As many working Americans approach the end of their career, they begin to worry over how to budget income for a long, full, and vibrant retirement. Living on a limited, fixed income can make it difficult for seniors to cover day-to-day costs and unexpected retirement expenses—let alone pursue new hobbies, leisure, and travel.

Adjusting to retirement doesn’t have to be stressful, however. You should be able to hang up your working hat without fear of spending after retirement or concern over how to save money on a fixed income. Today’s post explains how to create a retirement budget to proactively prepare for your post-career years. We’ll go over common retirement expenses you should account for, as well as ways you and your family may be able to supplement your finances to enjoy The GoodLife in Retirement.

What does the average retiree spend per year?

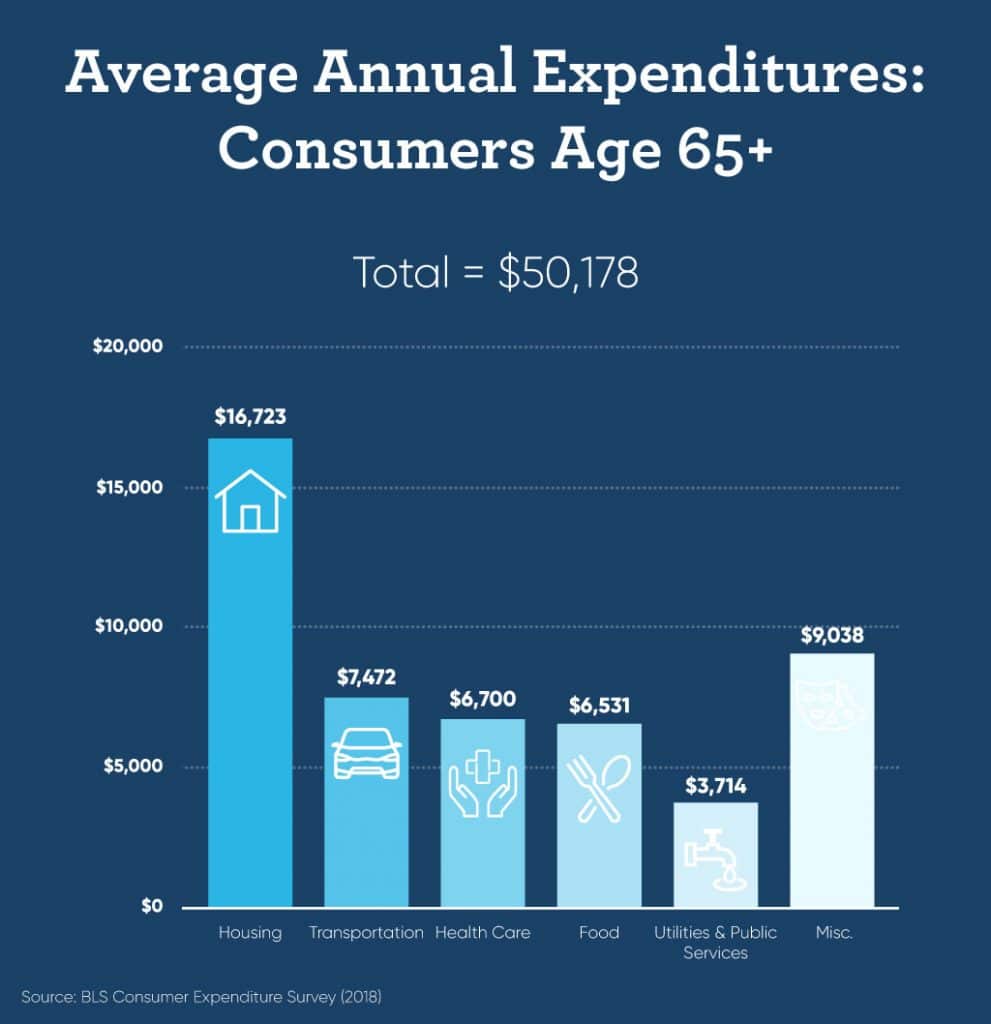

Retirees spend an average of $50,178 annually, according to the Consumer Expenditure Survey. The survey was conducted by the U.S. Bureau of Labor Statistics (BLS) between Q3 2017 and Q2 2018.Note: The BLS data on retiree spending habits from July 2018 to June 2019 will be released in April 2020.

