Pros & Cons of Annuities: Thinking About Retirement

Saving for retirement is a financial task that should be on top of everyone’s list, but it’s not as easy as it may seem. It’s likely that you’ll encounter numerous expenses in your lifetime—student loans, a mortgage, medical bills. These expenses can make funding retirement challenging. But, for most of us, we’ll need some stream of retirement income to get by.

Once you determine how much you need to save for retirement, you’ll be able to begin planning. There are various retirement vessels available, such as IRAs and employer-sponsored 401(k)s. Another popular option is an annuity, which we’ll explore in depth in this post. But what is an annuity? Simply put, annuities are a form of insurance that provides guaranteed income in retirement. While they sound enticing, they do come with a fair share of drawbacks worth considering.

As you begin to think about retirement and the possibility of an annuity, it’s important to know their pros and cons. In this post, we’ll go over what annuities are, the different types of annuities, the pros and cons of annuities in retirement, and more. Read through for a full scope of annuities, or use the links below to jump to a section of your choice.

Key takeaways

- Annuities are a financial product purchased from an insurance company that provides either a lump-sum payment or multiple payments over time during retirement.

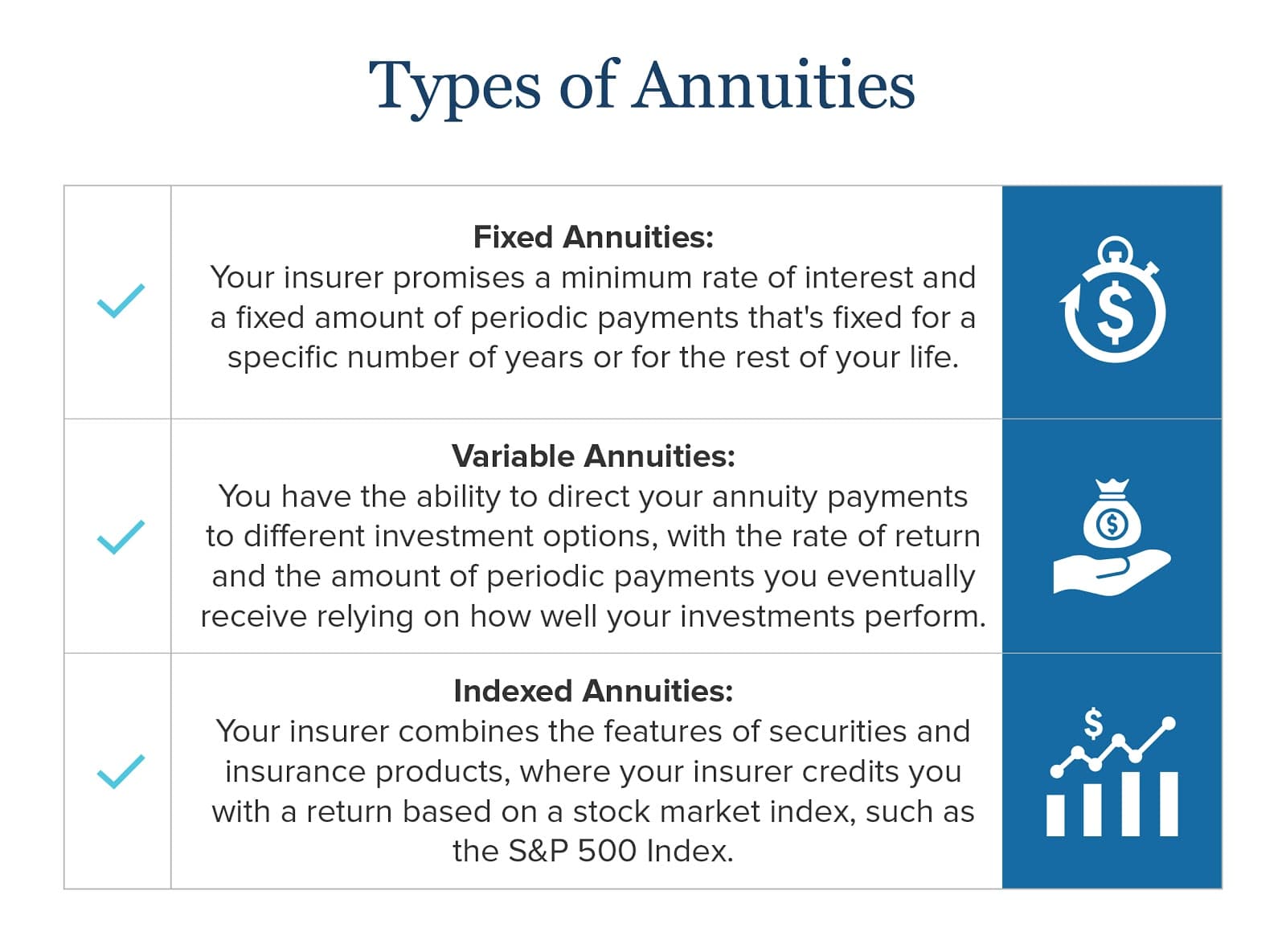

- There are three main types of annuities: fixed annuities, variable annuities, and indexed annuities.

