How Much Do I Need to Retire?

Many Americans have the life-long goal of a comfortable retirement, but many don’t know how much it costs to retire or how much they should have saved by the time they leave the workforce. Additionally, many Americans have become interested in retiring a little earlier than the usual 65. You might be asking, how much money do I need to retire?—and how much do I need to retire by 62?

We’re committed to helping our clients and readers live The GoodLife in Retirement. Read through this article for an in-depth look at how much money you need to retire. Or, simply click on one of the links below to jump straight to your frequently asked question of choice.

Before knowing exactly how much to save for retirement, it’s important to consider some current events. Retirement in the 2020s is changing.

Changes in Retirement

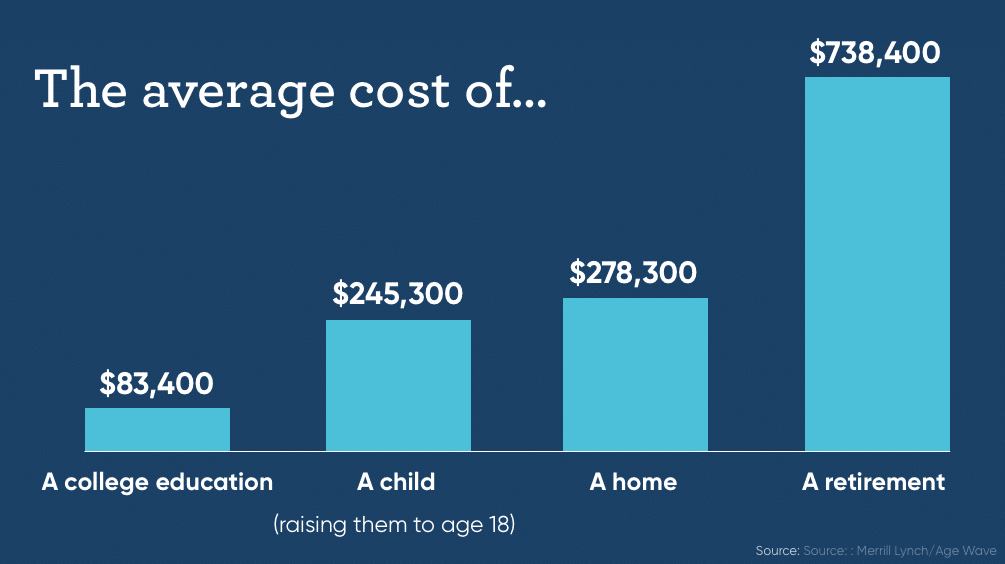

A retirement study (2017) published by Merrill Lynch in conjunction with Age Wave, “Finances in Retirement: New Challenges, New Solutions”, shows that the average cost of retirement is over $700,000 or about 2.5 times that of the average house. Compared to other big expenses during life, retirement is usually the highest.

Many facets of retirement planning listed below have evolved during the most recent decades, leaving a large portion of the aging Baby Boomer population unprepared to afford a comfortable retirement.

Life Expectancy

There are a lot of questions that go into financial planning for retirement: How much do I need to have saved at the time of retirement? How much income per year do I need to retire comfortably? How will my investment accounts perform, and how will retirement taxes affect my bottom line?

While all these answers will differ from person to person, the biggest unknown variable is, how long will I live? The answer to this question is very important for retirement planning but is often the hardest number to pin down.

You can’t be certain how much you’ll need to retire without knowing what duration of retirement you’ll need to fund. Statistically, life expectancy for Americans has significantly increased in the past half-century thanks to healthier lifestyles and breakthroughs in medical technology. Today, a healthy, upper-middle-class couple aged 65 has a 43% chance that one or both partners will live to see 95.

Although living longer may be a good thing, it also means that your investment portfolio and retirement income plan should be able to last for at least 30 years or more.

Getting Started with Reverse Mortgages

If you’re looking to get started with a reverse mortgage, these articles can help guide you through all aspects of the process.

Guide to HECM Loan Reverse Mortgage Limits

Source of Funding

The retirement funding formula is also changing, with responsibility shifting more and more to the individual and less reliance on government programs or employer pensions. In the years ahead, personal savings will become increasingly more important for funding longer retirements as the long-term viability of Social Security benefits is in question.

While personal savings is an important factor for increasing your retirement funding portfolio, there are other options as well. Reverse mortgages, like those offered by GoodLife Home Loans, can be a useful way for retirees to augment their retirement finances using the equity they’ve built in their home. Additionally, other forms of short-term retirement loans may be better suited for some retirees’ plans.

- Be sure to read our full guide to retirement income strategies to gain insights into your full set of options.

