It’s wise for seniors to consider their asset allocation in retirement. This new chapter in life likely comes with a change in financial goals that could impact how you choose to diversify your portfolio.

Some financial advisors recommend asset allocation by age, working under the assumption that younger investors are more likely to take an aggressive approach – but this line of thought isn’t always black and white. The truth is, investment strategies are not one-size-fits-all, and the process of determining how to allocate your assets in retirement will be very personal, unique to your preferences.

That said, although there is no “right” asset allocation strategy; there are steps you can take and questions you can ask yourself to establish what may be the right strategy for you. Today’s post discusses some of these considerations so you can feel more confident about your financial future and live The GoodLife in Retirement.

What is asset allocation?

Asset allocation refers to the process of dividing your funds across different types of investment accounts, each of which functions, performs, and returns differently. Establishing a diverse portfolio, rather than placing “all your eggs in one basket”, benefits investors because it limits exposure to any single type of asset.

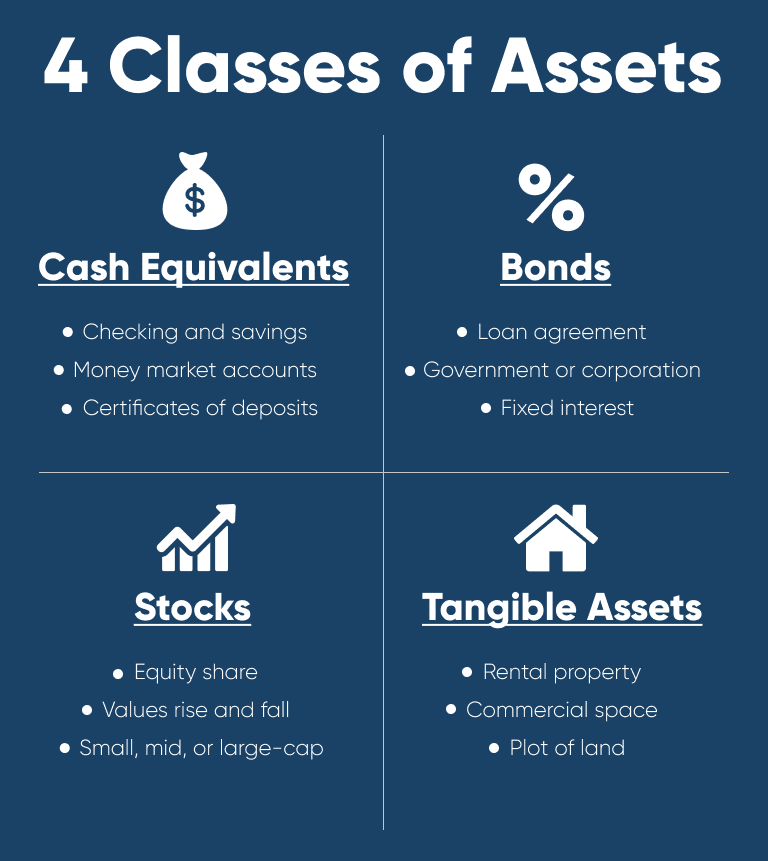

Generally speaking, there are four different types of assets where you can allocate money: cash equivalents, bonds, stocks, and tangible assets.

Cash Equivalents

These liquid assets can be easily converted back into cash. Some examples include:

- Checking and savings accounts

- Money market accounts

- Certificate of Deposits (CDs)

While you don’t always want to leave a large sum of cash sitting in the bank, it’s wise to hold onto some in case of emergencies and to use as a security blanket in case an investment takes a hit.

Market volatility underscores the need for cash equivalents; as interest rates rise, bond values fall and stock performance fluctuates dramatically. Cash, on the other hand, lends stability to your financial profile.

However, it does have a significantly lower return than what you might earn from other assets, and for that reason, shouldn’t be used as part of a long-term investment strategy. It’s wiser to prioritize this asset allocation in retirement, once your portfolio has matured, rather than early on in your career.

