Understanding Monthly Retirement Income Needs

As you prepare for retirement, you may wonder if your savings are on track to maintain your quality of life while being able to pursue hobbies or travel with your increased leisure time. According to research by Boston College, 50% of households are at risk of not having enough funds to continue their standard of living in retirement.

Your exact financial needs will depend on your goals during retirement. Do you want to age in place? Do you plan on traveling? Are you going to pursue a new hobby? These are just a few of the questions you’ll want to know the answer to as you create your strategy for financial stability during your retirement.

Keep reading below to see how your retirement income compares to the rest of the nation’s average retirement income and what you can do if you think it won’t be enough to meet your needs. Navigate directly to the FAQ you’d like to learn more about or continue reading for a full overview.

- What is the average retirement income? What’s the median retirement income?

- What’s the monthly average retirement income?

- What is a good monthly retirement income?

- What amount should I have saved for retirement?

- What can I do if my retirement income falls below average and I feel it won’t be enough?

- Retirement planning and average retirement income

What is the average retirement income? What’s the median retirement income?

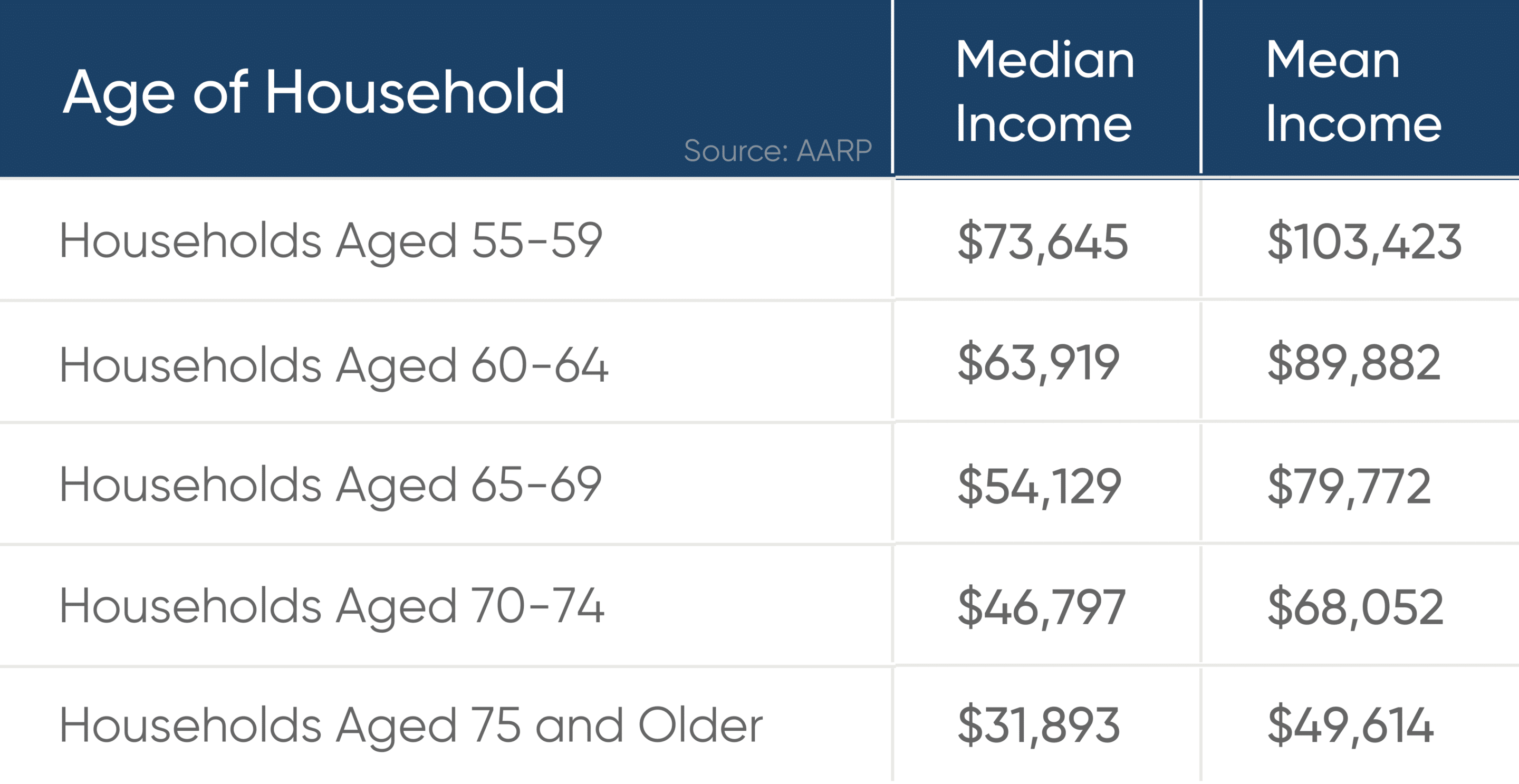

According to data from the US Census Bureau, the average retirement income is around $73,000. However, the median retirement income—which is often a more accurate reflection of the majority of cases—is just around $47,000. As retirees age and continue to use up their income streams, average income goes down. A full breakdown of retirement income by age can be found in the chart below.

