Retirement is one of the most important things you can plan for in life, yet many adult Americans find themselves unprepared as they near the end of their career. Seniors often find themselves wondering how much they need to retire and how long those retirement savings will last. Many feel concerned about whether they’ll be able to cover medical bills and afford day-to-day expenses while keeping up with the cost of living.

KEY TAKEAWAYS

- Retirement savings should be enough to last around 30 years.

- One rule of thumb is to withdraw about 4% of your saving each year in order to keep your investments growing.

- The younger you plan on retiring, the more you’ll need to have saved.

- Some states, like New Mexico, Georgia, and Michigan have lower cost of living for retirees.

- However, 8/10 workers still plan on working even after they retire.

There’s no one-size-fits-all answer to how long your retirement savings should last; it depends on a wide variety of factors. Today’s post goes over all the considerations you should keep in mind when contemplating the longevity of your retirement savings, so you can feel financially confident heading into your post-career years.

How long will my money last in retirement?

According to AARP.org, your retirement savings should last you 30 years—but that’s dependent on a number of variables and will vary from person to person.

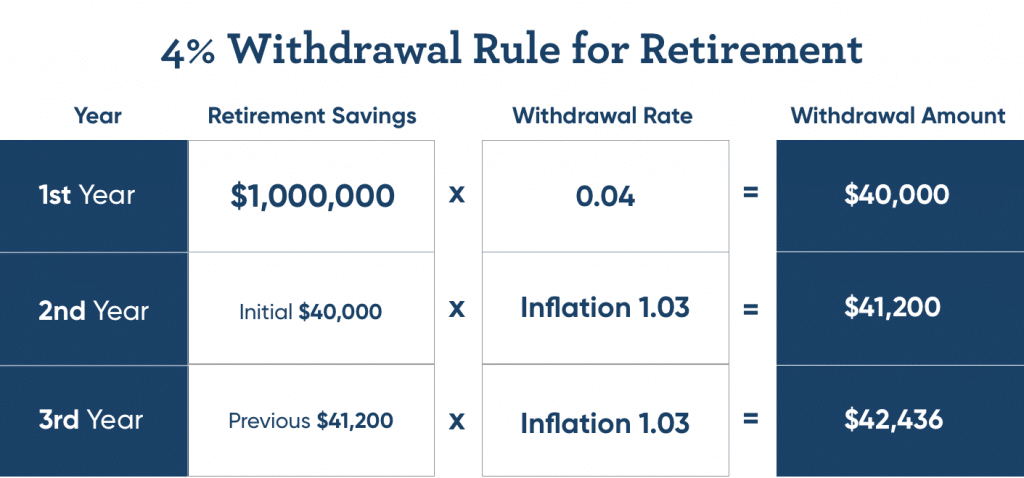

AARP and many financial planners estimate an individual’s necessary retirement funds and corresponding withdrawal rate by using the four percent rule. This rule of thumb assumes you’ll earn a 4% annual return on your investments and therefore suggests that you can withdraw 4% of your savings account(s) (including stocks, bonds, mutual funds, bank CDs, and so on) in the first year you retire.

The next year, you would withdraw that same amount plus an adjustment for inflation. Essentially, if you withdraw 4% and earn 4% back, you should have enough savings to safely last your retirement.

Here’s an example: Say you have $1,000,000 in savings and we assume that the average rate of inflation will stay stable at 3%. Your initial 4% withdrawal would be $40,000, the next year would be ($40,000 x 1.03) $41,200 and so on. Take a look at the four percent rule in action below.

Bear in mind, however, that this is just a general rule of thumb. There are several factors that could affect whether this method will successfully make your savings last throughout long and vibrant retirement, such as the rate of inflation or one of your investment portfolios taking a hit, since this formula assumes that your account will see an annual return of at least 4%.

When it comes to your personal retirement planning, it’s always best to speak with a qualified financial advisor who can analyze your circumstances and offer a strategic savings plan customized to your needs.

