgage interest rates change and vary depending on several factors, which we’ll discuss at length in the course of this post.

Like most other loans and lines of credit, reverse mortgages charge interest on the funds you borrow. Interest accrues daily over the lifespan of the loan and is added to each monthly statement. While most traditional loans require minimum payments each month, reverse mortgages defer loan and interest repayment until the loan reaches a maturity event. This means that you’re only responsible for making payments on your loan once it becomes due and payable.

There are a few events that signal the maturity of your loan, at which time you will need to repay the principal and interest accumulated on the reverse mortgage:

- You sell your home

- The last borrower no longer occupies the home

- The last borrower passes away

- The loan goes into default due to non-compliance with loan terms

Most standard loans require that borrowers have a strong credit history indicating their ability to make timely payments; if their credit score is weak, they may have to pay a higher interest rate to mitigate the lender’s risk. However, reverse mortgages do not require monthly payments. As such, lenders do not use credit scores to determine the reverse mortgage interest rate, according to Experian. That said, a credit check will be used to determine whether you have any tax liens or other marks that may affect your reverse mortgage eligibility.

Reverse mortgages are also known as home equity conversion mortgages (HECMs), which is a program overseen by the US Department of Housing and Urban Development in conjunction with the Fair Housing Administration. These loans are federally insured, which means that if the outstanding loan balance is higher than the appraised property value, the government – not the lender – will cover the loss.

Note: HECMs are non-recourse loans, which means that borrowers (or their heirs) are only required to pay back 95% of the appraised property value or the outstanding loan balance, whichever is less. If you ever want to learn more about how reverse mortgages work, our Reverse Mortgage Specialists are happy to answer any questions you may have.

The FTC states that borrowers cannot deduct interest on reverse mortgages until the loan is either partially or fully paid off. It’s wise to consider reverse mortgage tax implications before determining whether this is the right form of financing for your situation.

What’s the difference between a fixed interest rate and a variable interest rate?

One factor that affects how reverse mortgage interest is calculated is whether your loan has a fixed or variable rate. Let’s take a closer look at both options.

Fixed Reverse Mortgage Rates

If a reverse mortgage has a fixed interest rate, it means that the interest rate will not change over the course of your loan. Fixed interest rates are typically only available if you opt to receive a lump sum payment, which means all funds are distributed once the loan closes (after paying off any existing mortgage or liens on your property).

Many homeowners opt for this type of payout when they want the security of knowing that their interest rate won’t go up or down over the lifespan of the loan.

How are they calculated?

Fixed interest rates reflect the current economic conditions and are typically determined by investors or financial institutions.

The actual fixed rate available to borrowers will vary depending on loan factors. If you’re interested in a fixed rate reverse mortgage, our team can help you determine your potential interest rate.

Adjustable Reverse Mortgage Rates

If you’d prefer to receive your reverse mortgage funds in incremental payments, you may opt for an adjustable reverse mortgage rate. The interest rate on adjustable loans may fluctuate on an annual or monthly basis.

An adjustable rate can offer more flexibility, as borrowers have the ability to pull funds as necessary through a line of credit or receive regular monthly installments to supplement retirement income. However, this flexibility is only available with an adjustable interest rate.

How are they calculated?

Adjustable reverse mortgage rates are dependent on two factors: an index and a margin. The sum of these equals your adjustable interest rate.

- Index: The index is a standard rate that fluctuates based on market interest rates; interest rates can increase or decrease based on whether the index goes up or down. Lenders currently use a published financial index called the London Interbank Offered Rate (LIBOR). LIBOR is an average value of combined interest rates, which value is calculated based on values submitted by top global banks every day.

- Margin: After determining the interest rate index, lenders consider their margin. This is an interest percentage that a lender adds to the index – essentially, this is the money a lender makes on the loan.

The sum of these two numbers determines your adjustable reverse mortgage interest rate. For example, if the current LIBOR is 3.00% and the lender’s margin is 2.00%, the expected interest rate is 5.00%. Your expected rate is used to determine the loan amount and its potential total cost. The economic index is constantly in flux and lenders have the ability to set their own margin – in addition to their rate cap and floor – which explains why the interest rate on reverse mortgages varies.

Getting Started with Reverse Mortgages

If you’re looking to get started with a reverse mortgage, these articles can help guide you through all aspects of the process.

Guide to HECM Loan Reverse Mortgage Limits

What are rate caps and rate floors?

There are two additional factors that can affect an adjustable interest rate on a reverse mortgage: caps and floors.