If those averages seem a little high, remember those numbers are slightly misleading because households making the highest amounts of money will skew the data and pull up the average. The mean or average income is calculated by adding together each household’s income and then dividing by the total number of households.

The median income is calculated by putting together all incomes from low to high, with the very middle income in the list acting as the median. Many experts believe the median income is a more accurate representation of retirement income. However, those median numbers still don’t reflect the reality for a large swath of retired Americans.

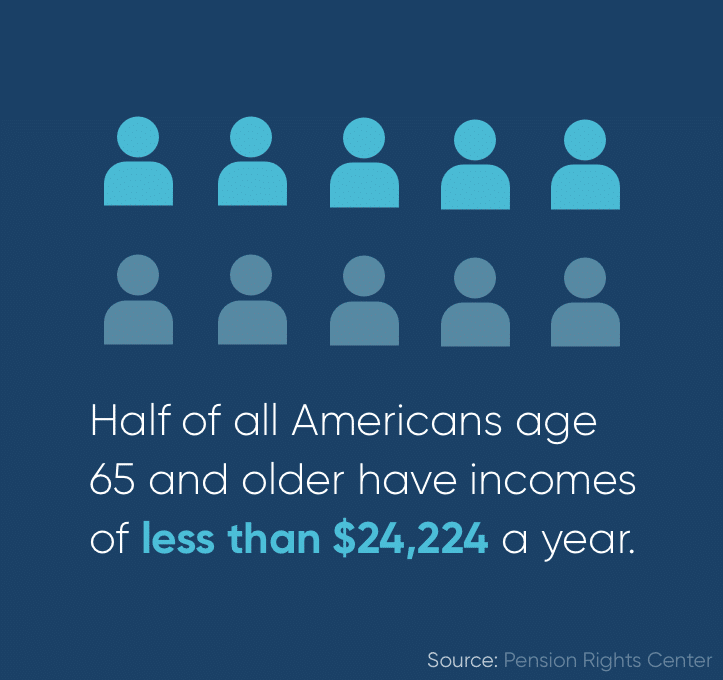

The Pension Rights Center reports that half of all Americans age 65 or older have incomes less than $24,224 a year. That number is lower because it’s only individual incomes of those above the age of 65, not household totals. As you can see from the numbers above, the median household income falls as you move farther up in age.

As USAToday.com asks, could you live on around $32,000 as you hit your mid-70s? That’s the median income for households aged 75 and older. If that doesn’t seem like enough, there are ways to ensure you have additional streams of income to depend on that we will dive into in later sections.

- Curious about other helpful income statistics? Read our guide to the average American net worth.

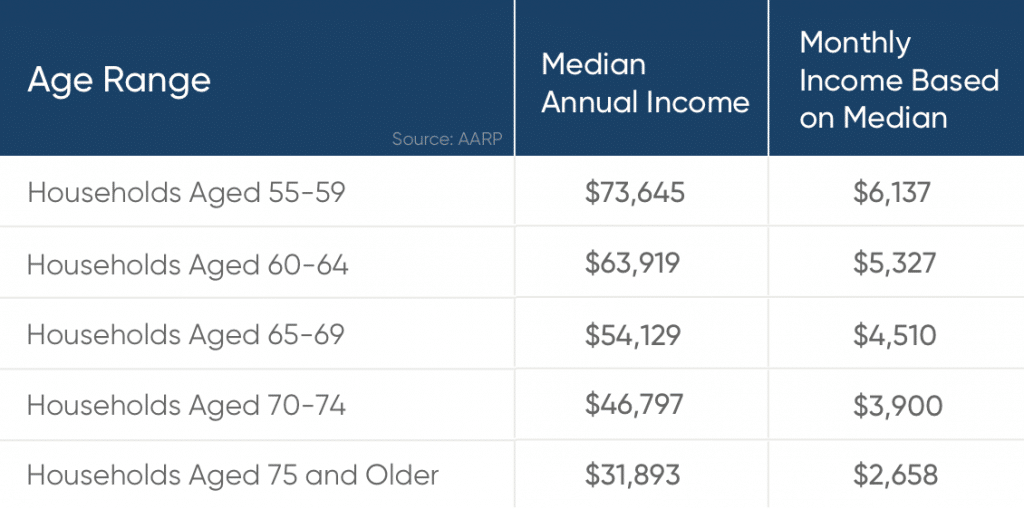

What’s the monthly average retirement income?

There is no exact monthly average retirement income for retirees because of a variety of unpredictable factors such as investment returns, inheritance funds, and savings differences. If we refer to the median numbers mentioned in the first section, here are some of the monthly numbers based on the median annual incomes.

Again, these are simply a more granular look at the median income averages per age range on a monthly basis. They may not reflect your particular situation.