How to Calculate How Much You Will Need for Retirement

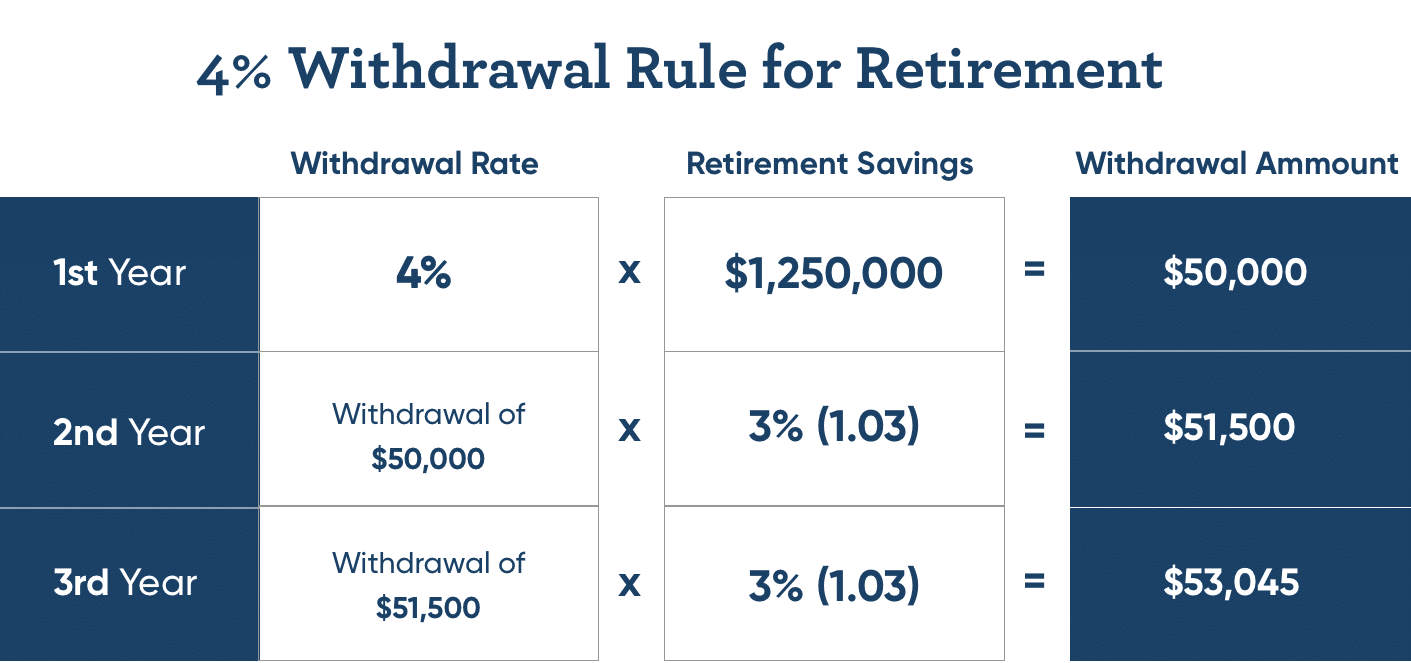

Once you estimate your ideal retirement income, you can calculate how much you’ll need in savings to make that income a reality—while also making your money last—using the 4 Percent Rule. This general rule of thumb refers to how much money you should withdraw from your savings each year in order to maintain an account balance that keeps income flowing throughout your entire retirement.

For example:

$30,000 / 4% = $750,000

$50,000 / 4% = $1,250,000

$75,000 / 4% = $1,875,000

As you can see, to live on $50,000 per year, you would need savings of at least $1.25 million.

Note: This formula can give you an idea of how much money you need to save for retirement in order to create enough returns to finance your lifestyle. The 4 Percent Rule does not account for other sources of income, such as Social Security, and it assumes that you will never exceed the annual 4% withdrawal (which amount should be adjusted each year to reflect inflation). Annual inflation is factored at 3%. That means, by this rule of thumb, you can continue to withdraw the same amount that you did in your first year of retirement, plus an additional 3% annually, to accommodate the higher cost of living. Take a look at the withdrawal amounts in the table below for a better understanding.

Although you cannot guarantee the accuracy of this formula due to market volatility, the 4 Percent Rule is one of the best methods to make sure you can retire comfortably without outliving your money.

How Much Do I Need to Retire at 62?