Bonds

Bonds are loan agreements between you (the “holder”) and a corporation or government entity (the “issuer”). Investor.gov explains that when you purchase a bond, you are lending to the issuer who promises to make interest payments during the life of the bond as well as repayment of the principal when the loan matures.

Bonds provide predictable returns and the opportunity to preserve capital while investing. Financial advisors recommend this investment allocation because they are conservative, reliable, and add stability to any portfolio.

Stocks

Stocks, also called equities, are a type of security that gives investors a share of ownership in a company. Investors make stock allocations for two major reasons:

- Dividend payments, which come when the company distributes some of its earnings to shareholders

- Capital appreciation, which happens when a stock rises in price

Stocks have the greatest potential for growth over the long haul, so it may be smart to invest in these assets as early as possible. Investors who hold onto their shares for extended periods of time say 10 years or more, tend to see strong, positive returns.

That said, stock prices rise and fall, and there’s no guarantee that the company whose share you own will perform well. Shares can be classified by the size of the company, reflected by its market capitalization. There are small-cap, mid-cap, and large-cap stocks, all of which are overseen by the US Securities and Exchange Commission (SEC).

The stock market is complex. Equities are usually categorized into one or more of four categories: growth stocks, income stocks, value stocks, and blue-chip stocks.

- Growth stocks rarely pay dividends but their earnings grow at a much faster rate than the market average. Investors buy them early in age, hoping for capital appreciation over time.

- Income stocks pay consistent dividends, so it can be a good decision to allocate these assets later in life in order to receive a steady source of income that can offset retirement expenses.

- Value stocks are cheaper to purchase due to their low price-to-earnings (PE) ratio. They’re purchased with the hope that the market has overreacted and that the stock’s price will rebound. These shares can be lucrative, but they’re also risky. You might consider avoiding them during the late stages of your investing career because your portfolio will have less time to recover if their value does not increase.

- Blue-chip stocks are shares in large, well-known companies with a solid history of growth. They’re often considered a “safe” stock allocation bet at any stage in your financial planning.

Getting Started with Reverse Mortgages

If you’re looking to get started with a reverse mortgage, these articles can help guide you through all aspects of the process.

Guide to HECM Loan Reverse Mortgage Limits

Tangible Assets

Finally, tangible assets are physical investments such as rental properties, commercial spaces, and plots of land. These are typically purchased with the goal of building personal wealth, receiving passive rental income, or reselling for profit down the road.

Keep in mind though, profits are not guaranteed and you will likely need to pay taxes on the funds received in the transaction. For that reason, you might think about including tangible assets within your estate rather than selling them in retirement.

What is an asset allocation strategy?

An asset allocation strategy considers your risk tolerance and time horizon to create a portfolio of dynamically mixed investments.