What is a good monthly retirement income?

A good monthly retirement income is enough to keep your standard of living comparable to what it was before you left your career. A good rule of thumb is to save enough to replace around 80% of your pre-retirement monthly income.

For example, if you were earning about $5000 a month before retiring, you can aim for an average monthly retirement income of $4000 afterward. This is because in retirement, you’ll no longer be making contributions to Social Security and Medicare—and instead, you’ll be benefiting from those programs.

Ultimately, what is a good monthly retirement income will depend heavily on personal factors. These may include:

- Cost of living where you retire

- Lifestyle costs

- Medical needs

- Retirement travel plans

- Plans for heir inheritance

- And more

Knowing how to budget retirement money can seem tricky at first—but it doesn’t have to stay that way. Read our full guide on how to save money on a fixed income for more helpful retirement finance tips.

Getting Started with Reverse Mortgages

If you’re looking to get started with a reverse mortgage, these articles can help guide you through all aspects of the process.

Guide to HECM Loan Reverse Mortgage Limits

What amount should I have saved for retirement?

That depends, but the AARP recommends saving 10-12 times your current salary. Another rule of thumb mentioned above is to replace around 80% of your annual pre-retirement income. When you begin to plan your retirement income strategy, you’ll need to consider your personal finance goals, future travel plans, and other expenses.

When you retire, your spending might increase in some categories, like health care, for example. But other expenses like your car loan or student loan payments may be low or non-existent since you’ve had time to pay down your debts.

The amount of money you need for retirement differs from individual to individual. It’s best to plan out a number that allows you to retire comfortably with the help of a financial planner who can dispense expert advice on dependable revenue streams and how to safely draw down your savings and other retirement funds. Your income will likely need to last at least 20-30 years, depending on the age you leave the workforce and retire.

What can I do if my retirement income falls below average and I feel it won’t be enough?

Knowing how to afford retirement is consistently one of Americans’ top 5 retirement concerns. Ideally, you can consult a financial planner to decide what your options are if you feel that your retirement income won’t be enough to meet your individual goals.

As you map out your retirement income strategy, you should consider three major pillars: flexibility, growth, and guaranteed sources of income.

Many older Americans rely on Social Security benefits as a dependable source of income during retirement, but that’s only one part of the bigger picture when it comes to bridging the gap to maintain your standard of living. Some of the options for creating retirement income, such as an investment portfolio, should begin early on in your life. But even if you’ve had a late start to investing, you can still make up for lost time by investing more of your income into your 401(k) as you near retirement.

Listed below are some retirement income sources that may give you the funds you need:

- Reverse mortgages: Reverse mortgage eligibility is determined by the qualifications listed below.

- Must be 62 years of age or older

- Must own a substantial amount of equity in their home

- Must live in their home permanently

For older Americans who are 62+ and have considerable equity in their homes, a reverse mortgage may be a viable option to supplement fixed income sources. A reverse mortgage loan allows retired homeowners to convert the equity they have in their homes into cash to be used as they see fit for expenses like healthcare or costs associated with aging in place. The funds can be distributed in the form of fixed monthly payments, a line of credit, a lump sum, or a combination of those options. The best part? You never have to pay back the loan, and the funds you receive aren’t considered taxable income by the IRS.

If you’re curious about what your reverse mortgage loan proceeds might be, you can use GoodLife’s reverse mortgage calculator to get an estimate.

- Investment portfolio: Your retirement portfolio is extremely important. The sooner you start putting money away into a retirement account, the longer you allow your money to grow. Again, it’s best to consult a financial planner, so you pick a mix of stocks and bonds that match your long-term goals and complements your current risk tolerance.

- Annuities: An annuity is simply a contract you make with an insurance company in exchange for an upfront investment that gives you payments for the rest of your life.

- Social Security: As mentioned above, many retired Americans rely on Social Security benefits during retirement. The main question you’ll have to ask yourself when you factor in your monthly benefit payment is, “When should I start to take my Social Security benefits?”

- You have the option to claim your benefits as early as age 62, but if you do, you forgo getting even bigger monthly payments if you wait until your full retirement age. Your full retirement age is dependent on your birthday but is generally between 66-67 years of age.

- Social Security benefits for 2019 average around $1,461 a month. For most retirees, this isn’t enough to get by comfortably.

- Pensions: Only 14% of US workers have pensions but if you do have one, you’ll need to decide between getting a lump sum payout or a stream of income.

Retirement planning and average retirement income

The average monthly retirement income is just that: an average. It doesn’t necessarily encompass all the different variables that are going into your particular retirement income plan. With that said, you can still use the numbers for national retirement income as a yardstick to compare your own savings and earnings. If you find that your savings are falling short of your financial goals, there are a variety of options available to retirees, including reverse mortgages. If you’d like to explore reverse mortgage solutions for your own retirement, contact one of our Reverse Mortgage Specialists to find out more.

1-866-840-0279

1-866-840-0279