- There are many pros and cons of annuities. Some pros of annuities include retirement income for life, tax-deferred growth, death benefits, guaranteed rates, and protection from market volatility.

- Some cons of annuities include their high price point, limited access to money, higher tax rates, complexity, and the fact that they are not FDIC insured.

What is an annuity?

An annuity is a financial product often bought from an insurance company. When buying an annuity, you can either make a single payment or multiple payments. When you reach retirement and it’s time to make withdrawals, the insurance company provides either a lump-sum payment or multiple payments over time. Annuities also require a written contract between you and the insurance company, which outlines your annuity’s terms and conditions, such as the payment structure.

There are a few reasons why people choose annuities, with one of the main reasons being the ability to manage income in retirement better. Annuities offer three things:

- Tax-deferred growth: Similar to traditional 401(k)s and IRAs, you don’t pay taxes on the income and investment gains until you withdraw during retirement.

- Death benefits: If you pass away before you’re able to make withdrawals from your annuity, the beneficiary listed in your contract will receive a specific payment.

- Periodic payments for a certain period of time: When it comes time to make withdrawals from your annuity, you can get periodic payments for the rest of your life or the life of your spouse or another beneficiary.

Like many of us, you may be wondering how much income you need to retire. In a study by Merrill Lynch in conjunction with Age Wave, it was found the average cost of retirement is over $700,000. Getting to that number may sound impossible, but investment options like annuities can help. There are plenty of reasons why one might buy into a retirement annuity. But before you make a decision, let’s look at the different types of annuities available to you.

What types of annuities are there?

There are multiple types of annuities you can choose from to start preparing for retirement. Each one comes with its own structure and guidelines, which are worth looking into, so you can find an annuity plan that works for you, should you choose one. Below are the different types of annuities:

- Fixed annuity: With a fixed annuity, you already know when and how much you’ll be paid when your insurer starts making payments to you, which is the annuitization phase. Your insurer promises a minimum rate of return and a fixed amount of periodic payments. The rate of return can be fixed for a specific number of years, such as 20 years, or for the rest of your or your spouse’s life. It’s best to check with your state’s insurance commission to ensure your insurance company is registered to sell insurance in your state.

- Variable annuity: When choosing a variable annuity, you have the ability to direct your annuity payments to different investment options, typically mutual funds. The rate of return and the number of periodic payments you eventually receive rely directly on how well your investments perform. The different types of annuities have pros and cons, and one of the pros with variable annuities is that your investments have the opportunity to grow more than a fixed annuity. However, this means there is more risk, and if your investments perform poorly, you’ll have less money for retirement. Variable annuities are regulated by the U.S. Securities and Exchange Commission.

- Indexed annuity: Lastly, there’s the indexed annuity, which combines the features of securities and insurance products. With this option, your insurer credits you with a return based on a stock market index, such as the S&P 500 Index. State insurance commissioners regulate indexed annuities.

With the different types of annuities in mind, let’s look at the pros and cons of buying an annuity in the next section.

Pros and cons of annuities

As with any financial decision, it’s important to weigh the advantages and disadvantages to determine whether it’s right for you. Below, we’ll highlight the pros and cons of annuities for retirement income, so you can decide whether it works for your financial situation.

Pros of annuities

There are many appealing benefits of annuities that draw people into buying them. Consider the following pros of annuities as you weigh this investment decision:

- Retirement income for life: One of the top reasons why people buy into annuities is that they can guarantee retirement income for life. For many, running out of money during retirement is a dreaded fear. Even with the help of 401(k)s, IRAs, and other investment vehicles, it’s possible to run out of money. When buying an annuity, you can get a steady source of income for either a set period of time or for life, depending on your contract, and can serve as a supplement to Social Security.