Risk Tolerance

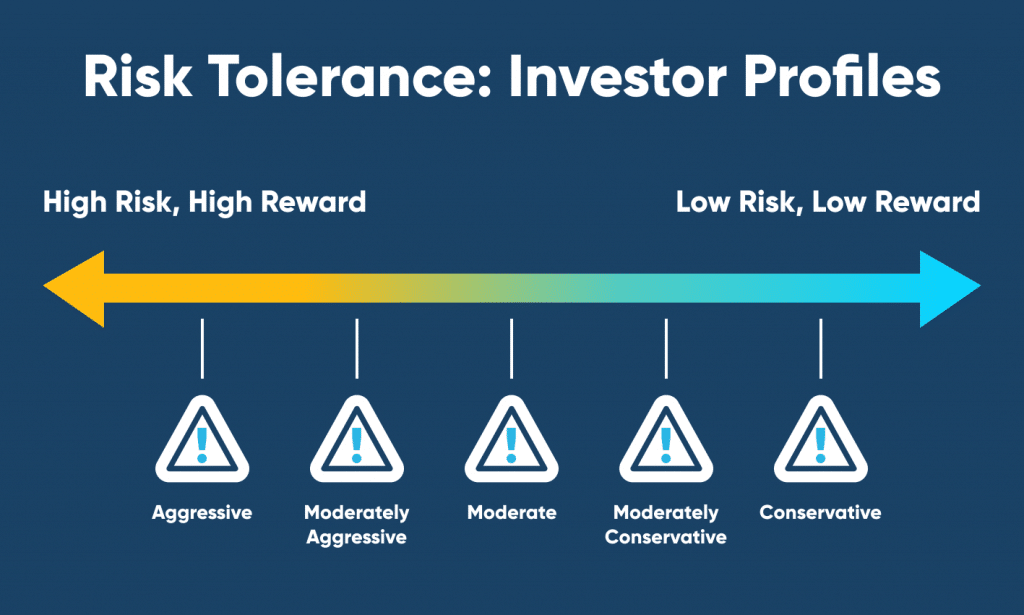

When it comes to investing, risk and reward are inherently linked. You’ll need to decide how much variability in investment returns you’re willing and able to withstand in your financial planning.

All investments involve some degree of risk, and with greater risk comes the reward of a potentially greater return. Each type of asset has an assigned level of risk that helps guide investment allocation strategies depending on your risk tolerance.

An aggressive investor values maximized returns and are willing to take on substantial risk. They typically have a strong stock allocation (75%+) consisting mostly of growth and small-cap equities. Financial advisors who believe in asset allocation by age suggest that this could be a good strategy for younger investors who have more time to recover if their portfolio suffers a loss.

On the opposite end of the spectrum is the conservative investor whose profile contains fewer equities and greater fixed-income investments such as bonds and cash equivalents. This type of investor prefers to preserve the principal over seeking appreciation.

In between each side of the scale, there are a number of investment profiles that each approach risk tolerance a little differently. If you started out with an aggressive investor profile, it may be wise to adjust your asset allocation as you get closer to retirement. Lower risk and more conservative allocations tend to be better suited to retirees.

What should my asset allocation be for my age?