What factors affect how long my retirement savings will last?

Every financial situation is unique, so be sure to run through this list of considerations when estimating how long your money will last in retirement, including the duration of your retirement, which assets you hold, and how you spend money.

● The Age You Choose to Retire

You can claim Social Security as early as age 62, but it’s generally wise to wait to claim Social Security until you reach your full retirement age (FRA) or even waiting until age 70. Your FRA depends on the year you were born; for those born in or after 1960, the FRA is 67. According to SSA.gov, you will be penalized for every month you retire early with a reduction of benefits up to 30% for those retiring at age 62.

In order to retire at 62, you’d need to have a lot more in savings because the amount of your Social Security benefit will be substantially smaller. A lower monthly income will force you to rely more heavily on the money you’ve saved up, causing your savings to not last as long.

Alternatively, if you wait until age 70 to retire, you can accumulate delayed retirement benefits that will increase your Social Security benefit and allow you to dip less into your savings so that they may last longer—ideally between 20-30 years considering the rapidly increasing rate of life expectancy.

● The Type of Retirement Account

Which type of retirement account you have—a traditional 401(k), IRA, Roth IRA, or pension—dictates when you have to withdraw from your savings.

Congress recently passed the SECURE Act and changed the age at which you must take required minimum distributions (RMDs) from your 401(k) or IRA account at a specific rate calculated by your life expectancy; as of Jan. 1 2020, you must begin taking RMDs at age 72 compared to the previous requirement of 70½. Failure to take RMDs will result in a penalty of 50% of the amount you should have withdrawn. However, there is no such rule for Roth IRAs and pensions, so your savings may last longer in these types of retirement accounts.

Additionally, the different assets you have within your portfolio can dramatically impact how long your savings last through retirement. There are many types of investments, some of which are low- or high-yielding with low- or high-risk of market volatility.

Depending on your investment strategy and how you allocate funds in retirement, your portfolio may have a higher yield and last much longer. Correspondingly, an aggressive asset allocation could take a serious hit in the event of a market crash, essentially draining your savings, and your portfolio may not have enough time to recover and help fund your retirement.