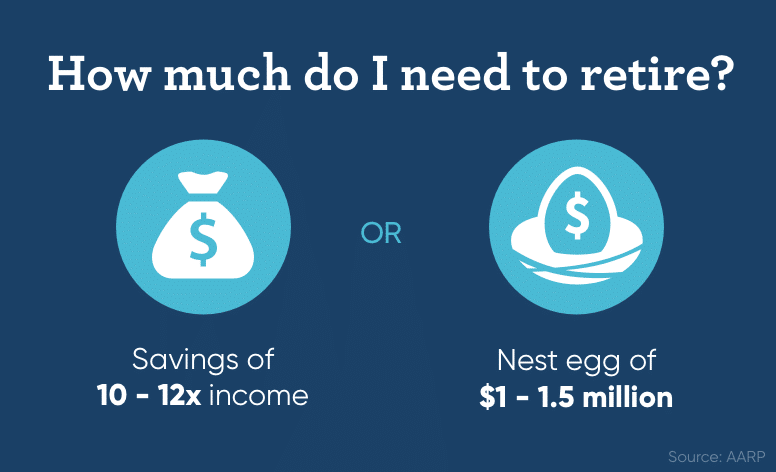

Thus far, we’ve established that the average retirement costs $738,400, may need to last 30 years or more, and will require additional funding from personal savings—so exactly how much should you have in retirement before you leave work? Conventional wisdom, according to AARP, suggests that you should aim to have a nest egg of $1 million to $1.5 million, or savings that amount to 10-12 times your current income.

Of course, there’s no hard and true number you should strive to attain in savings because however much is enough for retirement depends on how well you wish to live, what your living expenses might be, where you will travel, what new retirement hobbies you pick up, and whether your savings will generate enough cash.

That being said, it’s imperative that you ask yourself those questions and think them through with careful consideration. As you narrow down how much you need for retirement, you need to be honest with yourself. For example, if you currently make $100,000 while employed and spend most of your take-home pay, you probably won’t be able to retire comfortably on a $50,000 retirement income.

Knowing exactly how much to save in retirement is tricky. As you ask yourself, do I have enough to retire? Consider these factors:

- Will you travel in retirement?

- Do you plan on keeping your home, downsizing, or considering an option like a reverse mortgage?

- Do you plan on spending a similar amount of money on hobbies and leisure?

- If not, do you plan on spending more or less money?

- What is your average food budget? What other monthly necessities do you rely on?

- What medical plans do you have? How much do you plan to save for a rainy day?

How much should you have in retirement? It depends on retirement spending. Next, we’ll focus on Americans’ average retirement spending.

What Is the Average Spending in Retirement?

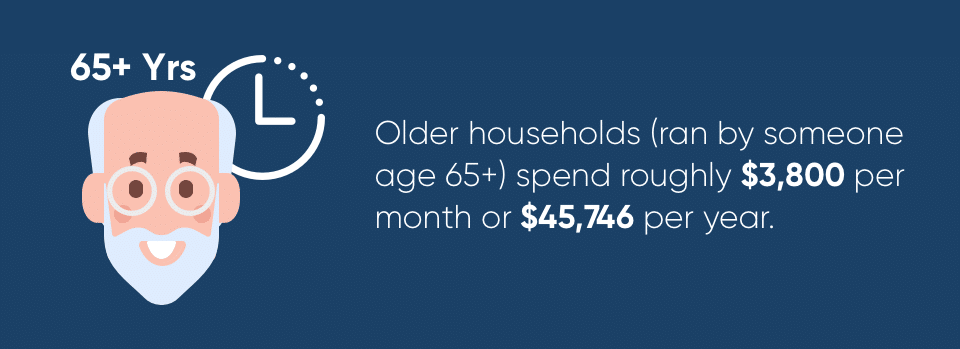

According to the latest findings from the U.S. Bureau of Labor Statistics, older households (defined as those with someone age 65 or older) spend roughly $3,800 per month or $45,746 per year. Spending tends to change after a few years in retirement; although you may no longer face student loan debt, car payments, or a mortgage, you likely spend more on medical bills, travel expenses, and leisure activities.

The average Social Security payout is $1,300 per month, according to RetirementLiving.com, which means that retirees will need to cover the cost of living using their own personal savings or pension funds.

However, few people are actually prepared to cover the average spending in retirement. According to the Merrill Lynch study, only 10% of pre-retirees age 50+ said they felt prepared for a 30-year retirement, 16% said they are prepared for a 20-year retirement, and 27% percent are prepared for a 10-year retirement.

The takeaway here is that an overwhelming number of participants (73%) do not have enough set aside to keep their finances afloat until they are 80 years old (if they were to retire at age 70).

How Much Is Enough for Retirement?

If that sounds like you, you’re not alone. Many people have trouble saving enough within 40 years of working to support themselves for 30 or more years during retirement, and often the financial assistance provided by government programs is not enough to cover the gap. In order to increase streams of income, many senior homeowners consider reverse mortgage benefits as a means to retire more comfortably.

Seniors at least 62 years old who have considerable equity in their home and meet reverse mortgage eligibility may be able to tap into their home equity for usable cash—without having to sell or vacate the property. (Those interested in other forms of retirement mortgage can also check out our blog for a simple explainer.)

If you’ve asked yourself, “How much do I need to retire?” and found that your target savings and ideal income are out of reach, use our reverse mortgage calculator to see how much equity you may be able to access so you can start living The GoodLife in Retirement. When you’re ready to improve your quality of life, contact one of our expert Reverse Mortgage Specialists who can explain if a reverse mortgage might be right for you.

1-866-840-0279

1-866-840-0279