As you plan for retirement, you might have caught wind of the term “immediate annuity” with promises regarding how this type of security can provide income for life. However, it’s extremely important for consumers to be aware of annuity pros and cons, including the profit-driven insurance companies that have been known to sell unsuitable products to vulnerable seniors.

In an effort to help you avoid elder financial abuse—in which victims lose an average of $140,500—we’re discussing the lesser known details of income annuities that agents tend to gloss over in an effort to earn commission. We’ll also compare how a reverse mortgage and other retirement vehicles might be better solutions that provide a steady stream of income during retirement with much less risk. Navigate using the links below to learn more.

What is an immediate annuity plan?

According to the U.S. Securities and Exchange Commission, an annuity is “a contract between you and an insurance company that requires the insurer to make payments to you, either immediately or in the future”. An immediate annuity has the former structure with no accumulation phase. Rather, you start to receive the payments right after you purchase the annuity. Once funded, the income annuity is annuitized immediately, which refers to the process of converting an investment into a series of payments.

Note: An immediate annuity is a financial instrument that converts a premium paid in lump-sum into a stream of payments at certain intervals for as long as the annuitant lives. Because it refers to a contract with an insurance company, many people refer to it simply as “insurance” for shorthand. Essentially, it insures that you (the annuitant) will receive income installments over the span of your lifetime.

Annuities became popular during the Great Depression amid concerns of stock market volatility and crushed investments. Now that pension plans are dwindling, some retirees are looking to immediate annuities with the goal of achieving a steady stream of guaranteed income—but this should come with extreme caution.

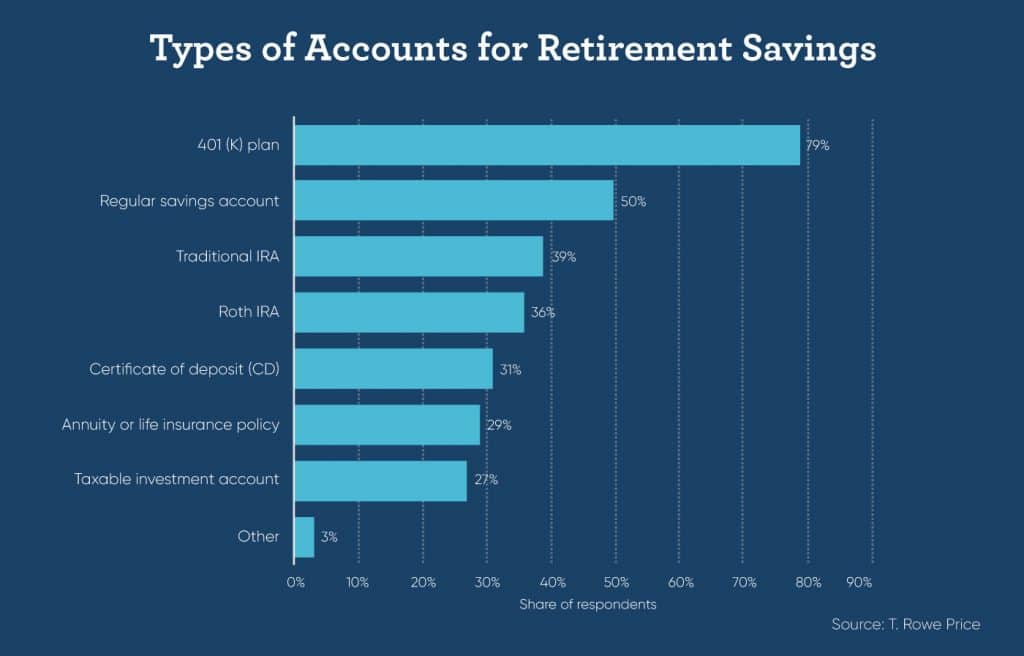

If you take a look at the graph below, you can see that annuities are among the least popular type of account for retirement savings. The data, compiled by T. Rowe Price, shows that a traditional 401(k) is dramatically more popular than an income annuity—79% of respondents reported using a 401(k) as a retirement savings tool versus the mere 29% of people who had purchased an annuity with retirement in mind.