The BLS divides its survey by age and major spending categories: housing, transportation, health care, food, and utilities. If you’re concerned about adjusting to retirement, the first step you should take is to compare your personal spending in each category against the national average.

Average Expenses in Retirement

In this section, we’ll take a deeper look at examples of retirement expenses to include within your budget, which are drawn from the annual average amounts reported in the BLS survey.

Housing – $16,723 for Ages 65+

Older Americans spend more than one-third of their retirement budget on housing. Housing costs include rent and mortgage payments, as well as the hidden costs of homeownership such as:

- Mortgage interest and charges – $1,483

- Property taxes – $2,274

- Maintenance, repairs, insurance – $2,057

The last figure is especially worth noting when adjusting to retirement because the BLS shows that this spending category increases by age demographic; consumers age 25 and under pay the least ($131), followed by 25-34 ($1,048), 34-44 ($1,273), 45-54 ($1,766), and 55-64 ($2,195). The range is topped by consumers at the retirement age of 65-74 ($2,196).

There are a few reasons that may contribute to the increase in spending on home maintenance, repairs, and insurance by age. One is simply that older properties likely experience more issues as their structural integrity weakens over time. Second, seniors aging in place may require renovations that retrofit the property with safety features, such as handrails and wheelchair ramps. Costs related to assisted living may also impact retirees’ housing budget.

Seniors concerned by the significant amount of housing costs in retirement may consider how reverse mortgage benefits could improve their financial situation. By tapping into a portion of your home equity through a reverse mortgage, you may be able to use the loan proceeds to pay off an existing mortgage, keep up with property taxes, afford home renovation projects, and cover medical bills. Unlike the hidden costs of homeownership, reverse mortgage costs are clear and upfront. Read through our reverse mortgage guide or speak to a GoodLife Reverse Mortgage Representative who can explain how this form of financing works and if you may be eligible to apply.

Transportation – $7,472 for Ages 65+

Fortunately, transportation costs go down in older households compared to the national average of $9,735 for all households. Although commuting costs may decrease, expenses for vehicles, gas, and insurance still often occur in retirement.

Health Care – $6,700 for Ages 65+Health care spending increases after retirement (compared to the annual average of $4,924 paid by all households) and is one of the top concerns faced by retirees. Medical bills are difficult to account for within a retirement budget because so many unexpected health issues may arise with age. The bills you incur are also contingent on whether you have a Medicare supplement plan or basic Medicare Part A coverage.

Food – $6,531 for Ages 65+

Spending on food at home and away from home decreases after retirement. In fact, the Consumer Expenditure Survey indicates that consumers spend less and less on these categories as they get closer to retirement age.

Average Annual Expenditures on Food at Home by Age

- 45-54: $5,186

- 55-64: $4,769

- 65+: $3,906

Average Annual Expenditures on Food away from Home by Age

- 45-54: $4,284

- 55-64: $3,215

- 65+: $2,607

The BLS data suggests that older demographics tighten their retirement budget when shopping for groceries and dining out for meals.

Utilities & Public Services – $3,714 for Ages 65+Older households pay less for utilities and public services than the national average of $3,956 paid by all ages. This category includes services like phone, cable, water, electricity, and gas.

Miscellaneous – $9,038 for Ages 65+ The remaining expenditures surveyed by the BLS include retirement travel, entertainment, and leisure, as well as expenses related to the upkeep of hygiene and appearance. Although the average amount spent on miscellaneous items amounted to $9,038 in older households, it’s important to note that this number can vary dramatically based on which fun retirement activities you pursue in your free time.