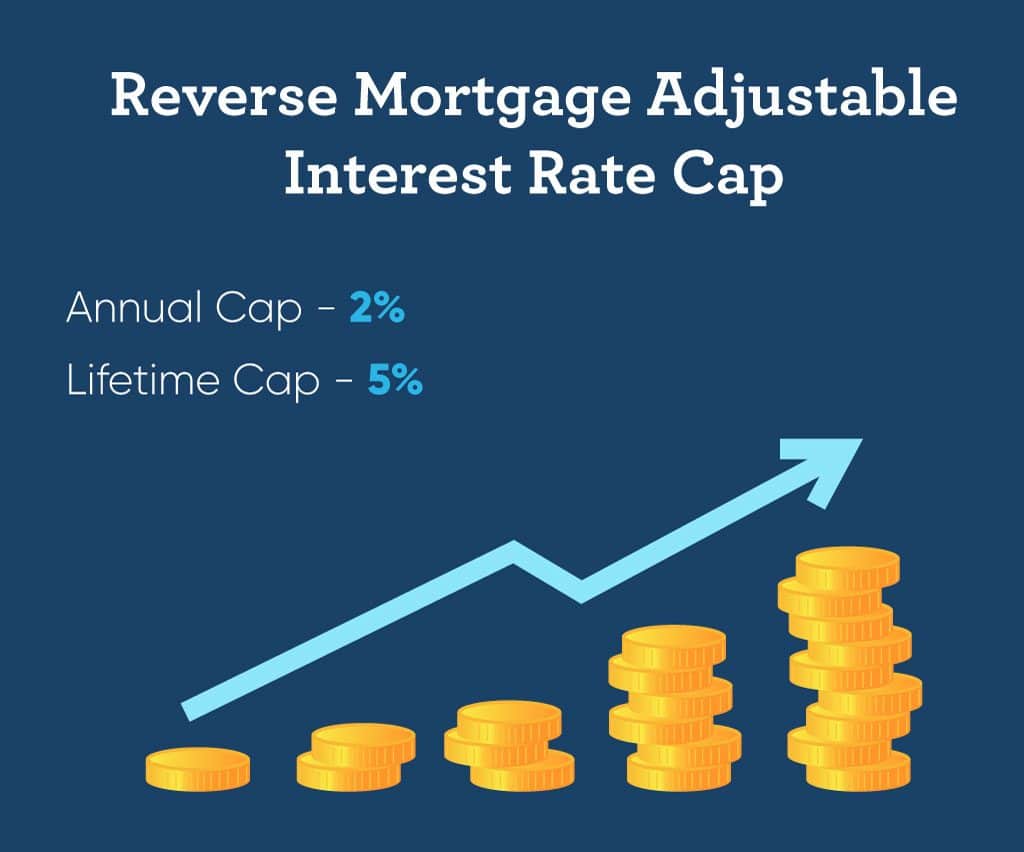

In order to limit how quickly interest rates may rise or fall within a given year, caps are in place to set a maximum rate that your loan can incur. According to HUD.gov, adjustable rate HECM loans have a 2% annual cap and 5% lifetime cap.

Additionally, your lender may assign a rate floor, which determines the minimum interest rate of your reverse mortgage. If your rate floor is 3%, you’ll always pay at least that amount, even if the sum of your index and margin drop below it.

What are the other reverse mortgage costs?

Interest rates are just one of the expenses associated with a reverse mortgage. In addition to interest, there are additional reverse mortgage costs that consumers should be aware of. The Department of Housing and Urban Development provides a detailed rundown of the fees and charges of a HECM:

- Mortgage insurance premiums (MIP): At closing, you’ll pay a 2% MIP for Federal Housing Administration (FHA) mortgage insurance. Over the life of your loan, you’ll also be charged an annual MIP that equals 0.5% of your outstanding mortgage balance.

- Third-party charges: You may pay third-party charges due to closing costs from third parties, including appraisal, title search and insurance, inspections, surveys, credit checks, mortgage taxes, and other fees.

- Origination fee: This fee compensates your lender for processing your reverse mortgage. Lenders may charge the greater of $2,500 or 2% of the first $200,000 of your home’s value plus 1% of the amount over $200,000. Origination fees are capped at $6,000, so you won’t pay any more than that, and lenders may choose not to charge the maximum amount.

- Servicing fees: Reverse mortgages may come with servicing fees; servicing refers to the maintenance tasks your lender must complete throughout the life of your loan. These activities could include sending you regular account statements, ensuring you receive your loan proceeds, and checking that you’re keeping up with your loan requirements. Service fees depend on the type of interest rate you have.

A reverse mortgage loan could be the financial tool that helps you live The GoodLife in Retirement. Our team of Reverse Mortgage Specialists can help you determine what your interest rate might be. Click this link to contact us and get started.

1-866-840-0279

1-866-840-0279