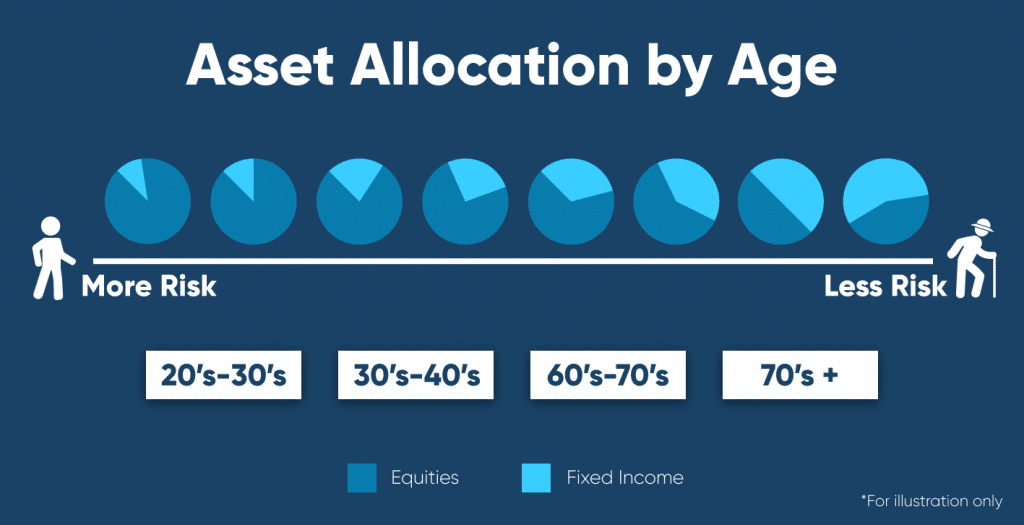

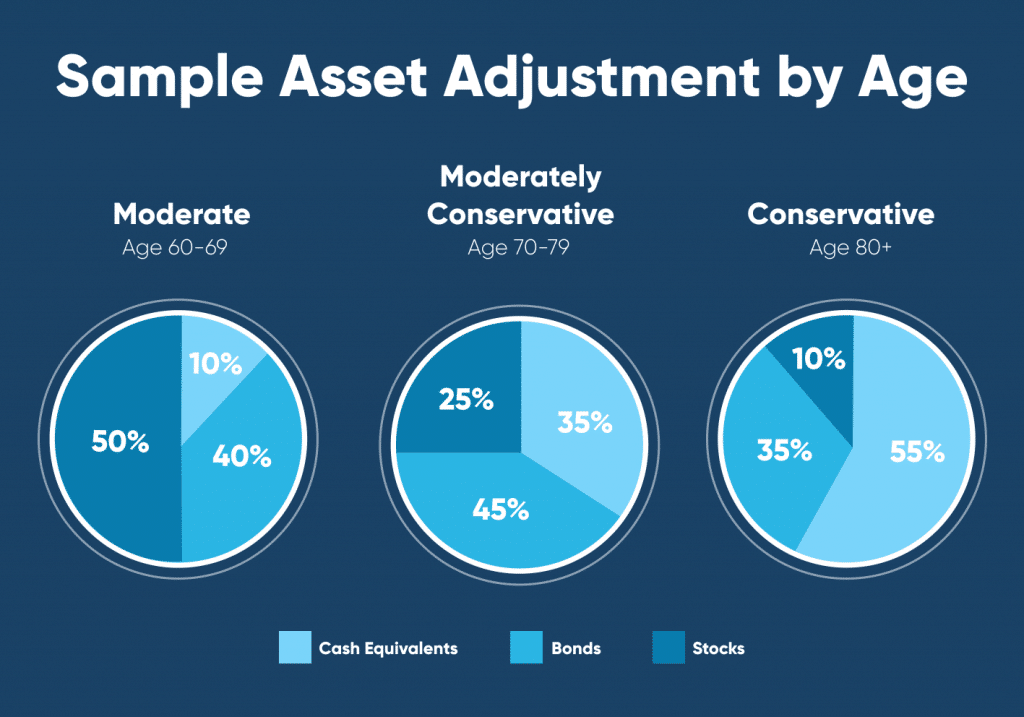

First, it’s important to note that there is no singular “correct” portfolio allocation by age. What works for you and your circumstances might not work for someone else because their tolerance for risk is different. They might also have a different financial goal on their time horizon. Below, you can see an example of how an investor might adjust their asset allocation strategy as they near their goal of financing retirement.

Time Horizon

Before choosing how to allocate assets by age, you should establish the financial goal you’re working toward. The number of years you have between then and now is referred to as your investment time horizon and will likely affect the allocation strategy you adopt.

The image above displays asset allocation by age for an investor whose goal is to save for retirement, with stock allocation decreasing over time in favor of assets that are more stable. Investor.org explains that this is a popular allocation strategy because it cuts back the risk of loss, since the need to take the risk for growth declines later in life, as does the time available to achieve potential growth.

Younger and middle-aged investors tend to be more focused on saving for their first home or their child’s college tuition rather than supplementing their retirement income. Therefore, they typically hold higher stock allocations early in life and prioritize fixed income over equities down the road.

However, if your goal is to pass money onto heirs within your retirement estate planning, it may be in your interest to allocate more assets in stocks for larger growth potential over a longer period of time. It might also be the case that, regardless of an investor’s time horizon, he or she inherently has a higher risk tolerance and chooses to maintain an aggressive asset allocation in retirement.

What if I need to adjust asset allocation in retirement?

Portfolio allocation by age is all about creating the right mix of assets at the right stage in life – but that can be more easily said than done. Sometimes, despite your best judgment, your portfolio can take a hit that requires years to recover.

If your investment portfolio isn’t performing as you want it to, you can consider rebalancing with the help of your financial advisor — but this may trigger transaction fees and tax consequences. Another option is to consider reverse mortgage benefits and how you might be able to use this financing solution to supplement your Social Security income in retirement.

Those who meet the reverse mortgage qualifications may be able to tap into a portion of their home equity, convert it into loan proceeds, and spend the funds to live The GoodLife in Retirement.

We’re committed to helping seniors enjoy the retirement they deserve and are happy to explain every part of the reverse mortgage process. Simply contact one of our experienced Reverse Mortgage Specialists to get started and learn how we may be able to help improve your retirement.

1-866-840-0279

1-866-840-0279