Let’s take a deeper look at immediate annuities, including annuities pros and cons as well as the various payment structures, to explain why they might not be the best solution to your retirement planning.

Annuities: Pros and Cons

Before making any decisions that can impact your income in retirement, it’s imperative that you do your diligent research. One of the many problems with immediate annuities is that they’re more often sold rather than bought. Commissions paid to sell annuities are very high, so insurance agents are known to upsell the benefits in an attempt to persuade you to purchase an annuity while glossing over the various annuity cons. Some perks they might describe include:

- Lifetime income

- Tax-deferred savings

- Death benefits

While these promises might seem appealing, there’s much more to an immediate annuity that meets the eye.

Getting Started with Reverse Mortgages

If you’re looking to get started with a reverse mortgage, these articles can help guide you through all aspects of the process.

Guide to HECM Loan Reverse Mortgage Limits

Lack of Liquidity

One of the biggest drawbacks of an immediate annuity is that they are not liquid. A traditional savings account—which 50% of people reported using for retirement in the above survey—typically allows you to withdraw funds whenever you want. Similarly, when you invest in stock, you can sell shares and free up cash for easy liquidity as needed.

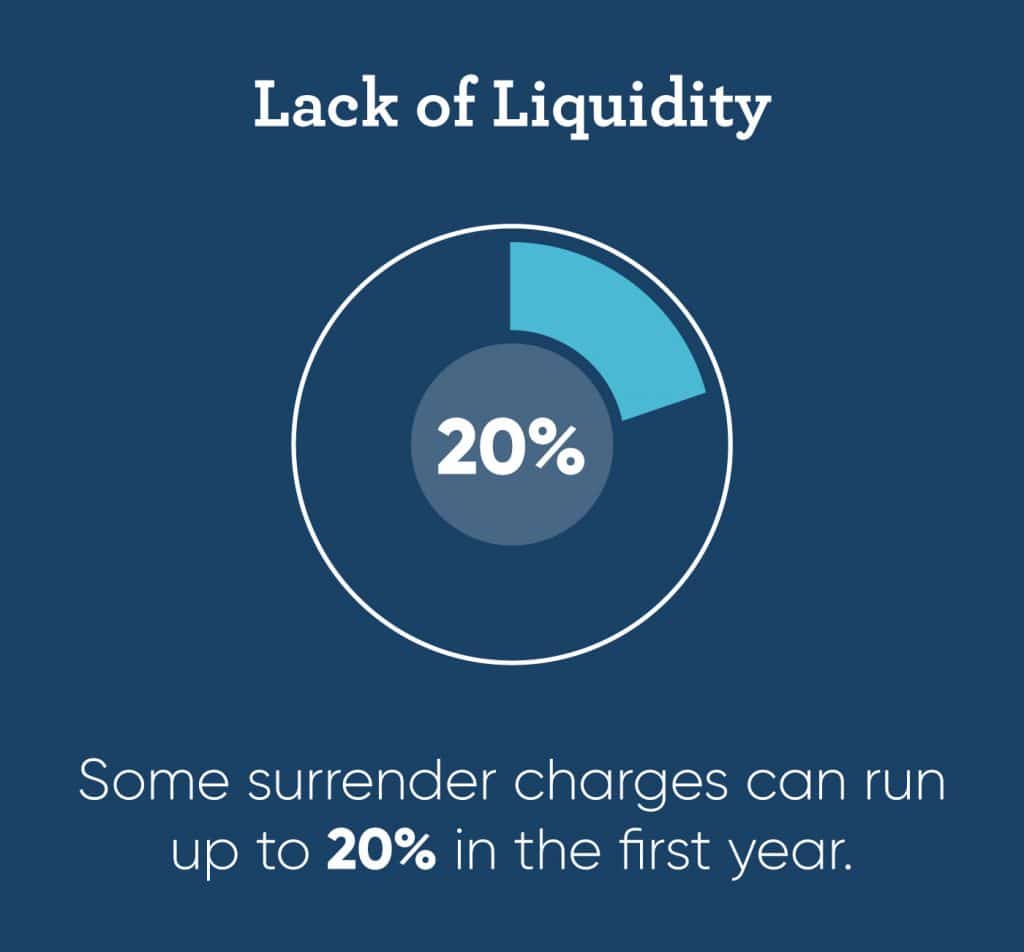

By contrast, the money you deposit into an immediate annuity is locked into the account. If you need or want to withdraw funds early, then you will likely face a steep surrender fee. A surrender charge is a percentage of money you must pay, or surrender, to the insurance company for taking money out of the annuity prior to a designated term.

The surrender fee will be built into your income annuity contract and will vary by management firm, but in some cases, the penalty can cost as much as 20%. The tax-advantaged annuity is intended to be a retirement asset, so if you withdraw those funds before you turn 59½, then you might incur an additional 10% penalty assessed by the IRS.

Unfortunately, many consumers are sold on this very specific financial tool without being fully aware of annuity pros and cons, such as their illiquidity.

Higher Tax Rates

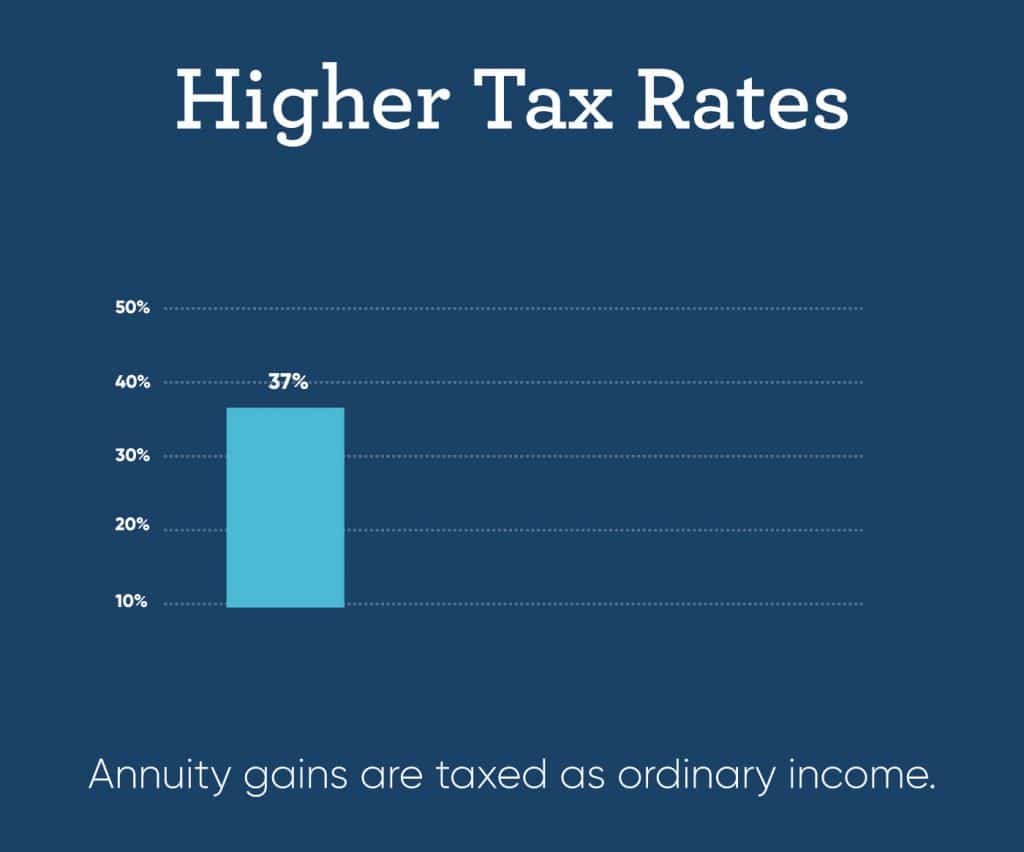

Compared to other retirement savings vehicles, an immediate annuity lacks certain tax advantages. It’s true that some income annuities are structured for tax-deferred growth, but this is typically irrelevant in the case of immediate annuities. The reason for this is that these have no accumulation phase in which time the funds would theoretically grow; any yield from a variable annuity would be incredibly low because the payout phase begins immediately.