How much should I budget for retirement?

Based on the BLS data, you should budget for $1,000,000 in expenses within a 20-year retirement—but this estimation will vary by person, family size, revenue stream, and retirement duration. Your retirement income planning and retirement budget should go hand-in-hand; you’ll need to learn how to save money on a fixed income in order to properly allocate funds for major expenses.

Frugal Retirement Budget

It’s always better to err on the side of caution by including extra room within your retirement budget. Here’s a look at what a frugal retirement budget might look like based on the findings published in the Consumer Expenditure Survey.

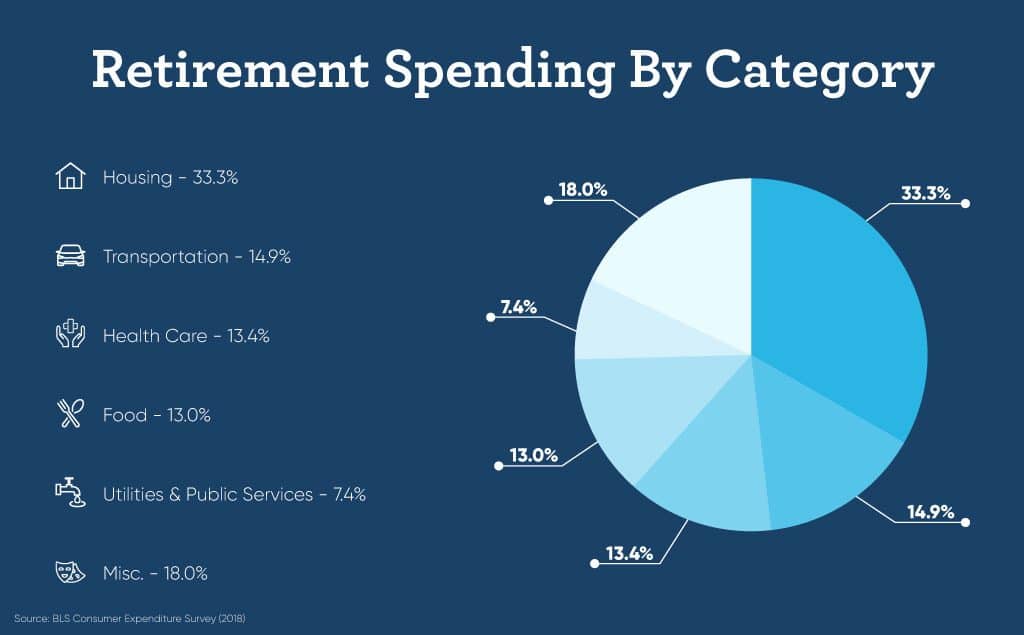

- Housing – 33.3%

Count on allocating 30-35% of your spending after retirement on housing costs.

- Transportation – 14.9%

Roughly 15% of expenses may go toward transportation, but this percentage may be higher if you continue to work past 65, or lower if you no longer drive.

- Health Care – 13.4%

Increase your estimate for health care expenses to 15% of your budget. That way, you’ll know you have a “rainy day” fund on reserve should any serious health issues arise.

- Food – 13.0%

By stretching your budget and allowing for 15% (versus 13%) of expenses for food, you’ll be more comfortable adjusting in retirement knowing that you have more than enough to spend on meals compared to the average expenditure in older households.

- Utilities & Public Services – 7.4%

Although households over age 65 spend 7.4% on utilities and public services, you might allow for 10% of spending in retirement in this category. You want to be certain you can afford basic necessities like heat and water to live most comfortably.

- Miscellaneous – 18.0%

Although miscellaneous expenses make up 18% of spending in households over age 65, we suggest restricting these frivolous purchases to 10% of your overall retirement budget. That way, you’ll reduce the likelihood of running out of savings during retirement while still affording fulfilling activities and filling your time in meaningful ways.