- Tax-deferred growth: A significant perk of annuities is that the money you contribute is tax-deferred. This means the money you contribute doesn’t face taxes until it comes time to receive payments. Tax-deferred accounts, such as annuities and traditional 401(k)s and IRAs, can help reduce Social Security taxes. This is because you’ll have less taxable income because you’re delaying withdrawals.

- Death benefits: Different types of annuities have pros and cons, and one of the pros of variable annuities is that they can come with a death benefit. With a death benefit, the insurance company makes payments to a beneficiary, such as a spouse, for a certain number of years. With fixed and indexed annuities, payments end when the annuity’s owner dies.

- Guaranteed rates: For those looking for secure and predictable payments, you may want to consider fixed annuities. One of the pros of fixed annuities is that you will always know the rate of return for a certain period of time, which can prevent you from losing money.

- Protection from market volatility: With fixed and indexed annuities, your money can be protected even when the market experiences downturns. While risks come with most financial investments, these types of annuities can hold firm during market downturns but often have lower return rates and capped earnings than other investment options.

Getting Started with Reverse Mortgages

If you’re looking to get started with a reverse mortgage, these articles can help guide you through all aspects of the process.

Guide to HECM Loan Reverse Mortgage Limits

Cons of annuities

Annuities can help make it easier to manage income during retirement. However, even though annuities have many attractive benefits, there are a handful of drawbacks worth considering before buying into one. Take a look at some of the cons of annuities below:

- High price point: Arguably, annuities’ most significant drawback is their cost. Annuities come with many hefty fees that can dig into your wallet, such as commission fees, surrender fees, administrative fees, mortality fees, and expense fees. You’ll also face fees if you add additional riders, which are any custom provisions made to your annuity to meet your needs. Overall, average annuity fees are around 2.3% but can reach up to 3% or more.

- Limited access to money: Some annuities, such as variable annuities, come with a surrender fee, which is a sales charge you must pay if you sell or withdraw money during the surrender period. The surrender period is a set period of time, typically between 6 and 8 years, after you buy your annuity, and lowers the value and the return of your investment. If you do withdraw early, you can face steep fees. In addition to the surrender period, once you do begin receiving payments, you’ll only be able to access funds on scheduled payment dates.

- Higher tax rates: Payments made to an annuity are tax-deferred. When it comes time to receive payments, your withdrawals will be taxed at your regular income tax rate, not the long-term capital gains tax rate, which is the tax rate for individual stocks and mutual funds held for more than one year. Because withdrawals from annuities are taxed as ordinary income, you might end up paying more money to the government compared to other investment options.

- Complexity: Even when annuities are explained to investors, they can still be difficult to understand. Payout terms are based on when you begin withdrawing, and your actual rate of return can be hard to calculate due to the hefty fees that come with annuities.

- Not FDIC insured: Unlike bank deposits, annuities aren’t FDIC insured. This means if the insurance company you bought your annuity from goes bankrupt or cannot make payments, you might be unable to get your money. For fixed and indexed annuities, you might lose all of your investment if your insurer goes under. However, with variable annuities, you might be able to keep your initial investment since it went into investment options.

Is an annuity right for your retirement plan?

Now that you know the pros and cons of annuities for retirees, are they right for your retirement plan? As always, when it comes to investing, always do your research and work with a financial planner who can help you make sound financial choices. Weighing the pros and cons of annuities is a great place to start. If you choose to buy into an annuity, always work with a reputable and financially stable insurance company.

If you’re looking for a guaranteed stream of income to supplement other revenue streams in retirement, an annuity might be a good choice. However, if you want to invest your money later on in life or don’t have the funds to pay the upfront costs and fees, an annuity might not be the right choice.

However, if you decide an annuity isn’t right for your retirement plan, there are other options available. Investment vehicles like IRAs and 401(k) accounts are common retirement accounts you can use to save and grow your money.

How do annuities and reverse mortgages compare?

You can also tap into your home’s equity and convert it to cash with a reverse mortgage. When comparing annuities and reverse mortgages, you’ll find reverse mortgages offer better perks. For instance, with a reverse mortgage, all costs are clear and upfront and come with no fees or hidden commission costs. Payments from a reverse mortgage are also tax-free and backed by the U.S. Department of Housing and Urban Development, so you can stay protected. At GoodLife, our home loan can help you save money through reverse mortgages, so you can live better in retirement. Use our free reverse mortgage calculator to see how much equity you can access to increase your cash flow.

Sources:

Investor.gov | Merrill Lynch | Investor.gov | NAIC.org | Annuity.org | Investor.gov

1-866-840-0279

1-866-840-0279