When you do receive your payment, the annuity is taxed at your full income tax rate. Depending on how much you earn and what income tax bracket you fall into, that could be as high as 37% (as of 2019). This can be a significant burden on top of your additional retirement taxes.

If you compare that to the favorable long-term capital gains tax rate of 0%, 15%, or 20% depending on your income and filing status, then you can see how stocks, bonds, and mutual funds may have much higher yields with much lower taxation.

Those who would prefer to minimize the risk their retirement savings is exposed to due to market volatility might consider a Roth IRA. Contributions are not taxed at the time of disbursement and withdrawals can be made at any time without taxes or penalties.

Note: Reverse mortgage proceeds are not considered income, so you’ll never have to pay taxes on the funds.

Loss of Purchasing Power

When weighing annuity pros and cons, keep in mind that fixed annuity payments diminish your purchasing power over time. With a variable annuity, you’re allowed to direct your payments to various investment options and your payout will depend on the rate of those returns.

Fixed annuities work differently, as the insurance company promises a minimum rate of interest and a fixed payment amount at the time of contract. There are fixed annuity pros and cons, but the biggest drawback is the risk of inflation.

- Say, for example, your fixed monthly payment amount is $2,500 for life.

- If we conservatively estimate the rate of inflation at 1% annually, then in a decade, inflation will have grown 10% which puts the purchasing power of your income annuity at $250 less than it started at.

- It is wise to plan for a retirement lasting at least 20 years, so by that logic, your purchasing power would decrease to $2,000—likely at a time when income is needed most for medical expenses and estate planning.

Recipients of reverse mortgage proceeds, on the other hand, can decide how to receive their payments: a lump sum, installments, or line of credit. This flexibility offers peace of mind that your dollar can retain its value.

Hidden Costs of Immediate Annuities

When you purchase an annuity, you can expect to pay a lot in fees. Some fees and charges you should consider before you buy include:

- Administrative and Commission Fees – 0.10–0.30% of the policy value per year

These cover the agent’s commission cut, cost of mailing, and ongoing service fees.

- Investment Expense Ratio – 0.25-2.00% of the policy value per year

Variable annuities contain management fees for the stock and bond investment sub-accounts. - Mortality Expenses (M&E) – 0.50-1.5% policy value per year

This covers the guarantee to pay out your annuity beneficiaries a minimum of what was put into the account. - Cost of Riders – 0.25-1.00% policy value per year

You may choose to add this feature to variable annuities, as riders provide additional guarantees and death benefits.

In addition to the surrender charges assessed on early withdrawals—which are imposed for an average of 3-10 years’ time post-purchase—the hidden costs of annuities could potentially leave unprepared retirees financially disposed.

Reverse Mortgage vs. Immediate Annuity

Compared to the hidden fees and high commission rates on an immediate annuity, the costs of a reverse mortgage are clear and upfront. Reverse mortgages, also known as a home equity conversion mortgage (HECMs), are government-backed loans overseen by the U.S. Department of Housing and Urban Development (HUD) and the Fair Housing Administration (FHA).

These government agencies impose strict rules and regulations on reverse mortgages in order to protect consumers. Importantly, one major requirement is the need to receive official counseling on this form of financing before obtaining the loan.

An advantage provided by a HECM allows eligible seniors to tap into a portion of their home equity and convert it into tax-free cash. Take a look at our reverse mortgage calculator to estimate how much you could boost your retirement income.

Our Reverse Mortgage Specialists are proud to hold ourselves to the highest ethical standards and are on a mission to helping seniors live The GoodLife in Retirement. We’ll go over any questions you may have in precise detail so that you can feel confident you’re making the right financial choice for your future. Contact us today to see if a HECM might be a good fit for your unique circumstances and retirement plan.

1-866-840-0279

1-866-840-0279