● The Location Where You Retire

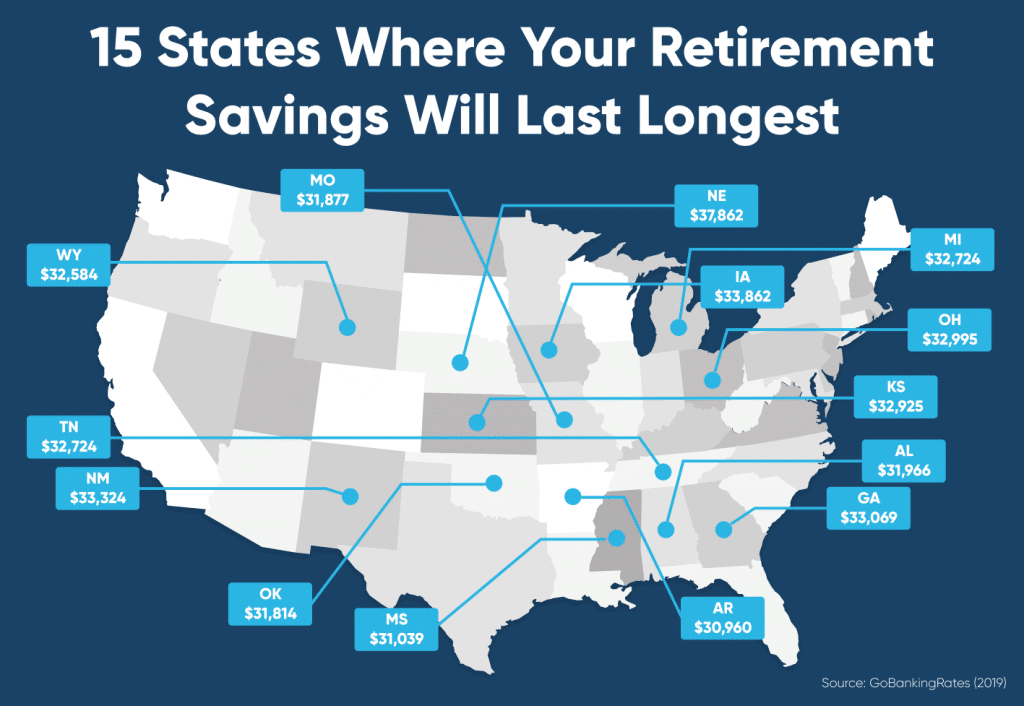

Where you choose to retire also has a large role in determining how long your retirement money will last. Some states have a much lower cost of living and allow you to stretch your savings further than if you were to live in a state with high housing costs.

GoBankingRates surveyed the entire U.S. and calculated the average cost of living in each state to identify the top 15 places where your retirement savings can last the longest.

Look at the map above to see how much more you could save by retiring in a state like Arkansas, where the annual cost of living came in at $30,960 or Mississippi, where you can live on $31,039 in a year—compared to states like California and Hawaii where the same amount of retirement savings would only last you 10-13 years.

● The Taxes You Pay in Retirement

Retirees often find themselves relocating to tax-friendlier states if they’re worried about how long their retirement money will last. Some states, for example, do not include Social Security benefits as taxable income while other states assess no income tax at all.

It’s also wise to check the tax obligation on your retirement distributions; in most states, you must pay tax on income from a 401(k) or traditional IRA, whereas no income tax is charged on Roth IRAs (as long as you’ve held the account for a minimum of five years and are at least 59½ years old).

Even after you’re no longer working, retirement taxes can be a very large expense and may cause you to use your saved money more quickly than if you were to live in a state with lower income, property, capital gains, inheritance, or estate tax rates.

● The Money You Spend While Retired

It should come as little surprise that the amount you spend on retirement expenses will weigh heavily on how long your savings last. There are fixed needs such as housing, nutrition, and health care that must be budgeted for, but variable spending can deplete savings more quickly.

While it’s important for seniors to enjoy their new-found free time by traveling in retirement or exploring new hobbies at their leisure, they should be sure to have a rainy day fund set aside that can cover any large, unexpected medical costs that Medicare insurance does not adequately cover.

Getting Started with Reverse Mortgages

If you’re looking to get started with a reverse mortgage, these articles can help guide you through all aspects of the process.

Guide to HECM Loan Reverse Mortgage Limits

● The Duration of Your Retirement

Finally, the answer to questions such as “How long will my money last in retirement and do I have enough?” depends on the duration of your retirement and how many years you will need to support yourself with savings.

Your life expectancy can be estimated by your gender and quality of health, but no one can know exactly how far, or for how long, you will need to stretch your savings to enjoy a comfortable life.

How can I make my retirement savings last longer?

If you’re concerned that your savings won’t support your retirement, you’re not alone—in fact, EBRI.org reports that eight out of 10 people expect to continue working for income after they retire.

There are many retirement employment opportunities and methods to earn supplemental income, but this option may be unavailable to seniors with deteriorating health or may seem unattractive to retirees looking forward to enjoying their new free time after working their entire careers.

An alternative option that retirees may consider is to supplement their savings with reverse mortgage proceeds. A reverse mortgage allows eligible seniors ages 62 years and older to tap into a portion of their home equity and turn it into loan proceeds that can be used to support a more comfortable retirement.

The added stream of revenue from a reverse mortgage can help cover medical bills, home renovations, travel costs, and other day-to-day expenses in retirement so that seniors can preserve their other savings.

GoodLife is committed to helping seniors enjoy the Good Life in Retirement, enjoying every moment to the fullest, free of financial hardship. If you would like to learn more and see whether this may be the right solution for your circumstances, contact one of our Reverse Mortgage Specialists who will be happy to answer any questions you have.

1-866-840-0279

1-866-840-0279