Getting Started with Reverse Mortgages

If you’re looking to get started with a reverse mortgage, these articles can help guide you through all aspects of the process.

Guide to HECM Loan Reverse Mortgage Limits

How to Create a Retirement Budget

When adjusting to retirement, create a budget by calculating your expenses in various categories and ensure they stay within their margins.

Monthly Retirement Budget Example

Based on the numbers presented by the BLS, here’s an example of a retirement budget you can use to guide your spending. If the average national annual expenditures for households over 65 is approximately $50,000, then this retirement budget example is based on monthly expenses totaling an average of $4,165.

- Housing – $1,457.75 (max. 35%)

- Transportation – $624.75 (max. 15%)

- Health Care – $624.75 (max. 15%)

- Food – $624.75 (max. 15%)

- Utilities – $416.50 (max. 10%)

- Misc. – $416.50 (max. 10%)

Keep in mind that estimated monthly expenses can vary based on birthdays, vacations, surgeries and other incidental events that might require additional spending in one category or another. In this case, make sure to adjust accordingly; for example, if you know you have a major medical procedure on the horizon, try to spend less eating out, or if you have travel coming up, conserve energy to cut back on utility costs.

How to Save Money on a Fixed Income

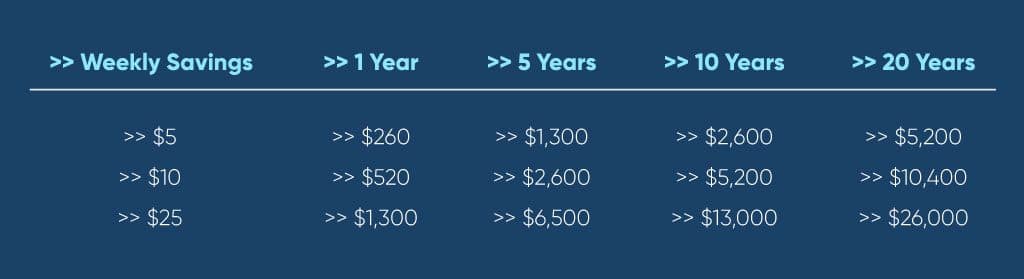

It might seem like a challenge to save money living on a fixed income in retirement. However, the table below illustrates how quickly weekly contributions of $5, $10, or $25 can build over time in a savings account.

Research published by EBRI.org states that seven out of 10 retirees rely on personal savings or investments as a source of income—meaning that for the majority of seniors, Social Security benefits are not enough to cover spending after retirement. That means it’s essential to bolster your savings account not only before you retire, but even more importantly after you elect to receive your benefits. That way, your money can continue to grow within your investment portfolio as you draw from savings to supplement your retirement budget as necessary.

The example retirement budget above allocates more funds toward major expense categories than consumers actually report spending on average; there’s a good chance that as you learn how to budget income, you spend far below these national averages. It’s important to put the leftover money that might have been spent on the cost of living directly into a savings account in order to create a security blanket should you face a sudden, surprising expense. Otherwise, you might find yourself in search of ways to borrow money when retired.

Budget Worksheet for Senior Citizens

For more help with how to budget income in retirement, use the worksheet provided by TIAA.org to guide your spending and saving habits. Generally, they suggest using a rough estimate of 70% of your retirement budget for essential spending and 30% for discretionary spending.

If you’re wondering how to save money on a fixed income, be sure to take advantage of the generous discounts offered to seniors. You can enjoy savings at retailers, restaurants, and movie theaters that can help protect you from over-spending after retirement.

Conclusion

A retirement budget can help ease your adjustment to living on a fixed income, but if you find that your current stream of revenue is not enough to cover spending after retirement, a reverse mortgage may be able to help you free up funds by tapping into your home equity. Talk to one of our Reverse Mortgage Specialists who can help you achieve The GoodLife in Retirement by determining if this solution is right for your financial needs.

1-866-840-0279

1-866-840-0279